Myth #1: It is EXPENSIVE. It is only reserved for the rich Arabs.

(Arabic Businessmen enjoying a cup of tea)

.

.

Helmi Hakim’s answer: Not true. You can start investing in shariah compliant funds with as little as $5/day or $150/mth.

Gone are the days where shariah compliant instruments are reserved only for the rich and institutional investors with minimal investment amount of $200,000.

Today, common man on the streets in Singapore can also be a shariah compliant investor, with only SGD$150/mth.

………………………………………………

…………………………………..

Myth #2: It is obsolete. It is backward. Some lament that Islamic Finance use ancient strategies. More than 1400 years ago.

Might no longer be applicable today.

Today is modern times. Modern times must use modern investment strategies.

.

.

.

Helmi Hakim’s answer: Not true.

In reality, Islamic Finance have timeless principles as stipulated in the holy Quran and Sunnah of our beloved Prophet Muhammad (Peace and Blessings Be Upon Him) which are relevant and applicable till the day of judgement.

The pertinent principles (no riba, no maysir, no gharar) haven’t change. The application perhaps have changed.

How we apply the pertinent principles essentially does change over time because the modern financial world and business as we know it today is very different to what happened 1400 years ago.

So essentially the modern financial Islamic Finance industry is about taking those crucial, pertinent principles.

And apply them in the modern context.

No riba. No Maysir. No Gharar. In the context of the 21st Century.

In fact, I can argue that most global financial problems in the world today happens because of Riba (Interest), Maysir (Speculation) and Gharar (Uncertainty).

Be it the subprime mortgage crisis in year 2008, the Asian financial crisis in year 1997, Euro Debt Crisis, 1MDB saga, anything you can think of.

Allah S.W.T. has given us the prescriptions to the global economic ailments in the holy Quran and sunnah of our beloved Prophet Muhammad (Peace and Blessings Be Upon Him).

Why don’t we just follow them?

Of course, if I were to lay down everything here, my post will never end.

You can schedule a free consultation session with me to discuss more. Insya’Allah. 🙂

……………………………………………

…………………………..

Myth #3: It is FAKE.

Yek Eleh… They just replace the word “interest” with the word “profits”.

It is still conventional. But just dressed up as Halal.

.

.

.

Helmi Hakim’s answer: Not true.

Name me any Islamic financial contracts. In essence, all of them are free from riba (interest), maysir and gharar.

Let me explain with a simple example.

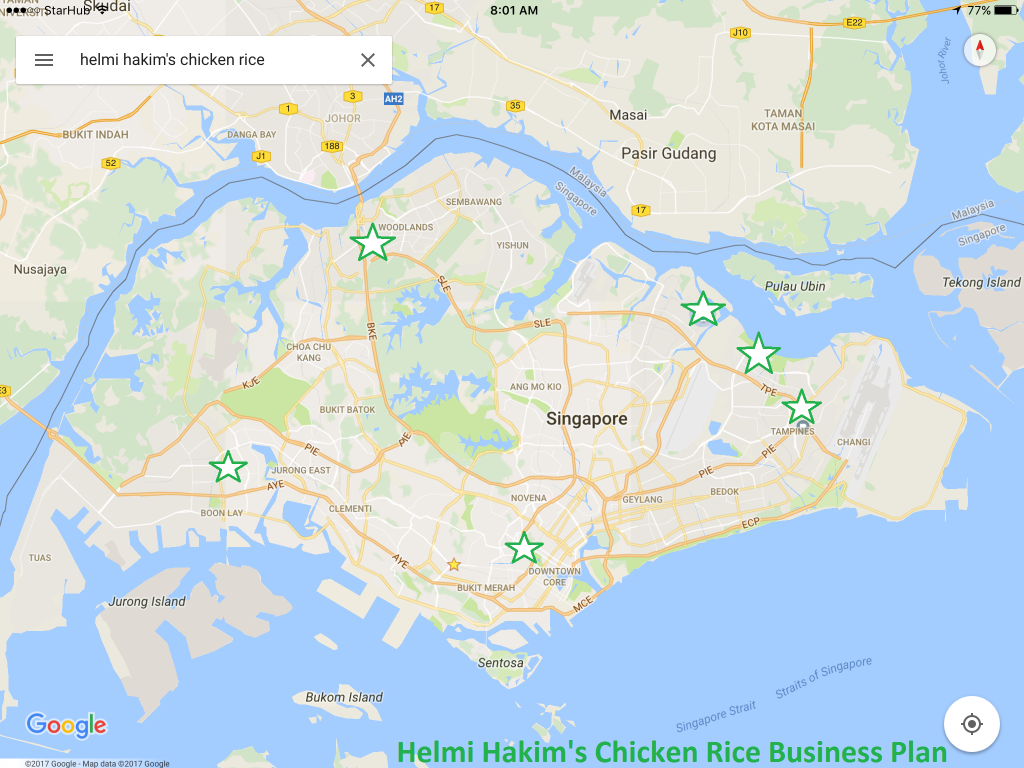

Example, I set up a chicken rice stall.

Alhamdulillah.

My chicken rice is delicious.

A lot of customers queue to buy my chicken rice every day.

As a businessman, because I have one chicken rice stall that is so profitable, I want to expand my business.

I want to open up more stalls selling my delicious chicken rice.

Perhaps now my stall is in Tampines.

(Copyright belongs to Google Map)

I want to open one in Punggol, one in Pasir Ris, one in Woodlands, one in Jurong West and one in Somerset.

But, I dont have much money.

So what I do, I become a bond issuer. I approach people like yourself.

You give me $100,000.

I promise you that every quarter, or every half year or perhaps every year, I will give you money.

Regardless, my new chicken rice stall makes money OR lose money,

I will still give you money.

The money that I give you is called coupons.

From shariah compliant perspective, the coupons is not permissible because it is still known as interest and essentially riba.

……………………………………………..

………………………

…………….

So how do we do it the shariah compliant way?

Again, I approach you.

This time round, I invite you to be my business partner in this new stall.

You run the stall for me.

I share with you my secret delicious chicken rice recipe.

At the end of the day, we share our profit and loss.

You take 70%, I take 30%. This is allowed from shariah perspectives.

In Islamic Finance, it is known as Musharakah.

………………………

………………

….

For another stall, I approach my friend.

This time round, my friend told me that he doesn’t want to run the stall.

But he wants to be an INVESTOR.

Okay. He contributes $50,000 to my new stall.

This time round, we have an agreeable profit sharing ratio.

Perhaps, I take 70% and he takes 30%.

However, if our business loses money, my friend’s loss will be limited to the $50,000 capital that he contributed.

This is allowed from shariah perspectives.

In Islamic Finance, it is known as Mudarabah.

Based on the above example,

I just like to illustrate that the application of Islamic Finance in our daily lives is REAL.

It is not just simply dressing up something that is haram to something that is Halal.

……………………………………………………….

………………………………………

Myth #4: It is DIFFICULT to understand.

It is too exotic. Too mysterious. Too unknown.

Mudarabah? Murabaha? Musharakah? Ijarah Muntahia Bithambleek?

Very confusing…

.

.

.

Helmi Hakim’s answer:

Well. The Malay proverb says, “Alah bisa, tegal biasa”.

Anything we do for the first time might feel difficult. But if we do it a lot of times, it becomes easier.

Because it becomes familiar and second nature to us.

In fact, when I first started my journey as a financial consultant in year 2007, I have ZERO educational background in Islamic Finance.

I had Diploma in Accountancy from Ngee Ann Polytechnic.

Sure! You asked me on how to interpret financial statements back then, Insya’Allah, I would be able to assist you.

But you asked me about Islamic Finance, I will stare at you with a blank face.

At that point, I just relied on the Fatwas by MUIS, our religious authority in Singapore. Nothing more than that.

Gradually, I upgrade myself.

I took my degree, Bachelor Of Science (Hons) Banking and Wealth Management with University of Wales (UK).

They have a module on Islamic Finance.

Then, I took an Islamic Finance Certification with Australia Islamic Finance Centre (AUCIF).

Currently, I am studying for my exams, Certified Islamic Finance Executive by Ethica Institute which is based in Dubai.

The point, I am trying to bring across is that we have to start somewhere.

A journey of a thousand miles began with the first step. The first step towards the right direction.

Insya’Allah, if we have set our niat right, Allah S.W.T. will guide us, show us the path and make it easier for us.

So, get started! 🙂

.

.

.

Myth #5: It is troublesome/leceh/mafan.

Make money, make money only lah. Religion should be set aside.

No need to distinguish whether it is Halal or Haram.

As long we can make money, it is for the greater good right? Why need to think too hard?

.

.

Helmi Hakim’s answer:

There are 2 ways of making money.

The shariah compliant (halal) way. And the non shariah compliant way.

If you can make money the shariah compliant way, why do it the non-shariah compliant way?

At the end of the day, you still make money right? 🙂

…………………

….

To say that making money the shariah compliant way in Singapore is troublesome is not true at all.

In fact, the basic fundamentals of how shariah compliant fund makes money and non-shariah compliant funds make money is the about the SAME.

The only difference is the underlying assets.

To do it the shariah compliant way, the underlying asset has to be shariah compliant.

No pork. No alcohol. No casinos.

And other pertinent requirements (absence of riba, maysir and gharar) to ensure that the financial transaction and the underlying assets are permissible in Islam.

Shariah compliant. Halal wa Thoyibban.

As Muslims, the practise of our beloved religion, Islam covers all aspects of our life.

Family. Community. Business.

To Ibadah. Morals and even areas such as our personal hygiene.

Islam does not adopt a secular model whereby religion plays little or no role in public affairs.

There is no segregation of ‘church’ and ‘state’ as such.

Religion and our daily lives goes hand in hand! 🙂

…………………………………………………..

…………………………………….

…………………………..

Above are just some myths that I came across when meeting hundreds of Singaporean Muslims out there, to share on how they can plan their finance, the shariah compliant way in Singapore.

If you are looking on the practical aspects on how you can save, accumulate and grow your money the shariah compliant way in Singapore, you can always whatsapp/sms me at 96520134 to schedule a FREE consultation.

Or perhaps click here to schedule an appointment.

You will want to schedule it asap because I can only accomodate 5 slots per week.

Click here to schedule your FREE consultation today!

Take Care! 🙂