……………………

….

.

I have to put a clause here.

My intention of sharing my journey is not to riak or to show off. My intention sharing my journey is to encourage and inspire others to be debt free, as much as they can.

Being debt free is possible in Singapore.

I was in a dilemma if I should create this blog post.

Share my journey, people say I riak. Dont share takut dosa, ilmu simpan sendiri.

However, after much considerations and requests from many,

dengan lafaz Bismillahirahmanirahim (In the name of Allah, Most Gracious, Most Merciful)

I decide to document my journey.

I will share with you 2 blog posts…….

This blog post, I will share, Why I aim to be debt free, my challenges and how to be debt free in Singapore.

The 2nd blog post, I will share, How to make it easier for you to be debt free in Singapore.

Keep an open mind. If not, (I am pleading with you) please don’t continue reading this blog post.

………………

……….

…..

If you are my client, you know that as an Islamic Financial Planner in Singapore, I have come up with a 4-prong approach to my personal finance.

1) Clear my HDB loan + Comprehensive Halal Insurance Coverage

2) Monthly Investment in shariah compliant fund + Top up when there is a market downturn (like the COVID-19 health crisis)

3) Shariah Compliant Stocks

(Act as turbo booster to increase investible assets value in networth statement for the next 5-10 years. Shariah compliant methodology adopted: Dow Jones shariah screening methodology + AAOIFI)

4) Additional Properties

…………………

………

…

Alhamdulillah. I have achieved the first 2 stages.

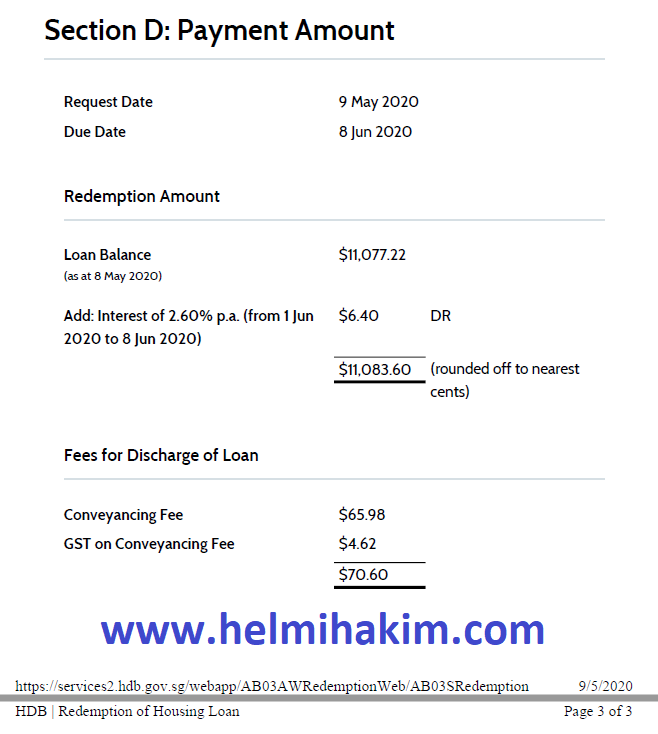

(My final payment to fully clear my HDB loan)

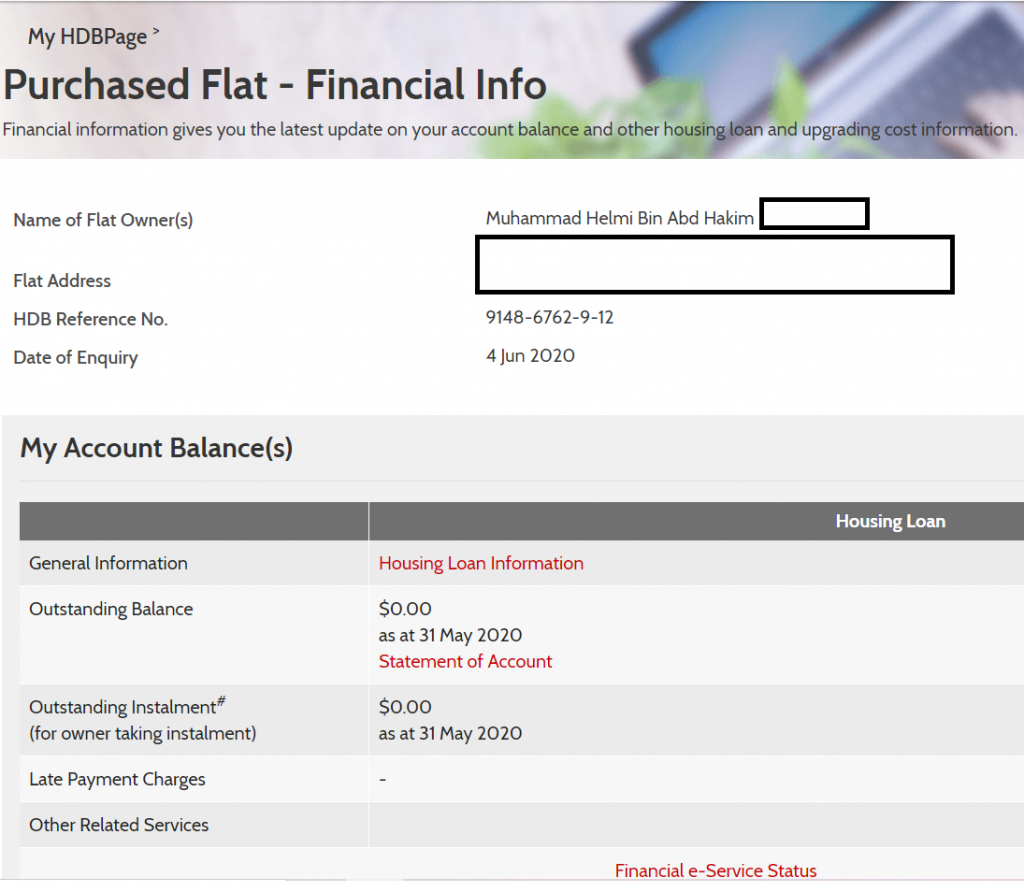

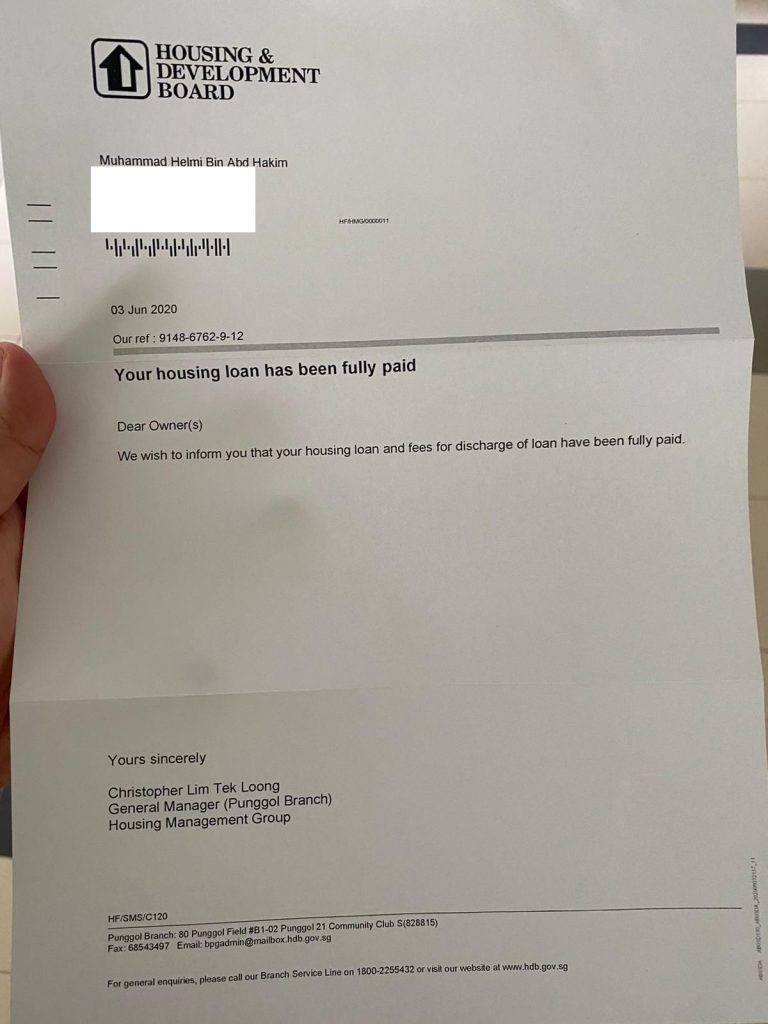

(and finally Debt Free!)

………………

……….

…

Alhamdulillah. Yes! I am now officially DEBT FREE! 🙂

It might look like a breeze at the seaside but fact of the matter, it is not.

It requires careful and meticulous planning.

It takes a lot of research.

.

.

.

When I first got married, I did some personal reflection. (that is when most people start to get serious about life)

I set goals.

Being Debt Free is one of them.

It is ironic because since young, I have been taught about Good Debts.

and Bad Debts.

Good Debts like housing loans are good because interest rate is so cheap in Singapore.

Bad Debts like credit cards with exorbitant 24% interest are bad.

It should be avoided at all cost.

That is what mainstream financial gurus of this century has been advocating over the years.

And I agree with them.

……………..

……..

..

And in my job as a financial consultant, I preach the idea of being Debt Free.

Most people will look at me in a strange manner.

“Biar betik si dekni.”

I don’t fault them. Because I used to think like them.

I thought it was not possible.

I thought if you want to be debt free in this cosmopolitan sophisticated Singapore,

you have to hold high positions.

Maybe if you are an executive director of an MNC. A vice president of a company. A group division manager at least.

You know, someone with positions. Alaaaah…. Orang berkedudukan with status.

Then only can be Debt Free

If not, not possible.

…………………………………………….

……………………..

……………..

Yet, the reasons I still stick to my guns, hold on to my dreams and work myself up to be debt free in Singapore because of a few reasons.

……………..

………….

…….

1) Life is unpredictable.

.

.

Being a financial consultant since year 2007, I have experienced 2 crises.

2008-2009: subprime mortgage crisis.

2020: Health crisis that we are facing now.

The prospect of people losing jobs are real.

The prospect of business closing down are real. The prospect of one depleting their emergency funds in a time of crisis is real.

I see it with my own eyes. People are struggling.

Scared of the future.

Nauzubillah…. I pray it won’t happen to you.

To me.

Or to anyone I love….

Yet, it is comforting and a relief to know that if sh*t happens, at least we still have a roof over our heads.

Better still if the biggest financial obligation of our life has been settled.

In short, from a financial advisor’s perspective, my risk profile for home to stay and risk profile for long term investment is DIFFERENT.

As a sole breadwinner in my family, I am very conservative in my approach for house to stay.

Yet, I am aggressive in my approach for long term investments.

2) Job disruption due to rapid development of technology

.

.

Even before the Covid19 pandemic, I have seen major changes in the new economy.

Jobs are replaced by machines.

15 years ago, if I want to do fundamental analysis of companies, I have to download the company’s annual report 1 by 1.

(15 years ago, when I was a student in Ngee Ann Polytechnic)

.

.

I had to create excel spreadsheet to do vertical and horizontal analysis.

Calculated the financial ratios. 1 by 1.

Everything did it by myself. Now, with Artificial Intelligence – with just a few clicks of a button, I can get all the answers I want.

Machines help me out with all that.

The role of a financial analyst has being made redundant.

This AI thing is very REAL.

…………………..

…………

…….

Let me give you another example in my industry. The insurance industry.

One of the biggest insurance companies in Japan terminated 34 employees in their Actuarial department.

And replaced them with an artificial intelligence (AI) system that can calculate insurance payouts.

The firm believes it will help increase productivity by 30%.

And save $1.2 million a year in salaries.

Now, my point is, If that can happen in Japan, anything can happen in Singapore.

Now, if we are stable with a good job.

If we are stable, with a healthy, profit making business.

It is good for us to be conservative on how we spend our money, clear our debts and prepare for rainy days.

.

.

.

3) Personal challenge to prove that it is possible to plan our finance the shariah compliant way in Singapore

.

.

In my job as a Islamic Financial Consultant, I always see:

Myths.

Excuses. Justifications.

That in Singapore, it is impossible to plan our finances the shariah compliant way. Too difficult.

Of course, Singapore doesn’t have shariah compliant home financing facilities like,

Murabahah, Ijarah Wa Iqtina or Musharakah Mutanaqisah.

For now, we make do with what we have.

Be it HLE loan or bank loan with the lowest interest. Try to clear it ASAP.

It can be done.

……..

…

…

Of course, Singapore doesn’t have the grand infrastructure or enjoy economies of scale to promote Islamic Finance financial instruments

like our counterparts in Malaysia or Indonesia.

Or even gulf countries like Dubai, Bahrain, Kuwait, Oman or Saudi.

(Me and my wife at Sultan Qaboos Grand Mosque in Oman)

(Beautiful interior of Sultan Qaboos Grand Mosque in Oman)

(Myself and the friendly Dai’s who promote the beauty of Islam at Sultan Qaboos Grand Mosque in Oman)

.

.

For now, we make do with what we have.

Start growing your money the shariah compliant way in Singapore with as little as $5/day.

And don’t look down on that small $5/day.

That small $5/day can help kickstart your journey to be a Muslim millionaire in Singapore. Insya’Allah.

My goal as an Islamic Financial Consultant in Singapore is to lead by example. Create more success stories.

When people say, its impossible. Change it to “I M Possible”.

When people say, there is no market. Change it to we will CREATE the market. And will EDUCATE and GROW this niche market.

When people play it safe, we charge ahead and go on the offensive.

……………………..

……………..

………….

It reminds me of the Roger Bannister story.

4 minute mile story.

Long long time ago, humans on this earth were led to believe that running 4 miles (equivalent to 4 rounds in the stadium) in less than 4 minutes is impossible.

Back then, nobody can run that fast.

Everybody believed that it was not possible.

They even had scientists and doctors to come on board and make a detailed scientific report

to substantiate with “latest up to date data”.

Substantiate and prove that running 4 rounds in the stadium in less than 4 minutes is impossible.

Impossible because our human body is just not created in a way

Impossible because of our bone structure, muscle fiber, tissues, anatomy limited by design

Impossible because….. (many more reasons why it wont work)

But you know what?

Roger Bannister believes.

For years and years…. No one was able to break that record

Roger Bannister believes he is able to do it.

And he did it!

The amazing thing for me is not Roger Bannister could complete 4 rounds in the stadium in less than 4 minutes.

The amazing thing here is within the 1st week Roger Bannister broke the 4 minute mile, someone else did it.

And now thousands of people have done it.

Because people have the mindset,

“If Roger Bannister can do it, so can I.”

.

.

…………………………………..

……………………

In my many years journey as an Islamic Financial Consultant, I met quite a number of people already cleared their housing loan in their 30s.

And they look very happy.

And they are just normal people like you and me. Having ordinary jobs.

Working 9-5.

Eat Nasi Padang at coffeeshops for lunch.

And sipping teh tarik gleefully.

The thing here is they look so “normal”. Don’t look like those sophisticated businessmen.

Or the “sovereign” type.

They are normal everyday people like you and me!

That is my aha moment.

My “Roger Bannister” moment.

If they can do it, so can I.

(I watch this video every time I feel down and demotivated)

………………..

………..

……..

Thus, I began interacting with people who share the same values as me.

I begin to ask the correct questions.

How can I make this work?

I began documenting things down. Identify the traits of financially successful people.

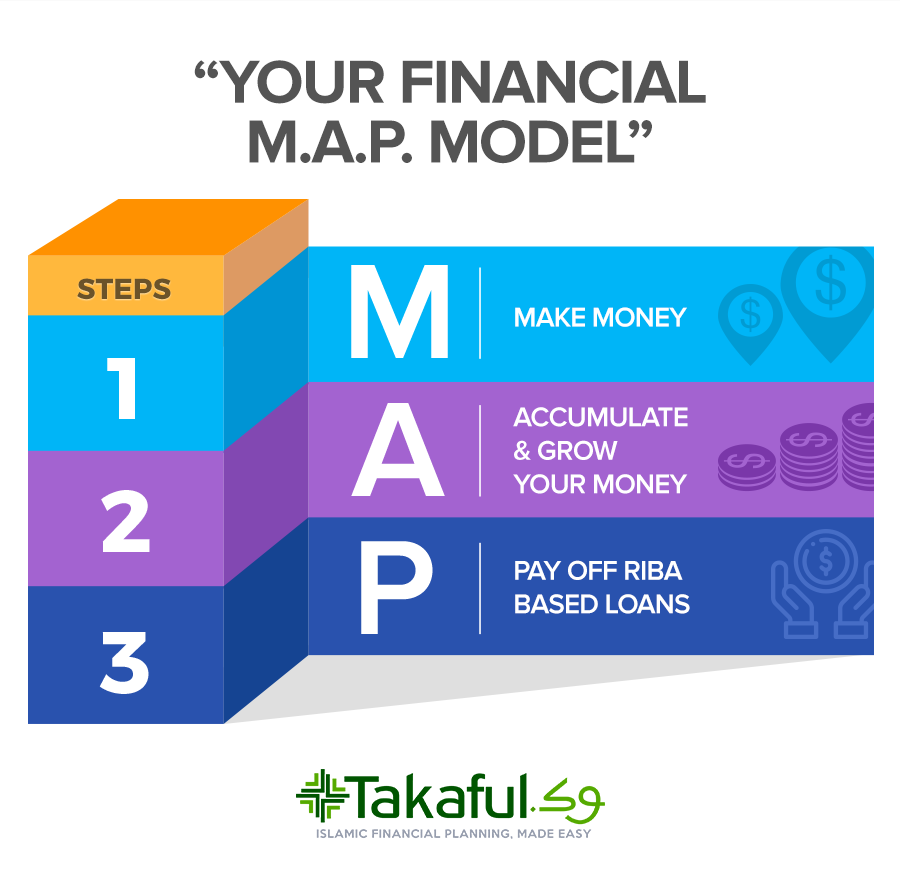

I develop Your Financial M.A.P. model and trademark it.

It is a simple 3-step model.

(Whatsapp Financial Consultant, Helmi Hakim at 96520134 to get free video, “5 Shariah Compliant Ways To Save More Money in Singapore”)

.

.

.

.

Wallah….. These are the exact strategies I used to accumulate a lump sum of money fast.

Be it for my wedding. For my honeymoon.

For my renovation expenses.

For me to buy my car without loan.

And also Alhamdulillah, for me to clear my housing loan.

Again my intention of telling you all this is not to brag.

I just want to give you the assurance that I am genuine.

I am real. I am your fellow Singaporean Muslim friend who walks the talk.

I understand your struggle and I want to help. Especially in this challenging times.

No bullsh*t. No textbook stuffs.

Simple actionable steps that even a 13 year old can understand.

I am with you.

My advice to you is just listen in to my 7 minutes video.

And just follow step by step.

No need to think too hard.

As long as whatever I share does not transgress shariah, is not haram.

Just do it!

Give your 1oo%! Do your best and leave the rest to Allah S.W.T.

Go key in your details. And start taking action.

I will share in greater detail on how to make it easier for you in my 2nd blog post. Stay tuned. Wait for it. 🙂

5) Financial Independence is my ultimate goal

Many of you know the definition of Financial Independence.

When you are financially independent, it means your monthly passive income > monthly expenses.

When you clear your housing loan, it means you have lesser monthly expenses.

Thus, you need lesser passive income every month to achieve your financial independence.

Another benefit of clearing loan is that you will have lesser stress.

People with lesser money-related stress have a clear mind.

Their brains are not shrouded with how to survive in the vicious, never ending rat race.

Their brains can think creatively.

Innovate.

Create opportunities.

…………………..

……………..

………….

Now… I hope you have benefited from my personal sharing, Clearing My 5 Room HDB flat loan at age 34….

If you are seeking a mentor, coach, consultant to share with you practical aspects on how you can plan your finance, the shariah compliant way in Singapore, I am always ready to help you.

You can always whatsapp/sms me at 96520134 to schedule a FREE consultation.

Or perhaps click here to schedule an appointment.

You will want to schedule it asap because I can only accommodate 5 slots for the following month.

Click here to schedule your FREE consultation today!

Take Care!

- 🐪 “Tie Your Camel and Trust in Allah”: What This Means for Your Financial Protection Through Takaful - February 8, 2026

- 5 Reasons Why Singaporean Muslims Welcome Takaful in Singapore - August 4, 2025

- 🌙 Just Got Your First Paycheck? Here’s Why Takaful Should Be Your First Step in Islamic Financial Planning - August 1, 2025

Salam. Thx for the share. Its always grest to hear someone story on clearing their loan at such a young age.

Due to the lack of Islamic finance options available, do you do a cash top up portion to hasten the speed up process?

Yes. You can do a cash top up to gradually reduce your outstanding loan. 🙂