Costs & Itinerary For Our Exotic Honeymoon To Morocco…

Alhamdulillah. Time is ticking fast, and in a few days time, I am a married man. 🙂

I created a blog post on the costs of Malay wedding in Singapore last year, and it has garnered a lot of attention from fellow social media enthusiastics. Some lamented that my wedding costs are too high, and there are also many who argued that my figures are too conservative. Nevertheless, that is the exact wedding costs, on my side, after doing barrage of research/food tasting/interviews etc2. 🙂

After settling other big commitments like buying our BTO HDB flat, booking our wedding venue (I can only book 150 days in advance), registering and meeting the naib kadi at ROMM and at the same time reserving our Kadi for our akad nikah, we finally bought our air tickets to our lovely honeymoon destination which is Marrakech, Morroco.

My fiance and I will like to have all the time for ourselves thus we opt for free and easy option to relax and enjoy. 🙂

As we choose to book air tickets without itinerary, we did our own background research by using online platforms like skyscanner.com.sg, expedia.com.sg, zuji.com.sg, to make comparison of the prices of the air tickets. Unfortunately, there is no direct flight from Singapore to Marrakech, thus using such platforms aid us, in planning our journey, at the same time, plan our finance well.

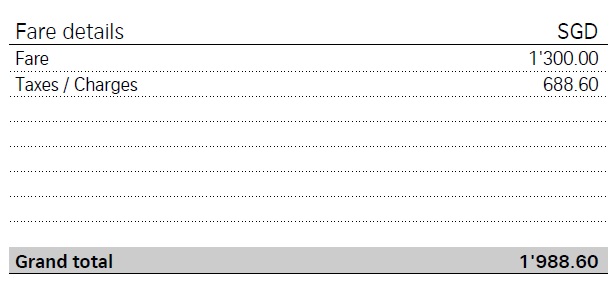

After planning the route and ensuring the available connecting flights are from the same airline, we then liaised with the airline directly, to book our air tickets. It costs us SGD$1998.60 each for the airline tickets from Singapore to Marrakech via Zurich and then return back home safely, 10 days later.

Next, we plan for our hotel/riyad. I have a personal preference to have our hotel to be as close as possible to the shopping area, Djemaa el Fna which is the centre of the medina and the heart of Marrakech. What I did, is that I go to google map on my ipad, and key in “Djemaa el Fna”. It brings me here automatically.

From the map above, you can see, that there are a lot of hotels/riyads located nearby. We want value for money hotels with good services. We have some fun choosing the hotels, narrowing it down to a few good ones and then read the reviews of the hotels at tripadvisor.com. We are spoilt for choice! 🙂

Tripadvisor.com has both good and bad reviews from people who have stayed in the hotel, that you will like to enquire.

…………………………………………………………………………………………………………………………………………………………………………………………………

…………………………………………………………………………………………………………………………………………………………………………………………………

We planned our itineraries first, and as most of our activities are of driving distance from Marrakech, we decided to just book the hotel in Marrakech for 10 nights. We booked through Booking.com and email the hotel again, to confirm that our booking went through. We arranged for airport transfers from the airport to the hotel too. The hotel stay costs $2484 for 10 nights. Of course, there are cheaper options, but we chose the best! 🙂

……………………………………………………………………………………………………………………………………………………………………..

……………………………………………………………………………………………………………………………………………………………………..

At first, we plan to spend some days in Marrakech and some days in Spain, but we then reach to a consensus to just spend our honeymoon days in Marrakech, as there are plenty of activities that we can do, like….

Cooking Class at Faim d’Epices

Hot Air Balloon, and watch the sun rise over the Atlas mountains

Camel Ride the palmeraie of Marrakesh

Quad Biking At The Dessert

There are really many, exciting activities to be done in Morrocco. Attached are our customized, yet detailed itineraries and indicative costs involved. (Right click and save target as)

…………………………………………………………………………………………………….

…………………………………………………………………………………………………….

Below, are the costs at a glance…

The costs might be steep, but in my opinion, it is money well spend! Really looking forward for our honeymoon. If you find, this post beneficial, do share it with your friends. If you have more ideas, on how to make this trip more fun and interesting, do hit the comment post below! Thank you! 🙂

p.s. By the way, if you wish to discover a simple & halal way to create a positive monthly cashflow and calculate your net worth for FREE, then please click here…