Occasionally, I received whatsapp messages, from prospects who get to know me online, asking me for instant financial advice over the phone.

……………………………………………………………………………………………………………………

“Which investment plan can give me the highest Returns On Investment in Singapore?

.

Now, my investment make money. Should I buy more, sell or hold on to my position?

.

Is insurance halal or haram for Singaporean Muslims?

.

I have medical complications. Diabetes, heart problem, cancer. Any insurance that can cover me?

.

I just started working. What plans should I take now?

.

I am going to retire. My money not enough. What should I do?.

I want to go Haj. Can you help me take my money out of my CPF? If cannot, how can you help me?

.

Now Singapore government introduce Medishield Life. Should I terminate my existing private hospital insurance plan? Why???? Why not???

.

I am a government civil servant. If I go hospital, government cover me fully right? How to know and confirm?”

………………………………………………………………………………………………………………………….

A lot of questions. Most of the time, I decline to answer them immediately and ask them to arrange for an appointment with me at my office in Woodlands Civic Centre.

This is because, I believe every individual is different when it comes to financial planning. Some of you are single, young and adventurous.

Some of you are sole breadwinners supporting your wife and kids. Some of you have been working for the past 30 years and are looking forward to your retirement.

……………………………………………………………………………………………………………………………

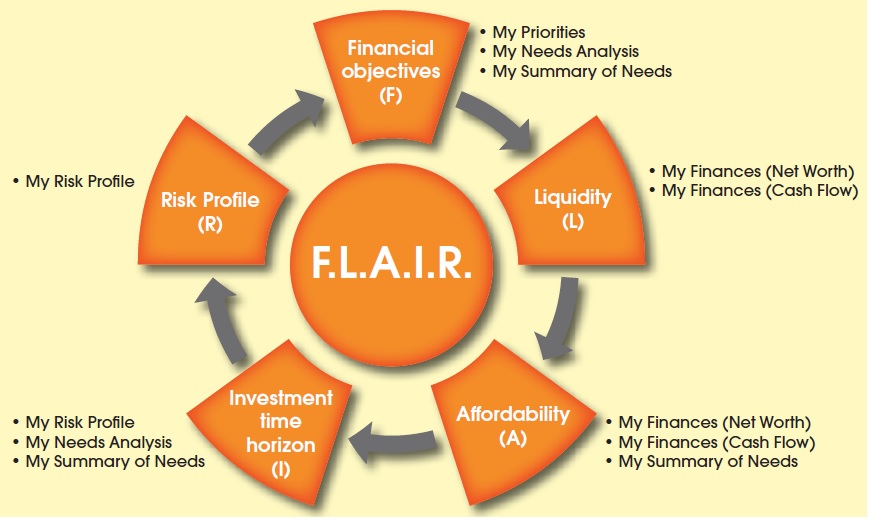

I use this special formula when helping my clients to plan their finances. It is called FLAIR. 🙂

FLAIR – the acronym for

Financial Objectives

Liquidity

Affordability

Investment time horizon

Risk profile

These are the few, simple, yet very important steps that I followed diligently when helping my clients plan their personal finances. Only after applying the proper process to gather these pertinent data, I will be able to formulate, develop and propose the most appropriate financial instrument to my clients.

………………………………………………………………………………………………….

………………………………………………………………………………………………….

Financial Objectives To Be Established

I simply ask them, “Thanks for meeting me. What do you want to plan specifically today?”

Some people will like to plan for their child’s education. Some will like to plan to save up for their retirement.

Some will like to save up for emergencies, to improve their living standards or perhaps save up to accumulate, grow their wealth.

What is your financial objective? 🙂

……………………………………………………..

Liquidity

I ensure that my client has sufficient liquidity that he can call on in an emergency (minimally 6 times of monthly expenses).

This is important, because in the event he fall sick and in need of money, he will not be forced to liquidate his insurance or investment plans at a loss. Most insurance or investment life plans require a long time commitment. If you liquidate the plans early, you might lose money.

………………………………………………………………………………………………………………………

Affordability

I draft for my clients their cashflow statement. After determining that they have a positive cashflow, I ask for their budget.

Through this process, I ensure that my client will not be over committing in the premium that he/she has to pay for the financial instruments that I recommend.

……………………………………………………………………………………………………………………………

Investment time horizon

If my clients want to plan for their retirement, I ask the, how long more are you going to work before you retire?

If my clients want to save for child’s education, I will ask for their child age, and the university, they will like their child to enrol in?

If my clients want to invest and accumulate their wealth, I will ask, how much time they can wait before realising their profit?

In short, what is your investment time horizon? Planning strategic financial objectives for an investment time horizon of 5 years is totally different than planning for long term financial objectives for 15 years or more.

……………………………………………………………………………………………………………………….

Risk Profile

I ask my clients a few relevant questions to determine my client’s risk profile.

Are their risk profile, conservative, moderately conservative, aggressive, moderately aggressive?

This will ensure that my client will feel comfortable with the recommendation that I proposed.

……………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………

So…. Remember Financial Planning, Remember FLAIR!

If you need advice on financial planning in Singapore, do whatsapp me at 96520134 for an appointment. Every week, I meet 5-6 individuals just like yourself online, and I hope to share my financial planning expertise with more of you out there. See you around. Insya’Allah. 🙂

p.s. By the way, if you wish to discover a simple & halal way to create a positive monthly cashflow and calculate your net worth for FREE, then please click here…