by Helmi Hakim | Jun 11, 2009 | Insurance, Investment, Miscellaneous

In life, you must always have a plan.

There’s a saying that if you FAIL to PLAN, then you PLAN to FAIL.

If you do not even care to plan, you will then be automatically be part of other people’s plan.

In todays’ context, I will be touching on creating your own financial plan. There are 6 Steps altogether, to build your personal financial plan. 🙂

Step 1- Set Goals and Objectives

What exactly do you want? You want to accumulate money for retirement? You want to accumulate money for your child’s education?

…or simply you want to leave some money for your beloved spouse and children, in case you go to heaven the next day?

Identify and segregate your goals, into SHORT TERM goals, MEDIUM TERM goals and LONG TERM goals! 🙂

…………………………………………

Step 2- Gather Data

Before you go to war, you need to know what weapons, do you have… the number of soldiers available and more relevant information.

Similarly,when you want to devise your own personal financial plan, you need to take stock of yourself financially. Where are you now?

Create your own net worth statement and cashflow statement.

……………………………………………………………………………………….

Step 3- Analyse and find solutions

So…you have consolidate your financial data into relevant structures like networth statement and cashflow statement? It is time for you to interpret them.

Benchmark it to your goals. How far off you are from your goals? What are the solutions and alternatives involved? 🙂

…………………………………………

Step 4- Recommendations

Out of the solutions and alternatives, CHOOSE the best one, most suitable for you. If you are super risk averse, investing in funds, will not be an option for you. You will love super safe, guaranteed endowment plans.

Relatively, if you are the gung ho and dare to take calculated risks, investing in funds will APPEAL to you. You may view, the returns from endowment plans as too little.

CHOOSE the best options for yourself.

…………………………………………

Step 5- Implementing Strategies

After deciding, which strategies suit you most, it is time to IMPLEMENT them.

…………………………………………

Step 6- Follow Up and Annual Reviews.

Every year, there will be changes in your family. Perhaps, if you are single, you may be getting married. If you are married, you may now have a newborn child. If you are working, you may now be enjoying a pay raise.

So, it is therefore, crucial for you to do an annualized review on your financial plan. What needs to be changed? What needs to be removed or add on?

Btw, if you need any help in the construction of your financial plan, you can always call me, Helmi Hakim at 96520134, for me to assist you in the creation and development of your financial plan. See ya! 🙂 🙂

by Helmi Hakim | Jun 8, 2009 | Insurance, Investment, Miscellaneous

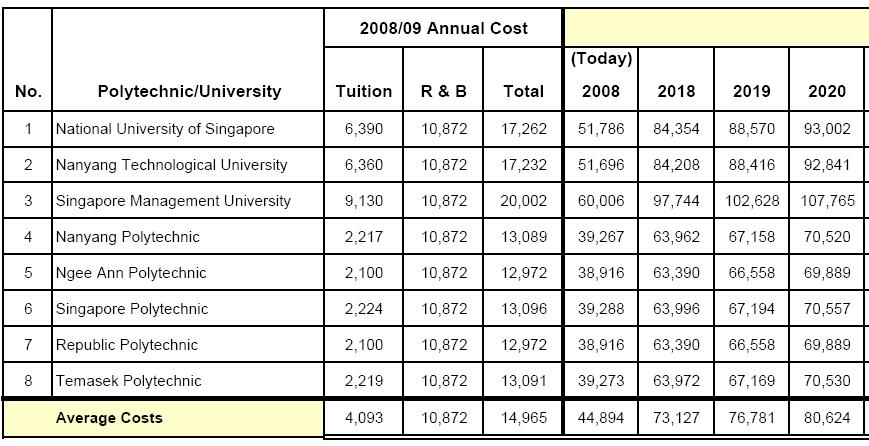

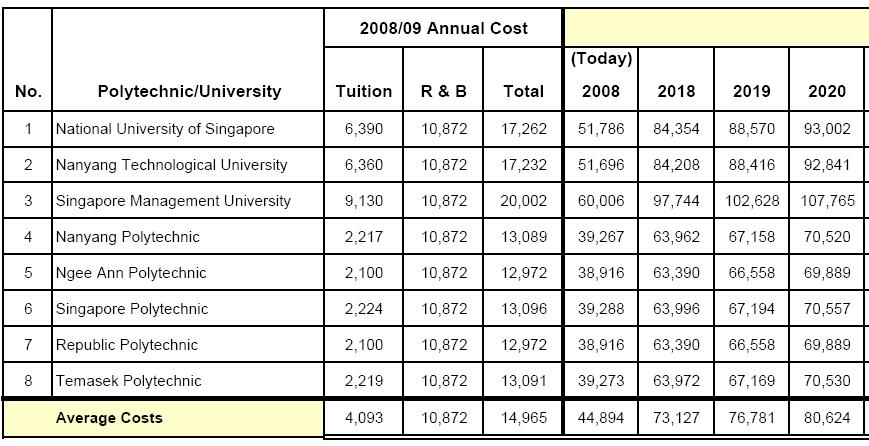

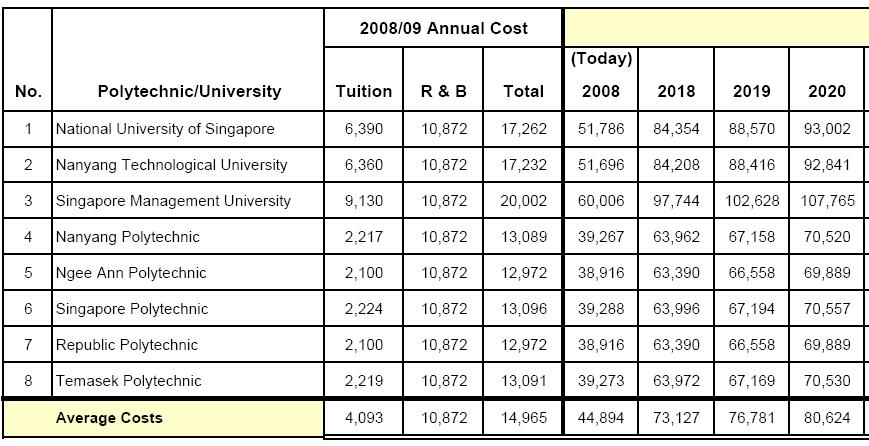

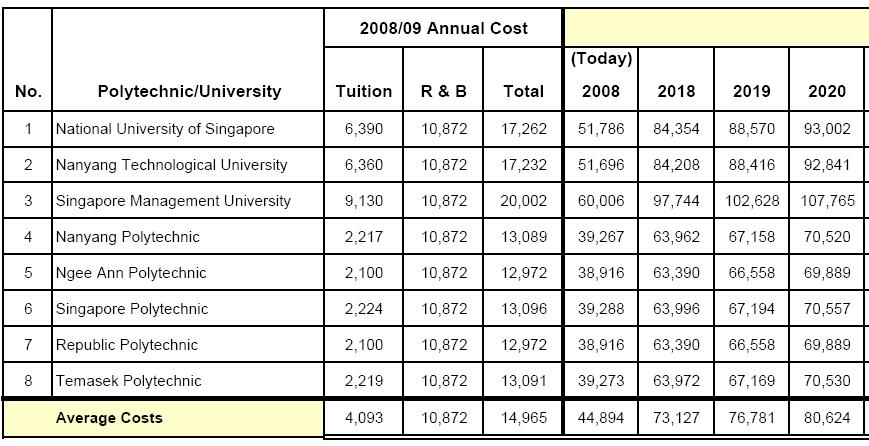

A recent survey by OCBC bank found that 6 out of 10 parents save only up to $40,000, when planning for their child’s tertiary education.

This statistic is NOT SURPRISING.

During the fact finding process I’ve done for my clients, I analyzed that many have a number of endowments or investment linked plans and they feel contented….. with what they have….without realizing their shortfall.

If you have a 10 year old child, who intends to go to a local university like NUS,SMU or NTU in the future, he will need at least $84,000. If he CHOOSES to study abroad, the amount will snowballed.

I will not indulge in an open discussion on best methdologies one should adopt to accumulate their child’s education funds’, because every individual has their own risk profile. You can contact me personally, for a non obligatory discussion in my office.

What I am trying to bring about here, is the awareness of knowing what plans you have and how it will impact you. Hiding behind that contentment, “I already have savings for my child’s education” wont help, if really, the projected amount for that upcoming years is relatively inadequate.

Start planning now! Your child’s future is in your hand! 🙂

by Helmi Hakim | Mar 23, 2009 | Insurance, Investment

Many of us, today, are holding tight, holding dearly to our CASH, because of the economic uncertainty that is looming wide on us. 🙁

If YOU read yesterday’s straits times’ newspaper, under the finance section, they recommend YOU to keep at least 12 months of YOUR monthly expenses as YOUR emergency funds instead of the usual, recommended 6 months monthly expenses in YOUR bank account.

I think that is a prudent measure & I will like to add on to it 🙂

You see….I believe, overall, in life, many of us have GREAT AMBITIONS to fulfil.

Some of us are entrepreneurial, will love to start our dream business. Some are career minded, looking forward to climb the corporate ladder. Whatever route or path, you CHOOSE, there is 1 BIG PURCHASE that you will do in your life.

I will usually recommend all my clients to settle this 1 BIG PAYMENT as soon as possible before spending on other stuffs. That is….

1) Paying For Your House

Try to pay your house in full as soon as possible.

Yeah…I know, for some adventurous people, they will say, “Helmi….mortgage rate is so low. May as well, I invest the money, and get higher returns”.

The one philosophy that, I shared with all my clients, is anything you want to do, PROTECT YOUR FAMILY FIRST.

This includes buying life insurance, buying hospitalisation insurance plan, and the most important, pay off your house loan as soon as possible.

This is because, in life, many unwanted things can happen. Today, you may be making lots of money, running your own business, or perhaps earning BIG MONEY, holding an enviable corporate position in your company, BUT no one can guarantee you such blissful fate in the upcoming years.

At least, should anything unwanted happen, you know, you got life insurance, you got hospitalization plan and you got YOUR HOUSE all secured.

You then only, depends on your 12 months contingency savings in your bank to pay for your basic necessities.

You know, I always hear people say, those who indulge in business, are taking BIG RISK. In fact, I will say, most of them take “calculated risk”.

Many of those businesspeople, I met are super risk averse. They do anything ONLY with a clear goal and a well developed strategy.

In fact, if you follow what I share with you, in this article, you are taking calculated risk because all your fundamental needs are well taken care of, should your business or career failed. YOUR BOTTOM LINE IS TAKEN OF. You can explore, can indulge in any field of endeavour FREE FROM WORRY & ANXIETY, because why?

Because your main structural support is already in place. You have done your homework. You have a plan for your worst case scenario.

Only then, you can start planning your financial life in a more adventurous way! 🙂

by Helmi Hakim | Feb 17, 2009 | Insurance, Investment, Miscellaneous, Motivation

Yes…. I am writing a book on Financial Planning.

I will complete it by June 09 and then send it for publishing. It will be available in your local bookstores, once ready! 🙂

The “planned” title of the book is “33 Common Questions People Asked Me As Financial Consultant In Singapore“… (title may change, to make it more CATCHY)

Let me detailed you some of the questions that I will answer in the book….

……………………………………………………………………………..

……………………………………………………………………………..

Questions On INSURANCE

– Why You Must Get Insurance?

– How Much Coverage Do You Exactly Need?

– What Are The Different Types Of Insurance Available For You?

Questions On SAVINGS & INVESTMENT

• How Do You Create Your Personal Income Statement, Your Personal Balance Sheet & Your Personal Cashflow Statement?

• Discover 3 Big Differences Between People Who Are Successful Financially & People Who Failed Financially.

• How Do You Increase Your Savings By 10% Without Losing A Tint Of Sweat?

• What Is Parkinson’s Law & How Do You Avoid It?

• Why, When, Where and How Do You Invest In Funds? X% Bonds? Y% Equities?

• How To Logically Create Passive Income, So That One Day You Can CHOOSE Not To Work?

• How Do You Measure, How Much EXACTLY You Need For Your Retirement?

• Why Your CPF/EPF Is Not Enough For Your Retirement?

• Why You Should Never-Ever Buy Stuffs On Loan? Examples?

• 6 Months Of Emergency Funds In Fixed Deposit. Huge Opportunity Cost?

• How To Use A Financial Calculator? Just Remember 5 Variables & You BECOME A Financial Expert. 🙂

• Looking For Instruments With Best Return On Investment? How Is Compounded Interest Different Than Simple Interest? (Learn To Interpret Deceiving Financial Brochures)

• How To Create A Budget?

• Credit Card, Double Edge Sword? How To Use It To Your Advantage?

• What To Look For When You Invest In Stocks? Are You Dividend Oriented Or Looking For Capital Appreciation?

• How To Reduce Tax LEGALLY If You Are An Employee? If You Are A Business Owner?

• What You Should Know When Financing A Car?

…………………………………………………………………………………………….

These are some of the questions that I will answer in the book. (working very hard on it!)

Right now, I need your help. I am very sure that at the back of your mind, you have some BURNING questions, on insurance, savings or investments.

PLEASE…….Please leave your questions in the comments section below.

Should you have a website, and you will like me to include your name and website url in my book, please leave your details below too…. Its a POWERFUL viral strategy for you to market your business for FREE! 🙂

Yes…. Just type one of your burning questions at the comments section, below…. I truly APPRECIATE your help! Thanks so much! 🙂

by Helmi Hakim | Jan 14, 2009 | Insurance, Investment

Today’s Financial Wednesday Blog Post, I will like to share with you is a concept that I learn from Adam Khoo’s Secrets Of Self Made Millionaire Book. It is a very practical and easy to understand concept that I applied and share with all my clients.

This is what I call the 4 levels of wealth. You have to go step by step, level by level in achieving your financial dreams.

Level 1 : Financial Stability

You have achieved financial stability when:

1) You have accumulated enough cash to pay for your 6 months expenses

2) You have hospitalization insurance and sufficient life insurance coverage, should death, permanent disability or 30 critical illnesses were to strike.

You must be really secure in this before proceeding into the next step to achieve financial security.

Imagine a person who has no money in the bank, no hospitalisation insurance plan, no life insurance plan, BUT HEAVILY INVESTED IN STOCKS (where many experience paper loss at this moment)…….

one day….touch wood…..get hit by a lorry. How will he or his family SURVIVE that financially ?

Level 2 : Financial Security

You achieve financial security when you have accumulated an amount of Positive Cashflow Assets (Investable Assets) that generate passive income to cover your MOST BASIC expenses.

Most Basic expenses refers to:

1) Home mortgage

2) Public transportation expenses

3) Food for you and your family

4) All Insurance premiums

These are just necessities that you spend on to lead a simple lifestyle. Should you stop working today, do you have enough passive income to pay for your simple expenses? 🙂

Level 3: Financial Freedom

You achieve financial freedom when you have accumulated an amount of Positive Cashflow Assets (Investable Assets) that generate enough passive income to sustain your CURRENT LIFESTYLE.

If you have a car, have a maid, have a golf membership club NOW, financial freedom means your passive income is enough to pay for all these expenses should you stop working today.

Are you FINANCIALLY FREE? 🙂

Level 4: Financial Abundance

This is the best!

You achieve financial freedom when you have accumulated an amount of Positive Cashflow Assets (Investable Assets) that generate enough passive income to sustain your DESIRED LIFESTYLE.

Your passive income must be able to pay all your expenses when you lead the LIFE OF YOUR DREAMS.

Example you like to drive a porsche, live in a private condominium facing the sea (my goal 😛 ), send your kids to the best school in town, you may be expecting a monthly flow of about $50,000 worth of passive income.

So guys…. Are you working your way up to financial abundance or continue to feel shiok2 be trapped into the rat race where someway, somehow, somewhat, your money seems to vanish in thin air at the end of the month? Work it out! 🙂

by Helmi Hakim | Dec 24, 2008 | Insurance, Investment

Some of you reading this blog, are business people.

Some of you reading this blog, are salespeople.

Some of you reading this blog, are financial associates. (like me) 🙂

If you belong to any of the above category, what I am about to share with you, will be something worthwhile reading.

I am going to share with you a formula, I read from Adam Khoo’s book, “Secrets of Building Multi Million Dollar Business” that will help you, INCREASE your sales revenue by leapts and bounds.

I will put it in my context, and I hope you can put yourself in my shoe, and later apply this concept in your own business.

If you happen to be my client, you will be nodding your head in solidarity agreement, that whatever I did, mutually BENEFIT both parties.

Myself from a business point of view, and YOU, as my client.

The formula is…

Total SALES REVENUE = Number of Clients X Average Dollar Purchase X Number Of Repeat Purchase

Ways To Increase Number of Clients

1) Create Blog & Maintain Email List

2) Social Media like facebook, friendster, myspace +++

3) Make more cold calls

4) Telemarketing

5) Roadshows

6) Network in Seminars

7) Referral System

Ways To Increase Average Dollar Purchase

1) Financial Planning

This is the only way for us to uncover the true shortage of critical illness coverage one needs as a form of income replacement, funds needed for retirement or funds needed for children’s education

2) Education

Our duty as financial associates is to educate and motivate you to make the right decisions. Once, you see and you understand the needs and the rationale, only then you will make the decision.

Ways To Increase Number of Repeat Purchase

1) Exceed clients expectation and give them a wonderful experience

2) Build friendship with them

3) Keep in regular contact

4) Send them special occasion card

5) Start a loyalty program

6) Again…Financial Planning…

Through proper financial planning, an advisor will have a proper system to follow up with client. Advisors can do yearly review, to help identify clients’ contemporary needs in years to come.

Thus far, I strongly believe that financial planning is the most powerful methodology that can benefit both clients and us, as advisors. 🙂

……………………………………………………………………………..

……………………………………………………………………………..