by Helmi Hakim | Oct 10, 2016 | Investment, Miscellaneous

First and foremost, I will to wish all my Muslim clients, Happy Asyura Fasting!

Muslims are encouraged to fast today.

The fasting is to commemorate the day when Prophet Moses (P.B.U.H) and his followers were saved from Pharaoh by Allah S.W.T by creating a path in the Red Sea.

Prophet Muhammad (P.B.U.H) said,

“The (act of) fast of ‘Asyura, how I dearly hope to Allah to forgive all my sins of the year before” (HR. Muslim no. 1975).

This is from the bounty of Allah towards us: for fasting one day He gives us expiation for the sins of a whole year. And Allah is the Owner of Great Bounty.

……………………………………………….

……………………………..

……………….

Now, back to the topic! 🙂

In my mission to be debt free, I read a lot of books, biographies of successful individual leading a debt free lifestyle.

One of the books that I love is 4 Laws of Debt FREE Prosperity, by Blame Harris and Charles Car.

…………………………………………………………

………………………………………

……………………..

There are basically 4 Laws of Debt FREE Prosperity! 🙂

Law #1: Tracking- the first law of debt free prosperity

For quite a while, a lot of people have asked me.

Since in Singapore, there is no shariah compliant financing facilities to buy a house, how do we clear our interest based housing loans as soon as possible?

What are the strategies?

Before I even lay down my strategies on how to save, accumulate and grow their money the shariah compliant way, I always ask them one question.

Do you track your housing loan repayment?

Most don’t.

Its a cycle. A routine. Every month, get their salary, they will just automatically pay their monthly mortgage.

They are not aware, how much of their monthly instalment are used to pay off principal, how much to pay for interest.

At the end of 5 years, 10 years, 15 years or 20 years, many are clueless to the balance outstanding amount.

If you don’t know, the outstanding amount, how to clear your housing loan?

That is why the first law of debt free prosperity, Tracking, is important.

You got to measure it BEFORE you can manage it.

When performance is measured, it improves.

So, if you want to clear your housing loan, you must track!

(Part of an excel spreadsheet, I have done for my client. If you like to have one, go to Takaful.sg and sign up for “Your Financial M.A.P.” session with me for FREE! )

………………………………

……………….

……….

Law #2: Targeting- the second law of debt free prosperity

The second law of debt free prosperity is Targeting!

Setting goals is IMPORTANT!!!

When do you want to clear your riba based housing loans? In 5 years?

10 years? 15 years? Or perhaps 20 years?

The goals must be written. Goals not written down are wishes.

They must be your own.

They must be measurable and specific.

They must be stated in the most visible terms available.

AND they must contain a deadline.

Personally, I target to clear my housing loan of $300,000 by 31st Dec 2020.

(hahahh… It’s a good thing that I blog here. I am confident of my strategies to achieve it and I will revisit this space again in the future.)

…………………………………….

…………………….

…………

Law #3: Trimming- the third law of debt free prosperity

Live on less than you earn so you can have a surplus to get you out of debt and invest in assets that appreciate.

A lot of people thought, if someone earns big, immediately he or she will become rich.

My experience as a financial consultant tells me otherwise.

I have met someone who earns more than $10,000/mth who cannot afford to get savings plan from me and at the same time, someone just earning $1,500/mth who has a few policies with me.

Your lifestyle determines how rich you are, not your income.

No one, regardless of income, can be financially successful unless they live on less than they earn.

Pay yourself first, and then live in what’s left over.

Law #4: Training- the fourth law of debt free prosperity

The book mentions that “The people who understand money spend it on assets that generate wealth. Those who don’t understand money, spend it on things that consume wealth, and thus the rich get richer and the poor get poorer.”

I have to agree with the statement in the book.

We all know that Singapore has one of the highest Gini Coefficient in the world.

Meaning the income disparity between the rich and the poor is wide!

To me the only solution is to continually upgrade ourselves in terms of our financial literacy.

Learn. Learn. And continue to learn. There are no shortcuts.

……………………………………

……………..

……

I hope you learn something from my sharing. If you will like to learn how to manage your finances better, and clear your riba based loans, visit Takaful.sg to schedule “Your Financial M.A.P.” session with me, Financial Consultant, Helmi Hakim for FREE!

You can also SMS/Whatsapp me directly at 96520134.

Insya’Allah! 🙂

by Helmi Hakim | Jun 18, 2016 | Insurance, Investment, Miscellaneous

Time flies… Now, we are moving to the third week of Ramadan. 🙂

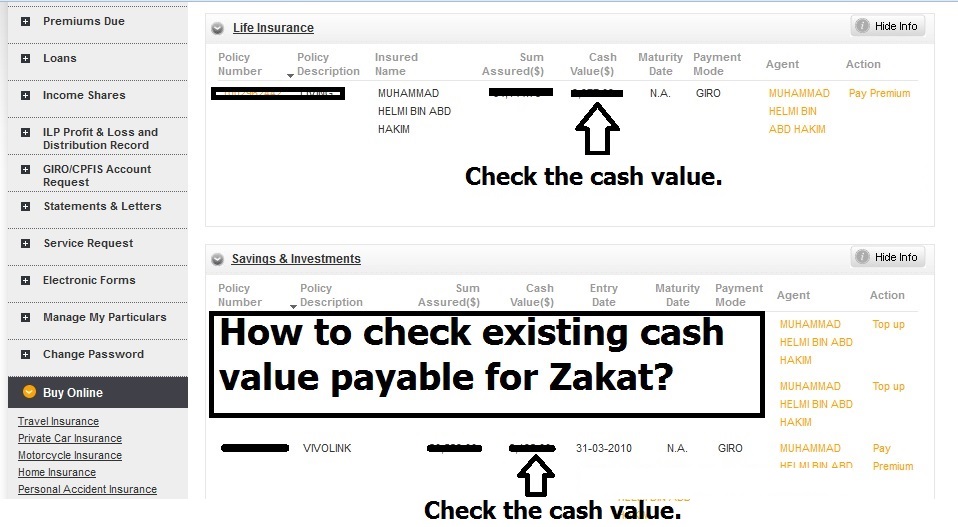

Alhamdulillah… For the past 1 week, I have a flurry of clients, asking me on the existing cash values of their insurance policies.

My clients need to know the cash value of their insurance policies so that they can calculate collectively, how much zakat to pay for the year.

………………………………………………………..

……………………………………………….

Zakat which literally means purification is the 3rd Pillar Of Islam.

Allah (S.W.T) has made Zakat compulsory on all Muslims. It is a religious obligation for all Muslims who meet the necessary criteria of wealth.

Here, to give Zakat implies purifying your wealth and soul by giving a portion of your wealth to those in need. The word Zakat appears in the Holy Quran a total of 32 times.

…………………………………………………..

………………………

There are 2 types of Zakat.

1) Zakat Fitrah

Firstly, Zakat Fitrah.

We pay Zakat Fitrah in the month of Ramadan, before Eid prayers.

The Zakat Fitrah rate that is obligatory on every person is one sa’ or 2.3kg of the staple food of the territory in which the person is in.

In Singapore, the staple food is rice.

……………………………………..

………………………………

Since 2005, Muis has introduced a two-tier Zakat Fitrah rate.

This is in accordance with the Syari’ah and allows the payer to choose the rate that is most suitable for them based on their daily consumption.

Normal Rate ($5.10 per person in 1437H / 2016):

Based on the median price of 2.3kg of rice (normal/average grade) that is consumed as a staple.

Higher Rate ($6.90 per person in 1437H / 2016):

Based on the median price of 2.3kg of rice (higher grade) that is consumed as a staple.

(MUIS Website)

2) Zakat Harta

2ndly, is Zakat Harta.

Zakat on your wealth.

For those of you, who have cooperative insurance plans or investment in Takaful fund with me, you can just SMS/whatsapp me and I will tell you the existing cash value of your policies.

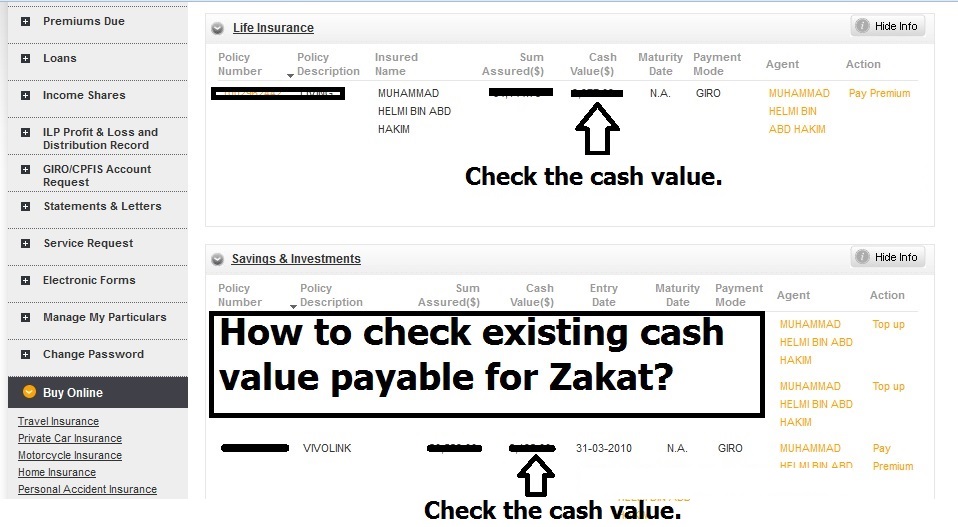

OR you can choose to check your existing cash value yourself using ME@INCOME.

-Go to income.com.sg

– At the top right hand corner, you will see, ME@INCOME LOGIN.

Log in from there to check the cash value of all your policies with me.

(Example, after you log into POLE)

If you started your policy for more than 1 year (haul) and your total surrender value of all your policies is above the nisab value, you calculate total zakat payable this way.

Your Zakat Payable for your insurance policies is Total Surrender Value ($) x 2.5%

As as this month, June 2016, the Nisab Value is $4905.

http://www.zakat.sg/About-Zakat/nisab.html

So, example, if your total surrender value is $10,000, you need to pay $10,000 X 2.5% = $250

You can pay your zakat online too. This is the link.

https://www.muis.gov.sg/epayment/Zakat.aspx

…………………………………………………………………………………

…………………………………………………………………

………………………………………………………………..

…………

I will link to end my blog post with a very good story that I get through whatsapp, sharing on zakat. Do share with your friends if you find it beneficial too! 🙂

*Story of 2.5%*

One day, a very wealthy man was walking on the road.

Along the way, he saw a beggar on the sidewalk.

The rich man looked kindly at the beggar and asked him why he was begging.

The beggar said, “Sir, I’ve been unemployed for a year now. You look like a rich man. Sir, if you’ll give me a job, I’ll stop begging.”

The rich man smiled and said, “I want to help you. But I won’t give you a job. I’ll do something better. I want you to be my business partner. Let’s start a business together.”

The beggar blinked hard. “What do you mean, Sir? ”

I own a rice plantation.

You could sell my rice in the market.

I’ll provide you the sacks of rice. I’ll pay the rent for the market stall.. All you’ll have to do is sell my rice. And at the end of the month, as Business Partners, we’ll share in the profits. Tears of joy rolled down his cheeks.

Do I keep 5% and you get 95%?

I’ll be happy with any arrangement. The rich man shook his head and chuckled.

“No, I want you to give me the 2.5%. And you keep the 97.5%.

For a moment, the beggar couldn’t speak. He couldn’t believe his ears. The deal was too good to be true. I want you to give me 2.5% of your profits so you grow”

The beggar now dressed a little bit better, operated a store selling rice in the market. He worked very hard. He woke up early in the morning and slept late at night.

And sales were brisk, also because the rice was of good quality. And after 30 days, the profits were astounding.

At the end of the month, as the ex-beggar was counting the money.

He told himself, Gee, why should I give 2.5% to my Business Partner?

I didn’t see him the whole month! I was the one who was working day and night for this business. I did all the work. I deserve 100% of the profits.

The rich man came to collect his 2.5% of the profits. The ex-beggar said, “You don’t deserve the 2.5%. I worked hard for this. I deserve all of it!”

If you were his Business Partner, how would you feel?

This is exactly what happens to us….

_ALLAH is Our Business Partner. ALLAH gave us life, every single breath. ALLAH gave us talents, ability to talk, to create, to earn money_

_ALLAH gave us a body, eyes, ears, mouth, hands, feet, a heart_

_ALLAH gave us a mind, imagination, emotions, reasoning, language_

_Giving 2.5% (your Zakat) is an expression of gratitude and love_

_Dont forget to give back what u owe_

_Jazakallahu Khairan_

*Humble Reminders*