by Helmi Hakim | Aug 8, 2016 | Miscellaneous

By now, you will have known that Pokemon Go has just been released a few days ago in Singapore.

I personally tried it out and it was fun! I feel adventurous discovering different types of Pokemon in their natural habitats and learning about their behaviors. It’s like having virtual pets as your collections.

(My latest collection as of now. Note: I am no expert as I only play the games, while waiting for my clients for appointments.)

……………………………………………………………………………….

…………………………………….

Pokémon Go is fun seriously! 🙂

Nevertheless, anything you do in life, there are risks involved. Below are some risk management strategies, you should take when playing Pokemon Go.

……………….

1) Do not play the game while you drive your car or ride your motorcycle at the same time… even when there is a traffic jam.

Or when your vehicle is stationary, because the traffic light is red.

It’s DANGEROUS and you cannot do both safely.

………………………….

………………..

2) Watch where you are walking, be aware of your surroundings and do not walk out into roads/car parks without looking.

…………………………….

……………………….

3) If you are at a park (there are many Pokemons for you to capture).

And you will like to focus your eyes on your phone, stand aside! Don’t block other people!

Have a lookout for cyclists/joggers when you resume your journey.

You don’t want to bump against them!

………………………………………………………………….

……………………………………………….

4) There have been reports of armed robberies in other countries in areas with high concentrations of Pokemon Go players.

It’s obvious that when you are too engrossed with your games, some unscrupulous characters or perhaps pickpockets will take advantage.

Stay alert at all times!

…………………………………………….

………………………………

5) Get in touch with your financial consultant, to understand better.

Insurance coverage that you should take, in the event accidents happen, even though you have taken the necessary precautions above.

You can whatsapp me, Financial Consultant, Helmi Hakim at 96520134 to arrange an appointment to discuss further. Insya’Allah…

……………………………………………………..

…………………………………

…………..

Share this blog posts with your love ones because you care! 🙂

by Helmi Hakim | Jul 29, 2016 | Insurance, Investment, Miscellaneous

Some of my peers in the industry have been asking…

“Helmi… You always talk about Islamic Financial Planning. What exactly is Islamic Financial Planning?

How is Islamic Financial Planning different than conventional planning?

Can we apply it exactly in Singapore?”

………………………………………………

…………………………………

………….

Yes. I specialise in helping Muslim families in Singapore, plan their finance in a shariah compliant way.

In accordance to the Quran (The Word of God)

And Sunnah (Traditions of Prophet Muhammad P.B.U.H).

One of the most important element of planning your finance the shariah compliant way is that you need to ensure that the financial strategies you advocate is free from prohibitive elements like riba, maysir and gharar.

AND the financial instruments that you choose is ALSO free from prohibitive elements like riba, maysir and gharar.

a. Riba, meaning payment or receipt of interests, is strictly forbidden.

Allah S.W.T said in the glorious Quran, Surah Al Baqarah, Verse 275:

“Allah has permitted trade and has forbidden interest”

………………..

………

.

b. Maysir, meaning any form of gambling. And Gharar, meaning uncertainty. Both are not allowed.

As stated in Surah Al-Maeda, Verse 90:

“O ye who believe! Intoxicants and gambling, (dedication of) stones, and (divination by) arrows, are an abomination,- of Satan’s handwork: eschew such (abomination), that ye may prosper.”

……………………………………

……………….

………

I like to give my clients, simple examples.

To explain difference between Riba (interest) and Profits.

This is important because many people out there get confused and thought that riba (interest) and profits are the same.

…………………..

………..

Example, today, I lend you $1000.

Tomorrow, I ask you, to pay me back $1001.

That additional $1 is riba…

Even though, it is only a small amount of $1. That additional $1 is riba.

Riba is not permissible in Islam!

……………………………………………………………….

………………………………………

Now, let me explain profit.

Example, today, I set up a drink stall.

I sell Bandung drink.

My cost per cup of Bandung drink is 40 cents. (You know the rose syrup, milk, water and ice)

I sell, the Bandung drink for $2.

My profit is $1.60.

Profit is permissible in Islam!

…………………………………………………………..

…………………………………………

…………………..

Some people asked me, “Is it necessary, to plan my finance the shariah compliant way? I think, as long, I make money, its okay right? No need to be too concerned if its halal or its not.”

………….

…….

I told them, I am a trained financial consultant.

I can present you ideas on how you can grow your money the shariah compliant way and also the non shariah compliant way. Convincingly.

And if you can grow your money the shariah compliant way,

why choose to do it the non shariah compliant way?

……………………………………………………………………………………………..

……………………………………………………………..

In addition to that, I told my clients and also my mentees. In our profession as a financial consultant, we are doing good jobs for our community.

(A picture of my family and myself)

You know, at times, I meet a family, and I bring about the idea of saving money for child’s education, to the sole breadwinner.

The Abang will look at me and say, “Child’s education? You mean you want my child to go to university? I myself, only have O’Level. How can you expect my child to go to university?”

………………………………..

…………………………………….

I told him, “Yes! Its possible! Your child will grow up and can go to university in the future!

He can be a lawyer, teacher, engineer, any profession that can help the community…He will be someone successful and beneficial to the community!!”

………………………………………..

…………………………………………….

AND we went one step further, we help that Abang plan for his child’s education, the shariah compliant way.

Not only that Abang helps his son, he also do it the blessful way. The shariah compliant way.

Both me, as his financial consultant, and him, as my client, will get passive pahala (good deeds) for the next 15-20 years of the plan. Its because both of us choose Islamic Financial Planning in Singapore.

We choose to do it the shariah compliant way. Avoid riba. Avoid maysir. Avoid Gharar.

That is what Islamic Financial Planning is all about.

Isn’t that a good position to be in? 🙂

…………………………………………………………………………..

……………………………………………….

So for those of you, who have been considering Islamic Financial Planning, take a look at the Financial Planning Building Blocks below and whatsapp/SMS me, Financial Consultant, Helmi Hakim at 96520134 to schedule an appointment. Insya’Allah! 🙂

(Financial Planning Building Blocks To Plan Your Finance With Financial Consultant, Helmi Hakim)

by Helmi Hakim | Jul 7, 2016 | Miscellaneous

Assalamualaikumwarahmatullah…. Thank you for your time, reading my blog post! 🙂

I, Financial Consultant, Helmi Hakim will like to take this opportunity to wish all my family, friends, clients and readers of my blog,

Selamat Hari Raya, Maaf Zahir Dan Batin! 🙂

Forgive me for all my wrongdoings, and for anything that I’ve said and done directly or indirectly that may have hurt your feelings for I am only human who is far from perfection.

Enjoy this festive season with delicious ketupat, rendang, lodeh, sambal goreng (my favourite) and tantalising kuehs!

Spend quality time visiting families and friends, and strengthen our silaturahim!

See you soon! Insya’Allah! 🙂

by Helmi Hakim | Jun 18, 2016 | Insurance, Investment, Miscellaneous

Time flies… Now, we are moving to the third week of Ramadan. 🙂

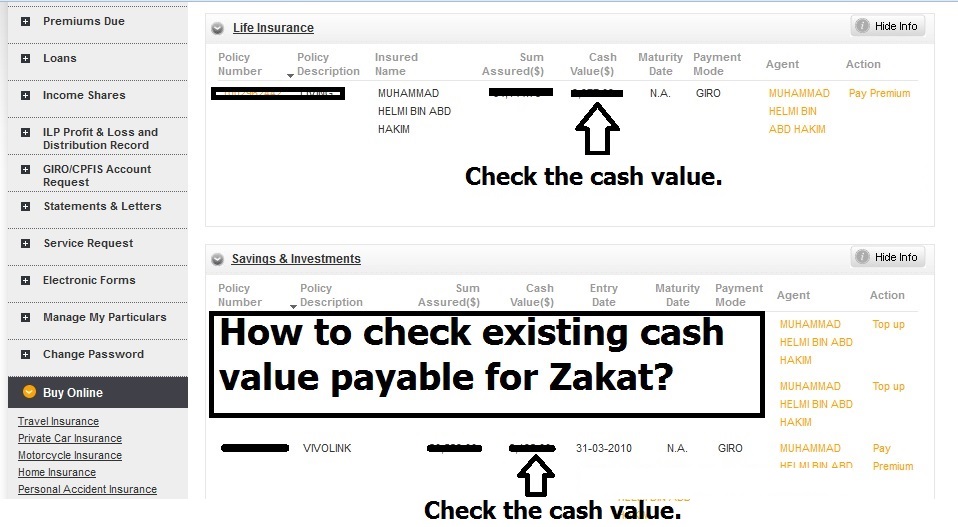

Alhamdulillah… For the past 1 week, I have a flurry of clients, asking me on the existing cash values of their insurance policies.

My clients need to know the cash value of their insurance policies so that they can calculate collectively, how much zakat to pay for the year.

………………………………………………………..

……………………………………………….

Zakat which literally means purification is the 3rd Pillar Of Islam.

Allah (S.W.T) has made Zakat compulsory on all Muslims. It is a religious obligation for all Muslims who meet the necessary criteria of wealth.

Here, to give Zakat implies purifying your wealth and soul by giving a portion of your wealth to those in need. The word Zakat appears in the Holy Quran a total of 32 times.

…………………………………………………..

………………………

There are 2 types of Zakat.

1) Zakat Fitrah

Firstly, Zakat Fitrah.

We pay Zakat Fitrah in the month of Ramadan, before Eid prayers.

The Zakat Fitrah rate that is obligatory on every person is one sa’ or 2.3kg of the staple food of the territory in which the person is in.

In Singapore, the staple food is rice.

……………………………………..

………………………………

Since 2005, Muis has introduced a two-tier Zakat Fitrah rate.

This is in accordance with the Syari’ah and allows the payer to choose the rate that is most suitable for them based on their daily consumption.

Normal Rate ($5.10 per person in 1437H / 2016):

Based on the median price of 2.3kg of rice (normal/average grade) that is consumed as a staple.

Higher Rate ($6.90 per person in 1437H / 2016):

Based on the median price of 2.3kg of rice (higher grade) that is consumed as a staple.

(MUIS Website)

2) Zakat Harta

2ndly, is Zakat Harta.

Zakat on your wealth.

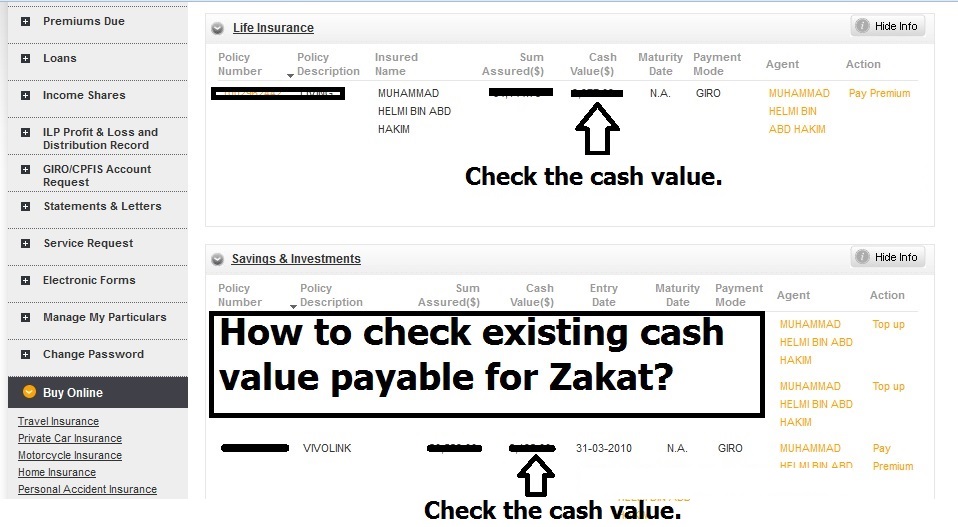

For those of you, who have cooperative insurance plans or investment in Takaful fund with me, you can just SMS/whatsapp me and I will tell you the existing cash value of your policies.

OR you can choose to check your existing cash value yourself using ME@INCOME.

-Go to income.com.sg

– At the top right hand corner, you will see, ME@INCOME LOGIN.

Log in from there to check the cash value of all your policies with me.

(Example, after you log into POLE)

If you started your policy for more than 1 year (haul) and your total surrender value of all your policies is above the nisab value, you calculate total zakat payable this way.

Your Zakat Payable for your insurance policies is Total Surrender Value ($) x 2.5%

As as this month, June 2016, the Nisab Value is $4905.

http://www.zakat.sg/About-Zakat/nisab.html

So, example, if your total surrender value is $10,000, you need to pay $10,000 X 2.5% = $250

You can pay your zakat online too. This is the link.

https://www.muis.gov.sg/epayment/Zakat.aspx

…………………………………………………………………………………

…………………………………………………………………

………………………………………………………………..

…………

I will link to end my blog post with a very good story that I get through whatsapp, sharing on zakat. Do share with your friends if you find it beneficial too! 🙂

*Story of 2.5%*

One day, a very wealthy man was walking on the road.

Along the way, he saw a beggar on the sidewalk.

The rich man looked kindly at the beggar and asked him why he was begging.

The beggar said, “Sir, I’ve been unemployed for a year now. You look like a rich man. Sir, if you’ll give me a job, I’ll stop begging.”

The rich man smiled and said, “I want to help you. But I won’t give you a job. I’ll do something better. I want you to be my business partner. Let’s start a business together.”

The beggar blinked hard. “What do you mean, Sir? ”

I own a rice plantation.

You could sell my rice in the market.

I’ll provide you the sacks of rice. I’ll pay the rent for the market stall.. All you’ll have to do is sell my rice. And at the end of the month, as Business Partners, we’ll share in the profits. Tears of joy rolled down his cheeks.

Do I keep 5% and you get 95%?

I’ll be happy with any arrangement. The rich man shook his head and chuckled.

“No, I want you to give me the 2.5%. And you keep the 97.5%.

For a moment, the beggar couldn’t speak. He couldn’t believe his ears. The deal was too good to be true. I want you to give me 2.5% of your profits so you grow”

The beggar now dressed a little bit better, operated a store selling rice in the market. He worked very hard. He woke up early in the morning and slept late at night.

And sales were brisk, also because the rice was of good quality. And after 30 days, the profits were astounding.

At the end of the month, as the ex-beggar was counting the money.

He told himself, Gee, why should I give 2.5% to my Business Partner?

I didn’t see him the whole month! I was the one who was working day and night for this business. I did all the work. I deserve 100% of the profits.

The rich man came to collect his 2.5% of the profits. The ex-beggar said, “You don’t deserve the 2.5%. I worked hard for this. I deserve all of it!”

If you were his Business Partner, how would you feel?

This is exactly what happens to us….

_ALLAH is Our Business Partner. ALLAH gave us life, every single breath. ALLAH gave us talents, ability to talk, to create, to earn money_

_ALLAH gave us a body, eyes, ears, mouth, hands, feet, a heart_

_ALLAH gave us a mind, imagination, emotions, reasoning, language_

_Giving 2.5% (your Zakat) is an expression of gratitude and love_

_Dont forget to give back what u owe_

_Jazakallahu Khairan_

*Humble Reminders*

by Helmi Hakim | May 29, 2016 | Insurance, Investment, Miscellaneous, Motivation

Alhamdulillah… My mentees and I, financial consultants from NTUC Income Cooperative were honoured to be invited to Islamic Banking & Investment Asia/Middle East Congress 2016 a few months back. 🙂

I received a lot of requests on my Facebook for me to share takeaways and learning points from the 2-day congress – but there was too much to share and I was really busy.

The event by itself, was really awesome! 🙂

……………………………………..

…………………………..

…..

As most of you might have known, I work as a financial consultant that helps Muslim families, plan their finance in a shariah compliant way in Singapore . So being able to interact face to face with industry leaders who champions Islamic Finance in the world is a dream come true for a financial practionioner like me in Singapore.

(My mentees and I)

There are really a lot of learning points, and I will try to share with you one by one… I will also add on my perspective, in the context of myself as a financial consultant helping out with the development of Islamic Finance in Singapore. 🙂

……………………………………….

……………………

……

1) Understand Islamic Finance background

Firstly, let us speak about the status quo as of now.

Islamic Finance is 42 years old.

Considering its size of $2 trillion Islamic Finance over $460 trillion conventional finance, Islamic finance is still considered very small.

38 million Muslims touched by Islamic Finance according to Ernst & Young study and about 90 per cent of the Islamic Finance (IF) assets globally sit in six countries, namely Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and United Arab Emirates.

It was argued during the session that OIC members are not using Islamic Finance extensively. Part of the reason is because laws and regulations of the particular countries are not matured and developed. To their governments, Islamic Finance requires changes in laws, introduction of new things, and that is the main hindrance.

………………………………………………………….

………………………..

Financial Consultant, Helmi Hakim’s Perspective:

I agree that there is an enormous opportunity to grow Islamic Finance further.

The very fact that only 38 million Muslims are touched by Islamic Finance, less than 1% of the global Muslim population, only means that there is a lot of work that needs to be done to educate and empower Muslims itself to undertake Islamic Finance products.

There is a huge opportunity for dakwah and it also means that there is a huge business potential and a relatively untapped market.

There are largely poor countries amongst the OIC countries, and I believe Islamic Finance noble principles and initiatives should be used to uplift the financial standard of the countries through economic and entrepreneurial activities/developments that will benefit the residents at large.

…………………………………………………………..

…………………………

………………………..

2) Islamic Finance Positioning

The experts brought 2 salient points in terms of Islamic Finance positioning.

Firstly, the experts discussed that the brand, “Islam” itself has been a hindrance towards the globalisation of the Islamic finance industry.

A number of Non Muslim countries react rather adversely to that term. Even in China – where people are not averse to Islam but to religion in general – the pitch for Islam becomes difficult. We tend to use the term “Islamic Finance” globally even in places where people are not comfortable with it.

The second salient point is the usage of Arabic terms to all the contracts. In Malaysia, the population do not speak Arabic. However, when we talk about contracts, all the terms are in Arabic. The panel argued that the idea is not feasible in places where the locals cannot even pronounce the terms. In some countries, they don’t have the Arabic alphabet kh-aa and H-aa.

The panel suggested that we should call the terms, as it is. It is participatory by nature. Call it participation banking. Or call it risk sharing.

In addition to that, we should educate everyone that that Islamic Finance is good for all of mankind.

The experts proposed what the industry ought to do is to pitch Islamic Finance as it is and suggested that if syariah compliant instruments went by a religious-neutral name and with less Arabic terms, it would open more interest beyond the Muslim market.

………………………………………………………….

………………………..

……………………….

Financial Consultant, Helmi Hakim’s Perspective:

To a certain extent, I agree that we have to be flexible when marketing shariah compliant principles, financial products in the market. To me, the main thing is that the financial products need to be free from riba, maysir and gharar.

When I market shariah compliant financial products to Muslims in Singapore, I educate them how it works with all the Arabic jargons and substantiate them further with Quran and Hadith.

However, when I promote to non-Muslim clients, I use universal noble principles like transparency, putting people before profits, concept of profits and risk sharing etc2, which are consistent with the principles of Islamic Finance.

I educate that Muslims cannot take usury/interest because God told us in the Quran. We believe Quran is God’s words.

For those who never heard about Islamic Finance at all, I skip through all the jargons, and cater my presentation specifically for them using simple examples. The keyword here is know your target market, speak their language and “Be Flexible”! 🙂

………………………….

……………………..

……………..

3) What Islamic Finance Advocates and The Status Quo Now

Islamic Finance has been known as profit and risk sharing.

Nevertheless, the current status quo, in the Islamic Finance world,

90% of the Islamic Finance transactions are of Murabahah or Ijarah, which is predominantly known as Debt Financing.

Only 10% of the Islamic Finance transactions are Musyarakah or Mudarabah (Equity Financing)

The panel discussed that, since Islamic Finance is all about profit and risk sharing, the industry itself should move more towards Musyarakah and Mudarabah.

………………………………

…………

Why are all the financial institutions still advocating Murabahah or Ijarah?

We have to understand that Islamic Finance Institution are subject to the same liquidity capital requirement as conventional counterpart, similar to Basel requirements.

In transactions like Musyarakah, the capital charge is 400% on the Bank’s risk-weighted assets.

Whereas, in Murabahah, the capital charge is only 8% on the Bank’s risk-weighted assets.

Bank Regulatory capital charge is simply the amount of capital that the Banks are required to hold against their assets.

It is understandable that equity financing has more risk, and because its more risky, the capital charges, the capital cost are thus higher than debt financing. It is understandably too expensive to run a Musyarakah, thus most financial institutions will prefer a Murabahah or a Tawarruq.

………………………………………………………….

………………………..

……………………….

Financial Consultant, Helmi Hakim’s Perspective:

I understand. Musyarakah and Mudarabah are more reflective of the essence of Islamic Finance. It is more reflective of the nature of risk and profit sharing advocated in Islamic Finance.

Thus, I come out with a 2 throng strategies on how this can be done, over the long term.

……………………………………………………………….

…………………………………………

………………………

Firstly, the Islamic Finance industry that operates itself in markets with predominantly, high percentage of Muslim population should start to focus in developing and promoting shariah compliant instruments that are of Musyarakah and Mudarabah in nature aggressively.

Those countries with lower percentage of Muslim population, can start of with Murabahah, Ijarah or Tawarruq.

Its because, we would not want a situation where you try to promote more of Musyarakah and Mudarabah in countries with lower percentage of Muslim population, they see that it is not feasible, the whole idea of introducing Islamic finance instruments will not even proceed.

Like a Malay proverb says, “yang dikejar tak dapat, yang dikendong keciciran“, which means what you’re running after, you do not get and you lose what you have.

Countries with high percentage of Muslim population, should lead the way. 🙂

………………………………..

………………………….

………………..

The second strategy, to bring more of Musyarakah and Mudarabah is to educate the local population of the benefits of equity financing and at the same time growing their money through investment in equities or participating in commerce activities.

Encourage entrepreneurship, the concept of profit and risk sharing, the concept of doing research before investing your money, the concept of SWOT (Strengths, Weakness, Opportunities, Threats) analysis.

The very concept, we invest our money, when we make profits, we share it 70%:30%, or maybe 60%:40%, instead of regardless, we make profit or loss,

I will get a pre-determined rate of return (profit rate) of 10%.

It is because, we do not want Islamic Finance to be seen, just as a replicate of conventional finance with a shariah compliant label on it.

……………………………………………………….

………………………………………….

I hope you learnt from my sharing above and do appreciate if you could share this blog post with your family and friends. Jazakallah Khayran… 🙂