by Helmi Hakim | Oct 16, 2014 | Insurance, Investment, Miscellaneous, Motivation

I was having a discussion with my colleagues, if there is demand for financial consultants, since consumers can just buy direct from insurance companies beginning next year.

In my honest opinion, there will still be demand for personalised service for professional financial consultants in the near future.

Let me give you a few real life examples, of why you will still need your financial consultant to plan, advice and service you.

………………………………………………………………………………………………………………………………………..

……………………………………………………………………………………………………………………………………….

1) Tried To Claim Outpatient Hospital Bills Unsuccessfully

I was referred to an engineer late last year. He was hospitalised.

He understands that, he can claim pre and post hospital bills up to 90 days.

With confidence beaming from his face, he dropped by the insurer’s office to meet the claim officer.

Submitted the bills and the claim officer rejected him outright, stating that outpatient treatment could not be claimed.

He was confused of his predicament. He met me. He narrate and pour out his story to me. I listen. I then explain to him that he needs to EXPLICITLY state that the outpatient treatment bills that he is submitting are for post hospitalisation bills.

Post hospitalisations bills can claim up to 90 days, and Alhamdulillah, I claimed for him successfully. 🙂

………………………………………………………………………………………………………………………………………..

2) Stroke Patient’s Family Don’t Know He Has A Severe Disability Insurance Plan

This was another referral. I come down to his house. I met his son. After chit chatting for a good 20 minutes, I begin to realise the purpose of my visit.

I told him, ” Actually, I come down to your house not to meet you, but to meet your father. I was referred to meet your father. Where is your father?”

He replied me, ” My father is in the room.”

I told him, “Asked him out lah.”

He replied me, ” My father is sick. He got stroke…”

I looked at him empathically, concerned and asked him in a deep, lower tone of voice….“Ok… Insurance all claimed already lah?”

He looked at me with despair and told me, ” My father terminated all his insurance policies already. He has none left…”

I then asked him, “How about Eldershield plan?”

He looked at me with a blur look and replied, “Terminate also.”

I asked him affirmatively, “Confirm???”

He shrugged. I get him to write his father’s name and IC number on a piece of paper, and I personally called the insurer.

Lo and Behold, his father has an in forced severe disability insurance plan known as Eldershield!

His father suffered from stroke for 3 months already, and never claim from his Eldershield plan. I then guide his son, on procedures to help his father claim from his Eldershield plan.

If he was not referred to a qualified financial consultant, there might be a glaring possibility, that this very client will never claim his insurance at all.

……………………………………………………………………………………………………………………….

3) Confident Got $300,000 Death Coverage

I get to know this client from the outreach financial planning workshop, we did at one of the community centres in Singapore.

I came down to his house and he signed up hospital insurance plans for himself and his family.

Subsequently, I asked, if he dies, how much his wife and 2 kids will get?

He answered me confidently, “No worry Helmi. If I die, my family will get $300,000.”

I said, very good. He has done his planning very well. His disposable income is $2500 per month, $300,000 is 10 X his Annual Salary, which as a rule of thumb means he is sufficiently covered!

Nevertheless, I asked for his policy document.

He rummaged through the drawer in his room and handed it over to me. Flipping thorough the policy document, I realised that he has an investment linked policy.

That investment linked policy comes with a “rider”. That rider states that if he dies DUE TO ACCIDENT, his family will get $300,000.

HOWEVER, if he dies a normal death, his family will only get $30,000. Imagine the shock on his face, when I told him this. He has been telling his wife, over the years, that if he dies, his family will get $300,000.

……………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………

These are just a few examples, why financial consultants are still needed in Singapore.

Singaporeans are generally busy people, and require the help of establish financial consultants like us, to educate, advice, assist, partner and motivate them to achieve their financial goals, to the best of their ability. 🙂

by Helmi Hakim | Apr 12, 2014 | Insurance, Investment, Miscellaneous, Motivation

I am offering

– my personal mentorship (you will be personally mentored and coached by me)

– share my secrets, how I build the trust and establish myself as the financial consultant, helping over 500 families with their financial planning needs

– build a career, promoting shariah compliant fund, and cooperative insurance, which emphasize noble principles like people before profits, transparency, honesty and trust

– M5, M9, M9A, HI certifications fully sponsored

– Attractive establishment fund to help you start in this business

If you are considering to be a financial consultant in Singapore, call 96520134 to arrange for a non obligatory chat. Look forward to hearing from you. 🙂

by Helmi Hakim | Dec 3, 2013 | Miscellaneous, Motivation

Alhamdulillah. Time is ticking fast, and in a few days time, I am a married man. 🙂

I created a blog post on the costs of Malay wedding in Singapore last year, and it has garnered a lot of attention from fellow social media enthusiastics. Some lamented that my wedding costs are too high, and there are also many who argued that my figures are too conservative. Nevertheless, that is the exact wedding costs, on my side, after doing barrage of research/food tasting/interviews etc2. 🙂

After settling other big commitments like buying our BTO HDB flat, booking our wedding venue (I can only book 150 days in advance), registering and meeting the naib kadi at ROMM and at the same time reserving our Kadi for our akad nikah, we finally bought our air tickets to our lovely honeymoon destination which is Marrakech, Morroco.

My fiance and I will like to have all the time for ourselves thus we opt for free and easy option to relax and enjoy. 🙂

As we choose to book air tickets without itinerary, we did our own background research by using online platforms like skyscanner.com.sg, expedia.com.sg, zuji.com.sg, to make comparison of the prices of the air tickets. Unfortunately, there is no direct flight from Singapore to Marrakech, thus using such platforms aid us, in planning our journey, at the same time, plan our finance well.

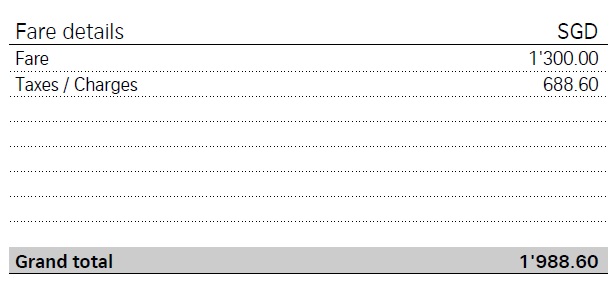

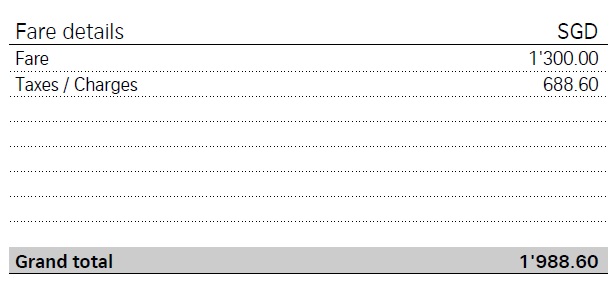

After planning the route and ensuring the available connecting flights are from the same airline, we then liaised with the airline directly, to book our air tickets. It costs us SGD$1998.60 each for the airline tickets from Singapore to Marrakech via Zurich and then return back home safely, 10 days later.

Next, we plan for our hotel/riyad. I have a personal preference to have our hotel to be as close as possible to the shopping area, Djemaa el Fna which is the centre of the medina and the heart of Marrakech. What I did, is that I go to google map on my ipad, and key in “Djemaa el Fna”. It brings me here automatically.

From the map above, you can see, that there are a lot of hotels/riyads located nearby. We want value for money hotels with good services. We have some fun choosing the hotels, narrowing it down to a few good ones and then read the reviews of the hotels at tripadvisor.com. We are spoilt for choice! 🙂

Tripadvisor.com has both good and bad reviews from people who have stayed in the hotel, that you will like to enquire.

…………………………………………………………………………………………………………………………………………………………………………………………………

…………………………………………………………………………………………………………………………………………………………………………………………………

We planned our itineraries first, and as most of our activities are of driving distance from Marrakech, we decided to just book the hotel in Marrakech for 10 nights. We booked through Booking.com and email the hotel again, to confirm that our booking went through. We arranged for airport transfers from the airport to the hotel too. The hotel stay costs $2484 for 10 nights. Of course, there are cheaper options, but we chose the best! 🙂

……………………………………………………………………………………………………………………………………………………………………..

……………………………………………………………………………………………………………………………………………………………………..

At first, we plan to spend some days in Marrakech and some days in Spain, but we then reach to a consensus to just spend our honeymoon days in Marrakech, as there are plenty of activities that we can do, like….

Cooking Class at Faim d’Epices

Hot Air Balloon, and watch the sun rise over the Atlas mountains

Camel Ride the palmeraie of Marrakesh

Quad Biking At The Dessert

There are really many, exciting activities to be done in Morrocco. Attached are our customized, yet detailed itineraries and indicative costs involved. (Right click and save target as)

PDF Format

…………………………………………………………………………………………………….

…………………………………………………………………………………………………….

Below, are the costs at a glance…

The costs might be steep, but in my opinion, it is money well spend! Really looking forward for our honeymoon. If you find, this post beneficial, do share it with your friends. If you have more ideas, on how to make this trip more fun and interesting, do hit the comment post below! Thank you! 🙂

by Helmi Hakim | Apr 24, 2013 | Insurance, Investment, Miscellaneous, Motivation

Alhamdulillah Wa Shukrillah…. I have finally graduated with Bachelor Of Science (Hons) in Banking and Wealth Management, University Of Wales, UK, with first class honours. 🙂

It has been an uphill task thus far, juggling appointments with clients and school, but a rewarding and satisfying one.

I have made great friends along the way and learnt what it takes to be an empathic, professional and competent financial planner. Now, I have the time and resources to share what I learnt, and apply it fully onto my 600+ clients. Till then, I shall wait patiently, for our convocation in November 2013. Insya’Allah… 🙂

by Helmi Hakim | May 11, 2012 | Miscellaneous, Motivation

How many of you have watched this latest movie, “The Avengers”?

For every 10 of you reading this blog post, I can guarantee at least 5-6 of you have watched this movie, because it is soooo popular… 🙂

My facebook feeds are flooded with people “checking in” the cinema to watch the movie or filled with snippets of reviews, line of thoughts about the movie. Overall, the movie was awesome, though I feel, some part of it should be trimmed away. i love fast action movie

…………………………………………………………………………………………………………………………………………………………………………………

So, what does Avengers got to do with financial planners in Singapore?

When I first watched the movie with my girlfriend, the first thing that struck me about the movie other than the explosive stuffs, was the importance of taking responsibility and teamwork.

As a financial planner, clients entrust us with their money. We need to take responsibility to manage their money well, recommending them plans, consistent with their risk profile.

We need to take responsibility to provide them with a trusted counsel, by placing instead of our company

We need to take responsibility to be open, honest and transparent with all our clients, at all times in our professional dealings. Do not suppress information, omit, delete or adjust, just to induce a sale..

If we can take responsibility, take ownership to help our client meet their financial goals while advocating such principles…….. This is what I call, the champion mindset with a loving heart! 🙂

………………………………………………………………………………………………………………………………………………

Second lesson that I get from the movie is the power of teamwork.

Recently, NTUC Income Muslim financial consultants did a roadshow at the Halal Food Expo 2012. To get our company to subside the rental fee + set up cost, we need to hit a certain target, a multiplier of the total roadshow costs.

As this is one of the roadshows that involved high costs, naturally the target is high. A few of our top producers contributed, but we still plagued with an irritating shortfall. Alhamdulillah, when all gives their share, we hit the target set, and get our roadshow subsidised.

This can only happen with the power of teamwork. Instead of relying on the producing consultants in the team, all put in effort and give their bit. That is where, goals are achieved and barriers are lifted. Hope you learn something from this post. Insya’Allah. 🙂

by Helmi Hakim | Dec 9, 2011 | Investment, Miscellaneous, Motivation

Few days back, I received a whatsapp message from my girlfriend.

She was talking about buying a beautiful eyeshadow, which was on sale at Tampines Point.

As she knew that I am a prudent and careful buyer, also a voracious saver, she asked me for help……. She asked me to motivate her, not to succumb to the temptation of forking out HUGE dollars from her wallet, to buy the beautiful eyeshadow……..shehasmanyofit

Did I succeed to convince her? The answer is a miserable, NO! 🙁

………………………………………………………………………………………………………………………………………………………………………………..

Today, I am going to share with you, simple yet pragmatic strategies on how, I curb myself from squandering and spending all my money on things that, I may not need.

………………………………………………………………………………………………………………………………………………………………………………..

Strategy No 1: Stop before you buy

The first strategy to curb yourself from spending is to procrastinate in buying…

Keep telling yourself, that you are going to buy the stuffs that you are looking at, the next following day.

I assure you that you will soon forget about it. 🙂

Tell yourself, “Do I really need this?”

How many hours, must I work to get back this money? How much is it worth, if i invest it @10%/annum in 10 years, 20 years, 30 years?

Strategy No 2: Pay yourself first

When you get your income, pay your personal savings plan first. You can instruct bank to do an automatic deduction to your personal savings plan. You can get endowment plans, or invest in funds, stocks or commodities like gold…

By setting aside that money for savings seperately, you will reduce the tendency to spend all that you have at once… 🙂

Strategy No 3: Destroy all credit cards except one. and pay full balance on time

Have you ever wonder, why the banks keep offering you attractive freebies, reward points and rebates if you sign up for their credit cards?

It is because, they know, when you have a credit card, you will tend to spend MORE when you have access to this easy credit…. They want you, to owe them money and pay interest…

My recommendation for you, is that, only keep one credit card for use, and pay the full balance on time….

That’s it!!! I hope, the 3 strategies, that I share with you, will be of much help for you to curb yourselves from spending over your limits…. 🙂