Time flies… Now, we are moving to the third week of Ramadan. 🙂

Alhamdulillah… For the past 1 week, I have a flurry of clients, asking me on the existing cash values of their insurance policies.

My clients need to know the cash value of their insurance policies so that they can calculate collectively, how much zakat to pay for the year.

………………………………………………………..

……………………………………………….

Zakat which literally means purification is the 3rd Pillar Of Islam.

Allah (S.W.T) has made Zakat compulsory on all Muslims. It is a religious obligation for all Muslims who meet the necessary criteria of wealth.

Here, to give Zakat implies purifying your wealth and soul by giving a portion of your wealth to those in need. The word Zakat appears in the Holy Quran a total of 32 times.

…………………………………………………..

………………………

There are 2 types of Zakat.

1) Zakat Fitrah

Firstly, Zakat Fitrah.

We pay Zakat Fitrah in the month of Ramadan, before Eid prayers.

The Zakat Fitrah rate that is obligatory on every person is one sa’ or 2.3kg of the staple food of the territory in which the person is in.

In Singapore, the staple food is rice.

……………………………………..

………………………………

Since 2005, Muis has introduced a two-tier Zakat Fitrah rate.

This is in accordance with the Syari’ah and allows the payer to choose the rate that is most suitable for them based on their daily consumption.

Normal Rate ($5.10 per person in 1437H / 2016):

Based on the median price of 2.3kg of rice (normal/average grade) that is consumed as a staple.

Higher Rate ($6.90 per person in 1437H / 2016):

Based on the median price of 2.3kg of rice (higher grade) that is consumed as a staple.

(MUIS Website)

2) Zakat Harta

2ndly, is Zakat Harta.

Zakat on your wealth.

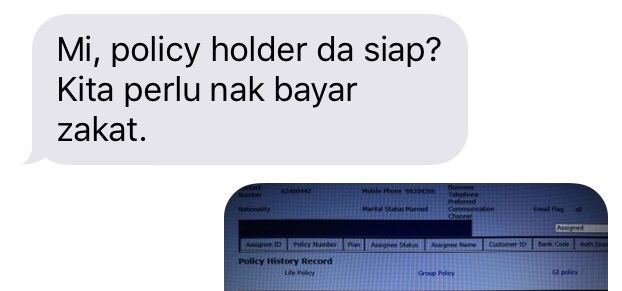

For those of you, who have cooperative insurance plans or investment in Takaful fund with me, you can just SMS/whatsapp me and I will tell you the existing cash value of your policies.

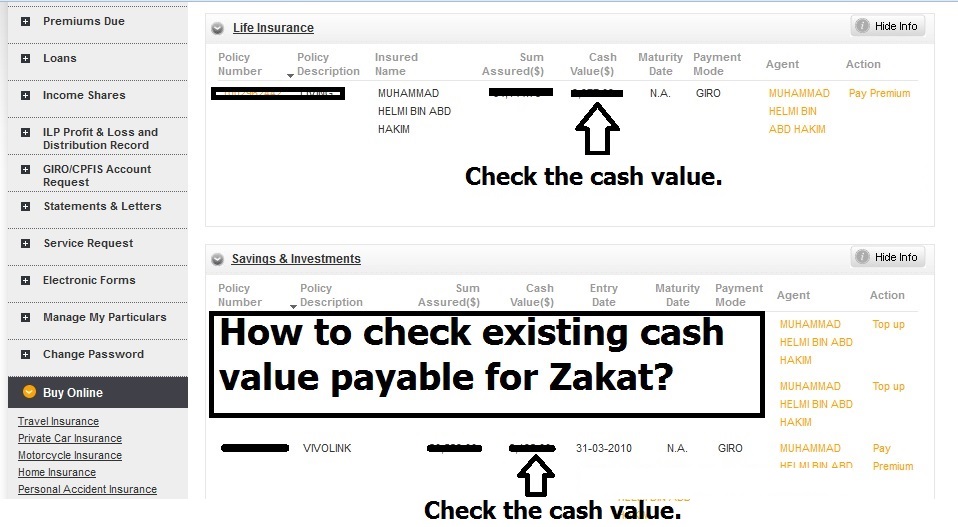

OR you can choose to check your existing cash value yourself using ME@INCOME.

-Go to income.com.sg

– At the top right hand corner, you will see, ME@INCOME LOGIN.

Log in from there to check the cash value of all your policies with me.

(Example, after you log into POLE)

If you started your policy for more than 1 year (haul) and your total surrender value of all your policies is above the nisab value, you calculate total zakat payable this way.

Your Zakat Payable for your insurance policies is Total Surrender Value ($) x 2.5%

As as this month, June 2016, the Nisab Value is $4905.

http://www.zakat.sg/About-Zakat/nisab.html

So, example, if your total surrender value is $10,000, you need to pay $10,000 X 2.5% = $250

You can pay your zakat online too. This is the link.

https://www.muis.gov.sg/epayment/Zakat.aspx

…………………………………………………………………………………

…………………………………………………………………

………………………………………………………………..

…………

I will link to end my blog post with a very good story that I get through whatsapp, sharing on zakat. Do share with your friends if you find it beneficial too! 🙂

*Story of 2.5%*

One day, a very wealthy man was walking on the road.

Along the way, he saw a beggar on the sidewalk.

The rich man looked kindly at the beggar and asked him why he was begging.

The beggar said, “Sir, I’ve been unemployed for a year now. You look like a rich man. Sir, if you’ll give me a job, I’ll stop begging.”

The rich man smiled and said, “I want to help you. But I won’t give you a job. I’ll do something better. I want you to be my business partner. Let’s start a business together.”

The beggar blinked hard. “What do you mean, Sir? ”

I own a rice plantation.

You could sell my rice in the market.

I’ll provide you the sacks of rice. I’ll pay the rent for the market stall.. All you’ll have to do is sell my rice. And at the end of the month, as Business Partners, we’ll share in the profits. Tears of joy rolled down his cheeks.

Do I keep 5% and you get 95%?

I’ll be happy with any arrangement. The rich man shook his head and chuckled.

“No, I want you to give me the 2.5%. And you keep the 97.5%.

For a moment, the beggar couldn’t speak. He couldn’t believe his ears. The deal was too good to be true. I want you to give me 2.5% of your profits so you grow”

The beggar now dressed a little bit better, operated a store selling rice in the market. He worked very hard. He woke up early in the morning and slept late at night.

And sales were brisk, also because the rice was of good quality. And after 30 days, the profits were astounding.

At the end of the month, as the ex-beggar was counting the money.

He told himself, Gee, why should I give 2.5% to my Business Partner?

I didn’t see him the whole month! I was the one who was working day and night for this business. I did all the work. I deserve 100% of the profits.

The rich man came to collect his 2.5% of the profits. The ex-beggar said, “You don’t deserve the 2.5%. I worked hard for this. I deserve all of it!”

If you were his Business Partner, how would you feel?

This is exactly what happens to us….

_ALLAH is Our Business Partner. ALLAH gave us life, every single breath. ALLAH gave us talents, ability to talk, to create, to earn money_

_ALLAH gave us a body, eyes, ears, mouth, hands, feet, a heart_

_ALLAH gave us a mind, imagination, emotions, reasoning, language_

_Giving 2.5% (your Zakat) is an expression of gratitude and love_

_Dont forget to give back what u owe_

_Jazakallahu Khairan_

*Humble Reminders*

p.s. By the way, if you wish to discover a simple & halal way to create a positive monthly cashflow and calculate your net worth for FREE, then please click here…