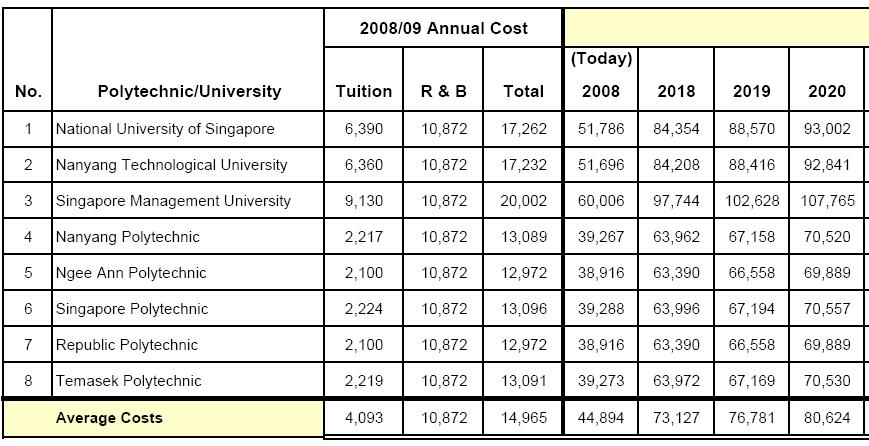

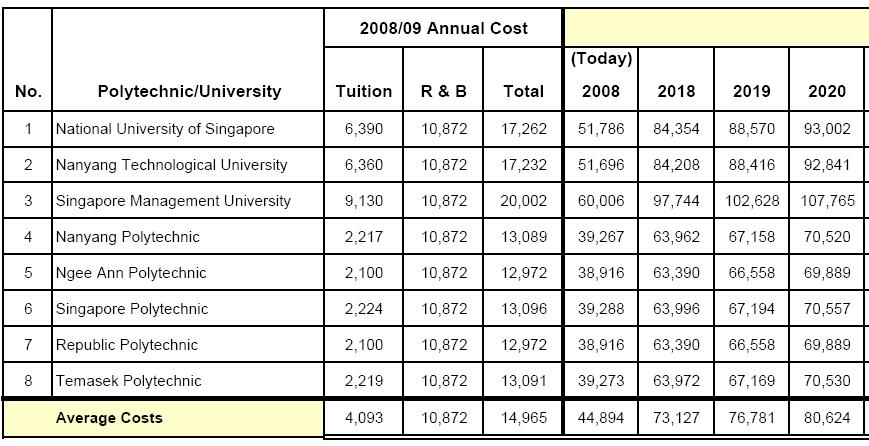

A recent survey by OCBC bank found that 6 out of 10 parents save only up to $40,000, when planning for their child’s tertiary education.

This statistic is NOT SURPRISING.

During the fact finding process I’ve done for my clients, I analyzed that many have a number of endowments or investment linked plans and they feel contented….. with what they have….without realizing their shortfall.

If you have a 10 year old child, who intends to go to a local university like NUS,SMU or NTU in the future, he will need at least $84,000. If he CHOOSES to study abroad, the amount will snowballed.

I will not indulge in an open discussion on best methdologies one should adopt to accumulate their child’s education funds’, because every individual has their own risk profile. You can contact me personally, for a non obligatory discussion in my office.

What I am trying to bring about here, is the awareness of knowing what plans you have and how it will impact you. Hiding behind that contentment, “I already have savings for my child’s education” wont help, if really, the projected amount for that upcoming years is relatively inadequate.

Start planning now! Your child’s future is in your hand! 🙂

p.s. By the way, if you wish to discover a simple & halal way to create a positive monthly cashflow and calculate your net worth for FREE, then please click here…

- 🐪 “Tie Your Camel and Trust in Allah”: What This Means for Your Financial Protection Through Takaful - February 8, 2026

- 5 Reasons Why Singaporean Muslims Welcome Takaful in Singapore - August 4, 2025

- 🌙 Just Got Your First Paycheck? Here’s Why Takaful Should Be Your First Step in Islamic Financial Planning - August 1, 2025