by Helmi Hakim | Oct 10, 2016 | Investment, Miscellaneous

First and foremost, I will to wish all my Muslim clients, Happy Asyura Fasting!

Muslims are encouraged to fast today.

The fasting is to commemorate the day when Prophet Moses (P.B.U.H) and his followers were saved from Pharaoh by Allah S.W.T by creating a path in the Red Sea.

Prophet Muhammad (P.B.U.H) said,

“The (act of) fast of ‘Asyura, how I dearly hope to Allah to forgive all my sins of the year before” (HR. Muslim no. 1975).

This is from the bounty of Allah towards us: for fasting one day He gives us expiation for the sins of a whole year. And Allah is the Owner of Great Bounty.

……………………………………………….

……………………………..

……………….

Now, back to the topic! 🙂

In my mission to be debt free, I read a lot of books, biographies of successful individual leading a debt free lifestyle.

One of the books that I love is 4 Laws of Debt FREE Prosperity, by Blame Harris and Charles Car.

…………………………………………………………

………………………………………

……………………..

There are basically 4 Laws of Debt FREE Prosperity! 🙂

Law #1: Tracking- the first law of debt free prosperity

For quite a while, a lot of people have asked me.

Since in Singapore, there is no shariah compliant financing facilities to buy a house, how do we clear our interest based housing loans as soon as possible?

What are the strategies?

Before I even lay down my strategies on how to save, accumulate and grow their money the shariah compliant way, I always ask them one question.

Do you track your housing loan repayment?

Most don’t.

Its a cycle. A routine. Every month, get their salary, they will just automatically pay their monthly mortgage.

They are not aware, how much of their monthly instalment are used to pay off principal, how much to pay for interest.

At the end of 5 years, 10 years, 15 years or 20 years, many are clueless to the balance outstanding amount.

If you don’t know, the outstanding amount, how to clear your housing loan?

That is why the first law of debt free prosperity, Tracking, is important.

You got to measure it BEFORE you can manage it.

When performance is measured, it improves.

So, if you want to clear your housing loan, you must track!

(Part of an excel spreadsheet, I have done for my client. If you like to have one, go to Takaful.sg and sign up for “Your Financial M.A.P.” session with me for FREE! )

………………………………

……………….

……….

Law #2: Targeting- the second law of debt free prosperity

The second law of debt free prosperity is Targeting!

Setting goals is IMPORTANT!!!

When do you want to clear your riba based housing loans? In 5 years?

10 years? 15 years? Or perhaps 20 years?

The goals must be written. Goals not written down are wishes.

They must be your own.

They must be measurable and specific.

They must be stated in the most visible terms available.

AND they must contain a deadline.

Personally, I target to clear my housing loan of $300,000 by 31st Dec 2020.

(hahahh… It’s a good thing that I blog here. I am confident of my strategies to achieve it and I will revisit this space again in the future.)

…………………………………….

…………………….

…………

Law #3: Trimming- the third law of debt free prosperity

Live on less than you earn so you can have a surplus to get you out of debt and invest in assets that appreciate.

A lot of people thought, if someone earns big, immediately he or she will become rich.

My experience as a financial consultant tells me otherwise.

I have met someone who earns more than $10,000/mth who cannot afford to get savings plan from me and at the same time, someone just earning $1,500/mth who has a few policies with me.

Your lifestyle determines how rich you are, not your income.

No one, regardless of income, can be financially successful unless they live on less than they earn.

Pay yourself first, and then live in what’s left over.

Law #4: Training- the fourth law of debt free prosperity

The book mentions that “The people who understand money spend it on assets that generate wealth. Those who don’t understand money, spend it on things that consume wealth, and thus the rich get richer and the poor get poorer.”

I have to agree with the statement in the book.

We all know that Singapore has one of the highest Gini Coefficient in the world.

Meaning the income disparity between the rich and the poor is wide!

To me the only solution is to continually upgrade ourselves in terms of our financial literacy.

Learn. Learn. And continue to learn. There are no shortcuts.

……………………………………

……………..

……

I hope you learn something from my sharing. If you will like to learn how to manage your finances better, and clear your riba based loans, visit Takaful.sg to schedule “Your Financial M.A.P.” session with me, Financial Consultant, Helmi Hakim for FREE!

You can also SMS/Whatsapp me directly at 96520134.

Insya’Allah! 🙂

by Helmi Hakim | Oct 8, 2016 | Insurance, Investment, Miscellaneous, Motivation

In my profession as a financial consultant, I always experiment with different techniques.

Different concepts.

And different strategies to help my clients solve their financial objectives/problems.

One of them is using Edward De Bono 6 Thinking Hats.

As humans, sometimes, when we face a problem, we tend to find ways to solve our problem, looking at it from only ONE perspective. ONE angle.

AND because of that, sometimes the decisions that we made may not be the best.

Simply because we don’t have a clear process.

That is why Edward Debono 6 Thinking Hats can help us understand and solve problems more efficiently.

………………………………………………………………………

…………………………………………………

………………………………………….

Let’s apply this to a financial objective.

“Clearing your housing loan debt.”

Each hat represents a specific thinking role/perspective.

……………………………………………………………..

…………………………….

1. The White Hat (Facts and Figures)

First, put on this thinking hat.

The White Hat deals strictly with facts and figures. No emotions or idea generation should happen here. So for our problem, the facts will look something like this:

My housing loan is $300,000, payable for 30 years.

My monthly instalment is $1201.02/mth.

Out of $1201.02, $650 goes to pay for interest, and $551.02 goes to pay outstanding balance.

Ceteris Paribus, after paying for 10 years, my outstanding balance will be $224,579.

If I can save up, accumulate and grow my money the shariah compliant way… having $224,579, on hand, at the end of 10 years, I will have cleared my housing loan debt.

Fact and figures. Pretty straightforward.

2. The Green Hat (Creativity)

Now that you’ve got all the facts, it’s time to come up with solutions.

Save $224,579 by the end of 10 years?

Easier said than done! 🙂

The Green Hat symbolizes creativity.

It’s about generating ideas and exploring possibilities.

So list all the ways you can think of to save money or get money.

E.g: – Open a separate shariah compliant savings account, BUT don’t have ATM card. Every month, get my pay, I do a FAST transfer to my separate savings account. It’s called FORCED SAVINGS.

-Clean my house, and set aside all my junk stuffs. Take picture and sell them at Carousell!

– Have a coin box. Everyday, just use notes to spend. All the coins, save it up in your coin box….

The list, continues…. Go on and on… Let your ideas flow. Like streams of water in the river…

3. The Yellow Hat

Awesome! Now you’ve got your ideas, it’s time to play pros and cons.

The Yellow Hat symbolizes optimism (because it’s such a bright, happy color).

It focuses on the positive aspects and benefits of your ideas.

In this thinking role, you have to pretend that everything will work out fine.

E.g.

Idea #1: Open a separate shariah compliant savings account, BUT don’t have ATM card. Every month, get my pay, I do a FAST transfer to my separate savings account. It’s called FORCED SAVINGS.

Positive Aspects: Awesome!!! It is a super quick way to save up and accumulate money.

.

Idea #2: Clean my house, and set aside all my junk stuffs. Take picture and sell them at Carousell!

Positive Aspects: Awesome!!! Its like killing 2 birds with one stone, or the Malay saying, “Sambil menyelam minum air.”

I have a clean house, clearing all the clutters away AND I make some money.

Idea #3: Have a coin box. Everyday, just use notes to spend. All the coins, save it up in your coin box….

Positive Aspects: Awesome!!! My wallet wont be bulging out with coins. And I save more money.

……………………………………………………………………………………

…………………………………………………..

………………………………………….

4. The Black Hat

You’ve got the positive benefits of your list of ideas. Now do the opposite.

The Black Hat deals with negativity. You’re going to play the devil and come up with all sorts of excuses why your ideas won’t work.

Idea #1: Open a separate shariah compliant savings account, BUT don’t have ATM card. Every month, get my pay, I do a FAST transfer to my separate savings account. It’s called FORCED SAVINGS.

Negative Aspects: Alright. Though I can force myself to save my money quickly, how much are the returns/hibah that I am getting?

Can it beats inflation? I doubt so.

Idea #2: Clean my house, and set aside all my junk stuffs. Take picture and sell them at Carousell!

Negative Aspects: Alright. Will anybody really buy my junk stuffs? Why would they buy when it is all JUNK?

Right?

Idea #3: Have a coin box. Everyday, just use notes to spend. All the coins, save it up in your coin box….

Negative Aspects: Can I really save much money, just by saving my coins everyday?

Substantial enough to pay off my housing loan in 10 years?

5. The Red Hat

Ok, so far you’ve used your mind to do all the work. Now use your heart.

The Red Hat represents emotions/feelings.

Go through your ideas, looking at both their pros and cons.

Ask yourself, am I comfortable with this idea?

Do I feel strongly for it?

Is the sacrifice worth it?

………………………………………………….

……………………………

………………………..

6. The Blue Hat

This is the final hat. Your objective here is to make sure that you’ve done all the previous steps correctly.

Then summarize your results and you should have a clear overview of what your final decision(s) is.

………………………………..

E.g.: Alright.

Perhaps all the methods above can work.

Opening up a separate shariah compliant savings account with out ATM card.

Selling unused stuffs in Carousell.

Having a coin box can help.

Alhamdulillah…. It can help me accumulate my money fast.

It can help me accumulate a sizeable capital amount.

But to accumulate $ $224,579 in 10 years, is no easy feat!!!

So what I can do, to make it looks more realistic is perhaps to extend my time-line to 15 years.

Instead of 10 years.

AND find ways on how to grow my money, the shariah compliant way in Singapore.

Beating inflation, and accelerate the returns so that I have enough to clear off my housing loans in the future.

…………………………………………………………………….

………………………………….

…………………………………

7. Conclusion

This thinking tool is really useful, especially for problems that require serious consideration.

You can apply this to any area of your life, such as career choice, insurance choice etc.

I personally went through this, when I designed “Your Financial M.A.P. Model”

– A Standard Step By Step Guide to Grow Your Money And Wipe Off All Your Loans With Riba, using Shariah Compliant Financial Strategies.

If you are interested to learn more, go to Takaful.sg, for a FREE “Your Financial M.A.P.” session!

In “Your Financial M.A.P.” session, you will also learn on how you can calculate your net worth in less than 10 mins, which allows you to fully understand your financial situation and create a master plan to get started on your journey to achieve the financial freedom you desire.

You will discover bulletproof strategies on how you can increase your savings by 20%, even if you have not saved a single dollar before (It’s like having money growing from your pocket out of nowhere)

I will share with you 8 financial ratios that acts as a financial compass, giving you the direction to the oasis of financial promise land.

I will also share with you a Quick way to save up money for emergencies. This will give you a peace of mind, rather than panicking and trying to scramble up money from nowhere. You know, you have a safety net to protect you 100%.

………………………………………………………………..

……………………………………………………………..

………………………………..

The first 100 who register will receive a Special Bonus. You will get an exclusive, personalised housing loan riba spreadsheet for FREE. (previously only available for paying customers and not available elsewhere).

You will be able to know how much of your monthly loan instalment goes to riba, and how much exactly goes to pay off your outstanding balance.

You can also find out how much riba you can save every year by paying your principal amount quickly.

Go ahead! Register for FREE “Your Financial M.A.P.” session at Takaful.sg!

See you soon! Insya’Allah! 🙂

by Helmi Hakim | Oct 3, 2016 | Insurance, Investment, Miscellaneous, Motivation

Some of you might have known me as the financial consultant that help Muslim families, plan their finance in a shariah compliant way in Singapore . You might have seen me in the papers, on national TV, dispensing financial advice specifically for Muslims in Singapore.

(Snapshot of my recent interview at a show, “Demi Cinta” in Suria. Picture from Toggle.sg)

…………………………………………………………………………………………………………………………………….

…………………………………….

One of the most common questions that I always get, is how do I get the motivation.

The strength.

The energy to push forward, in my journey to promote Islamic Finance in Singapore.

I have to admit, that it seems an arduous task ahead.

As an entrepreneur running my own financial practice, sometimes, my business is up.

AND sometimes, my business is down.

When I feel down, I read on the translation of the Quran and Seerah (biograghy) of all the messengers of God, from Prophet Adam to Prophet Muhammad (May Peace and Blessings Be Upon Them All).

Here are some learning nuggets that I learnt, that motivate and inspire me to continue to work hard to promote Islamic Finance in Singapore.

…………………………………………………………………………………………

………………………………..

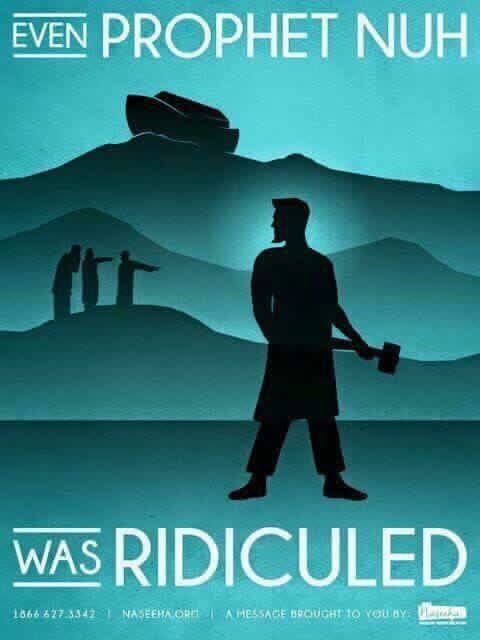

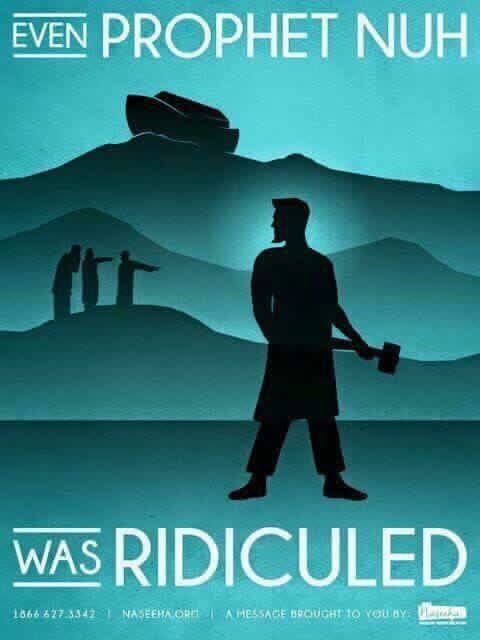

1) Follow the power of focus of Prophet Noah (Peace Be Upon Him)

When I am feeling down, I remembered reading about the story of Prophet Noah (Peace Be Upon Him).

Allah S.W.T commanded him to build a ship.

“And construct the ship under Our Eyes and with Our Inspiration and address Me not on behalf of those who did wrong; they are surely to be drowned.” (Quran 11:37)

………………………………………………………………………………………………

…………………………………………………..

Prophet Noah (Peace Be Upon Him) chose a place outside the city and far away from the sea to build his ark.

Some mocked and laughed at him.

Making comments about the ship’s location, far from any water source.

………………………..

..

They had no comprehension of the power and magnificence of God.

SO they could not understand why Prophet Noah (Peace Upon Him) would build a ship, on the top of a hill, far away from the ocean.

They called him crazy and laughed out loud.

The ship began to take shape and when it was finished,

Prophet Noah (Peace Be Upon Him) patiently waited for the command from God.

…………………………………………………………………………………………

…………………………………

When others said, many Muslims in Singapore don’t mind taking riba (interest)… The market is not big enough… When others questioned me on why I need to talk about Islamic finance, I remember the story of Prophet Noah (Peace be Upon Him)

I ignore these voices. I stay focus.

If I can help even 1 client plan their finance in a shariah compliant way, I have done my job.

If I can show 1 client, how they can reduce their riba/interest payable by even 1%, I have done my job.

Even if I meet with rejections upon rejections, after proposing shariah compliant initiatives, I have done my job as a Muslim financial consultant in Singapore.

2) The Importance Of Planning

Prophet Muhammad (Peace be Upon Him) planned very well when doing his Hijrah from Mecca to Madinah.

The Hijrah of Prophet Muhammad (Peace Be Upon Him) is one of the most important episode in the history of Islam.

Allah S.W.T could have just instructed the Angels to carry Prophet Muhammad (Peace Be Upon Him) from Mecca to Madinah, without effort.

However, we all know that the Hijrah does not happen that way.

Our beloved Prophet Muhammad (Peace Be Upon Him) had strategies and plans, in place. Some of them are….

– Asking Sayyidina Ali (May God Be Pleased With Him) to replace him at his sleeping place

– Went out of his house, when the sun is scorching hot, something that those who were travellers wont do at that point of time

– Choosing Sayyidina Abu Bakar Assidiq as his companion for hijrah to Madinah

– Choosing alternative route to Madinah which is further and not the route commonly used by others

– Asma’ bt Abu Bakar and Abdullah Bin Abu Bakar to send information and food supplies while he is hiding at at Thur cave

– Amir bin Fuhairah, the individual to remove the footprints of Prophet Muhammad (Peace Be Upon Him) and Sayyidina Abu Bakar

(Source: “Panduan Cashflow, Apa Yang Kamu Tuai Simpanlah Bersama Tangkainya” book, by Suzardi Maulan (Pakdi))

………………………………………………………………………………………..

……………………………………………………………………………………

My take is that if our beloved Prophet Muhammad (Peace Be Upon Him) planned very well when he is doing his hijrah, we should also have a plan, in doing anything in our life.

Everyday, I think of strategies.

Strategies on how, to get more people to plan their finance in a shariah compliant way in Singapore.

How to get more people plan their finance the shariah compliant way in Singapore?

Facebook marketing.

Blogging.

Words of Referral.

Making Educational Videos etc2…

I work hard to introduce these systems in place.

Alhamdulillah…. Till date, I have over 600 clients who trust their finance with me, not only from Singapore, but also from Malaysia, Indonesia, Bangladesh, India and many other countries… 🙂

Remember, my friends.

Anything you do, plan and prepare in advance.

If you don’t have a plan, you will go haywire. Create a plan and stick through your plan. Follow the footsteps of our beloved Prophet Muhammad (Peace Be Upon Him).

……………………………………………..

….

.

3) Motivation to get out of debts with interest

I adviced my clients on strategies to reduce riba, yet I have to admit that I am still servicing my housing loan. In Singapore, there is no murabahah financing, so its darurah, for us to take loan with interest to get our house.

We need a roof over our heads.

Everyday, I make doa/prayers/supplication to Allah S.W.T. to grant me the strength, the rezeki to accumulate as much cash as possible so that I don’t have to take loans with interest.

My motivation to stay away and get out of debts also propel me to me to work hard everyday, because interest/usury is haram. In addition to that, I need to walk my talk as an ambassador to promote Islamic Finance in Singapore.

I am also a firm believer of the ‘Man jadda wajada’ principle which means whoever puts in the effort, God willing, they will get what they work for.

Make doa. Put in a lot of effort and focus on your work. Tawakkal….

Insya’Allah…You will get what you work for.

4) Motivation to help my community grow strength by strength

Everytime, I read the news, I see Islam being potrayed in a negative light. What I learn in my part time madrasah (religious school) and what I see in the newspaper is totally different.

Of course, to explain the beauty of Islam is the jobs of our Islamic scholars. We seek their leadership to guide us, on how to live our life, in accordance to the Quran and Sunnah of our beloved Prophet Muhammad S.A.W.

I am glad that Asatizah Recognition Scheme (ARS) is now made compulsory, to ensure that our religious teachers and scholars are reliable guides for our community.

We need their expertise. We need their guidance. Reading and interpreting the Quran (God’s words) is not like reading a story book. We need… We depend on our Islamic scholars to interpet the verses of Quran and Hadith and apply them in Singapore’s context.

Nevertheless, I feel everyone has a role to play. Even in my position as a financial consultant in Singapore, I have a role to play. Empowering our Muslim community with financial knowledge is crucial. My job is real.

I advice my clients and their children, that whatever we do in life, we give our level best. Aim to be the best.

Prophet Muhammad (Peace Be Upon Him) says,

“The best of people are those that bring most benefit to the rest of mankind.” (Daraqutni, Hasan)

I hope, in the future, some of the children, I plan for becomes a scientist, becomes a lawyer, becomes a school teacher

or even become an Olympic Champion!

I hope, some days, I can see, my clients’ children names on the headlines of the newspapers, bringing glory to our community by being the best in their specialisation, in their chosen field.

………………………………………………………….

………………………………………………….

………………..

With the following reasons above, I am more determined than ever to help with the development of Islamic Finance in Singapore.

That is why, I created Takaful.sg.

Takaful.sg serves as a platform for me to educate.

Empower.

AND reach out to more Singaporeans who are interested to know more on the practicality and relevance of Islamic finance, in Singapore’s context.

………………………………………………………………

…………………………………..

In Takaful.sg, you can sign up for “Your Financial M.A.P” session (Worth $500) for FREE.

“Your Financial M.A.P. Model” is A Standard Step By Step Guide.

To grow your money.

AND wipe off all your loans with riba,

using Shariah Compliant Financial Strategies.

……………………………………………………….

……………………………….

You will also learn on how you can calculate your net worth in less than 10 mins, which allows you to fully understand your financial situation and create a master plan to get started on your journey to achieve the financial freedom you desire.

You will discover bulletproof strategies on how you can increase your savings by 20%, even if you have not saved a single dollar before (It’s like having money growing from your pocket out of nowhere)

I will share with you 8 financial ratios that acts as a financial compass, giving you the direction to the oasis of financial promise land.

I will also share with you a Quick way to save up money for emergencies. This will give you a peace of mind, rather than panicking and trying to scramble up money from nowhere. You know, you have a safety net to protect you 100%.

Go to Takaful.sg now and sign up for your FREE session today! Insya’Allah… 🙂

by Helmi Hakim | Oct 1, 2016 | Miscellaneous

I would like to wish all my blog readers,

‘A Blessful & Peaceful Ma’al Hijrah 1438’.

Happy Islamic New Year…

In this blessed, Islamic New Year, I have good news to share with you. 🙂

I have just launched Takaful.sg

It is a personal gift from me, in my capacity as a financial consultant that specialises on Islamic Finance for our Muslim community in Singapore.

In my course of work as a financial consultant, I have met too many Singaporean Muslims who would like to hijrah, from riba intensive ways of financial planning to shariah compliant based of financial planning in Singapore.

But many are clueless. Some are overwhelmed.

Through my humble initiative, Takaful.sg, I hope to reach more lives and share the beautiful message on Islamic Financial Planning to as many people as possible.

………………………………………………………………………………

……………………………………………..

………….

In this blessed new year, let us set new azam/resolutions.

New commitments.

One of my commitments is for me to reach out to more Singaporeans and share with them on how to clear their riba based loans.

AND start planning their finance the shariah compliant way in Singapore.

That is why, on this special day, I create and launch Takaful.sg

Share this link, with your family, friends and love ones! 🙂

………………………………………………………..

…………………………………….

In this blessful day, may Allah forgive all our past wrongdoings and accept our repentence. May the year ahead be showered with Blessings, Peace and Wisdom.

May the coming year be more fulfilling spiritually for everyone.

Amin…. Amin…. Insya’Allah.

‘A Blessful & Peaceful Ma’al Hijrah 1438’ to all my brothers and sisters again… 🙂

by Helmi Hakim | Jul 29, 2016 | Insurance, Investment, Miscellaneous

Some of my peers in the industry have been asking…

“Helmi… You always talk about Islamic Financial Planning. What exactly is Islamic Financial Planning?

How is Islamic Financial Planning different than conventional planning?

Can we apply it exactly in Singapore?”

………………………………………………

…………………………………

………….

Yes. I specialise in helping Muslim families in Singapore, plan their finance in a shariah compliant way.

In accordance to the Quran (The Word of God)

And Sunnah (Traditions of Prophet Muhammad P.B.U.H).

One of the most important element of planning your finance the shariah compliant way is that you need to ensure that the financial strategies you advocate is free from prohibitive elements like riba, maysir and gharar.

AND the financial instruments that you choose is ALSO free from prohibitive elements like riba, maysir and gharar.

a. Riba, meaning payment or receipt of interests, is strictly forbidden.

Allah S.W.T said in the glorious Quran, Surah Al Baqarah, Verse 275:

“Allah has permitted trade and has forbidden interest”

………………..

………

.

b. Maysir, meaning any form of gambling. And Gharar, meaning uncertainty. Both are not allowed.

As stated in Surah Al-Maeda, Verse 90:

“O ye who believe! Intoxicants and gambling, (dedication of) stones, and (divination by) arrows, are an abomination,- of Satan’s handwork: eschew such (abomination), that ye may prosper.”

……………………………………

……………….

………

I like to give my clients, simple examples.

To explain difference between Riba (interest) and Profits.

This is important because many people out there get confused and thought that riba (interest) and profits are the same.

…………………..

………..

Example, today, I lend you $1000.

Tomorrow, I ask you, to pay me back $1001.

That additional $1 is riba…

Even though, it is only a small amount of $1. That additional $1 is riba.

Riba is not permissible in Islam!

……………………………………………………………….

………………………………………

Now, let me explain profit.

Example, today, I set up a drink stall.

I sell Bandung drink.

My cost per cup of Bandung drink is 40 cents. (You know the rose syrup, milk, water and ice)

I sell, the Bandung drink for $2.

My profit is $1.60.

Profit is permissible in Islam!

…………………………………………………………..

…………………………………………

…………………..

Some people asked me, “Is it necessary, to plan my finance the shariah compliant way? I think, as long, I make money, its okay right? No need to be too concerned if its halal or its not.”

………….

…….

I told them, I am a trained financial consultant.

I can present you ideas on how you can grow your money the shariah compliant way and also the non shariah compliant way. Convincingly.

And if you can grow your money the shariah compliant way,

why choose to do it the non shariah compliant way?

……………………………………………………………………………………………..

……………………………………………………………..

In addition to that, I told my clients and also my mentees. In our profession as a financial consultant, we are doing good jobs for our community.

(A picture of my family and myself)

You know, at times, I meet a family, and I bring about the idea of saving money for child’s education, to the sole breadwinner.

The Abang will look at me and say, “Child’s education? You mean you want my child to go to university? I myself, only have O’Level. How can you expect my child to go to university?”

………………………………..

…………………………………….

I told him, “Yes! Its possible! Your child will grow up and can go to university in the future!

He can be a lawyer, teacher, engineer, any profession that can help the community…He will be someone successful and beneficial to the community!!”

………………………………………..

…………………………………………….

AND we went one step further, we help that Abang plan for his child’s education, the shariah compliant way.

Not only that Abang helps his son, he also do it the blessful way. The shariah compliant way.

Both me, as his financial consultant, and him, as my client, will get passive pahala (good deeds) for the next 15-20 years of the plan. Its because both of us choose Islamic Financial Planning in Singapore.

We choose to do it the shariah compliant way. Avoid riba. Avoid maysir. Avoid Gharar.

That is what Islamic Financial Planning is all about.

Isn’t that a good position to be in? 🙂

…………………………………………………………………………..

……………………………………………….

So for those of you, who have been considering Islamic Financial Planning, take a look at the Financial Planning Building Blocks below and whatsapp/SMS me, Financial Consultant, Helmi Hakim at 96520134 to schedule an appointment. Insya’Allah! 🙂

(Financial Planning Building Blocks To Plan Your Finance With Financial Consultant, Helmi Hakim)