How To Make It Easier To Be Debt Free in Singapore…

I shared in my last blog post that I cleared my 5 room HDB flat loan at age 34.

I also share with you my free video, “5 Shariah Compliant Ways To Save More Money in Singapore.”

If you have yet to download it, please download the FREE video now.

.

5 shariah compliant ways to save more money in Singapore

are like the seeds to grow your tree.

Without the seeds, THERE WILL BE NO TREES!

Only after downloading and watching the video above, you should proceed to read this post.

Reading this blog post and applying the strategies immediately is like taking those seeds and planting them now.

.

.

.

.

In this blog post, I will share with you the roots. The leaves. The trunk.

The branch. The twig. The flowers.

And of course, the FRUITS!!! 🙂

“Fruits of Riba Free Lifestyle” tree

.

I will share with you on how to make it easier for you to be DEBT FREE in Singapore.

Warning: This blog post is quite long. Jam packed with super simple yet powerful strategies.

Bookmark this page so that you can always refer to it. 🙂

.

.

.

1) Increase your income.

.

1 of the fastest way for you to clear your debt fast in Singapore is to EARN MORE.

Earn higher.

I am talking about your disposable income.

Money that goes into your pocket.

Simple logic.

If more money flows into your pocket every month, easier for you to be debt free.

I have created a series of videos here on how to double your income, the shariah compliant way in Singapore.

Listen in! 🙂

2) You must want it.

.

Yes. It is as simple as that.

You must want to be debt free in Singapore.

If you don’t want, no matter what kind of strategies I share with you.

It wont work.

I do know of many who see debt as a tool to become rich.

Its called Leverage.

In fact, today if you were to meet 10 financial consultants,

9 will encourage you to take more debts as long as you can fulfil TDSR. (Total Debt Service Ratio)

Especially in today’s low interest rate environment.

Fact of the matter, today as a financial planner, I also can show you multiple strategies on how to make money by taking more loans.

But as an Islamic Financial Planner, I CHOOSE to show you strategies to make money by avoiding, reducing and clearing your riba based loans.

Avoiding, reducing and clearing your Riba based loans to seek baraqah from Allah S.W.T. is the central core of my wealth accumulation strategy.

If we need to leverage, we leverage using Halal means. Without riba.

Because why?

Because we seek redha from Allah S.W.T.

We want to be happy in this dunya. And we want to be happy in the akhira.

Insya’Allah. Allah will make it easier for us when we do our level best following his commandments by avoiding riba.

.

.

.

Others go by the mantra,

Hutang hari ini, hutang selamanya.

I adopt a different position.

Hutang hari ini, LANGSAIKAN SEMUANYA!

So first thing first, whatever strategies you advocate.

You must want to be debt free in Singapore.

You can have 1001 financial strategies.

Yet being debt free must be your core objective from day 1 you start to plan your financial goals.

.

.

.

3) You must track it.

.

Work closely with your financial advisor. And track your personal finance very closely.

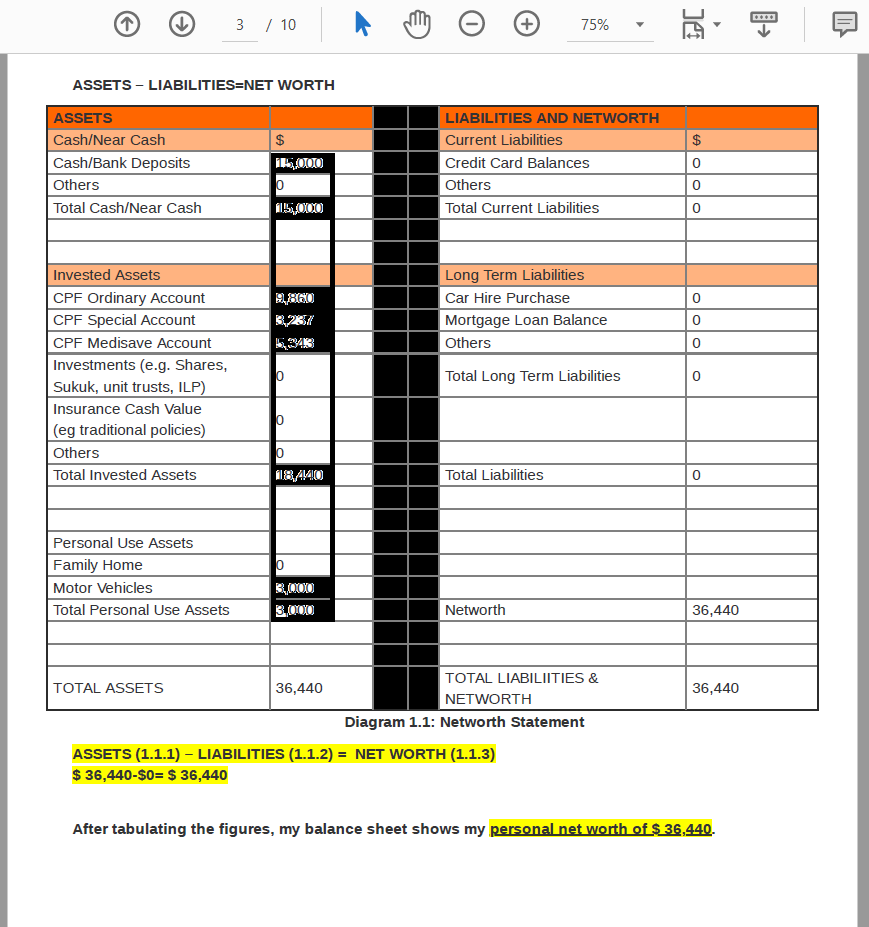

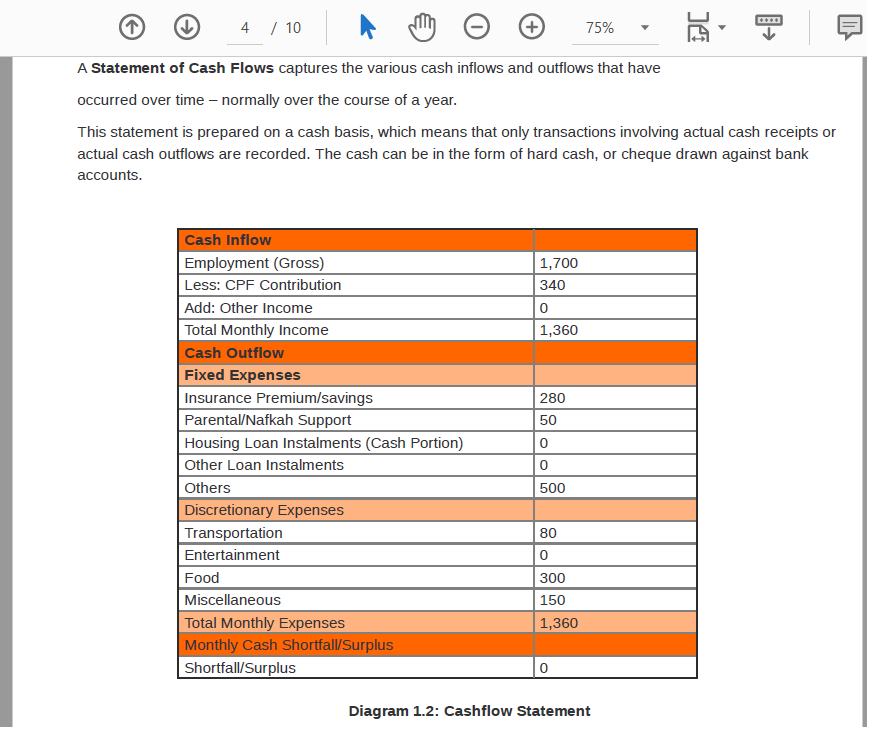

Your networth statement. Your cashflow statement.

Your 7 financial ratios.

To me, this is the most basic thing one must do in Singapore.

Especially if you intend to be Debt Free in Singapore.

Remember the “Fruits of Riba Free Lifestyle” tree I shared with you earlier?

( “Fruits of Riba Free Lifestyle” tree)

.

.

Your networth statement. Your cashflow statement.

Your 7 Financial ratios are like the roots of a tree.

If the roots are not strong and the wind blows,

Your tree will tumble.

You need to know your numbers at the back of your hand. And make sure everything is in order.

…………………………..

……………..

…………

(Halal Financial Plan that I created for my beloved clients)

(Halal Financial Plan Safety Card that all of us need to follow closely)

.

.

If you want a personalised 10 page Halal Financial Plan like the one I created for my clients above ,

click here to arrange “Your Financial M.A.P.” session

for FREE via Zoom!

I will personally curate and share with you your 10 page personalised Halal Financial Plan for FREE

in “Your Financial M.A.P.” session (Zoom Edition) .

***I can guarantee you that this Halal Financial plan is different than any financial plan you can see out there.***

It is designed specifically for our Muslim community in Singapore.

I have removed all the jargons and simplify it for you.

Financial reports that usually run into 40-50 pages (who has time these days to scrutinise 1 by 1 those thick, confusing reports?),

I summarise them into 10 colourful pages.

In fact, I make it so easy for you that even your Primary 6 child can join in and have fun to interpret your numbers! 🙂

.

.

Not only that!

As a special bonus, I will also share with you my exclusive, personalised housing loan riba spreadsheet for FREE.

From there you will be able to know how much of your monthly loan instalment goes to riba, and how much exactly goes to pay off your outstanding balance.

You can also find out how much riba you can save every year by paying your principal amount quickly.

If you pay housing loan instalment of $1000/mth, how much goes to principal, how much goes to interest?

.

If you pay housing loan instalment of $1000/mth consistently for 5 years, what will be your outstanding balance then?

If you pay housing loan instalment of $1000/mth consistently for 10 years, what will be your outstanding balance then?

If you pay housing loan instalment of $1000/mth consistently for 15 years, what will be your outstanding balance then?

.

If you know your numbers, only then you can Super Duper Focus on working your way up to reduce your unnecessary expenses and accumulate funds to pay the loans off.

Numbers give you purpose. It gives you energy and momentum.

You cannot hit a target you cannot see.

If you want me to give you Halal Financial Plan

+ exclusive, personalised housing loan riba spreadsheet (only for the first 10 lucky candidates),

schedule “Your Financial M.A.P.” session (Zoom Edition) for FREE now!

………………………..

4) You must position yourself to attract rezeki FIRST

and only after that work hard to receive it.

Let us do a simple yet profound exercise now.

I want you to find ants in your house now.

If you are in office, find ants in your office.

Do it now!

Search high and low.

Is it easy to find the ants? 🙂

No. Its challenging for most of us! 🙁

Especially if we keep our house or office clean, neat and tidy at all times.

Very difficult to find those ants.

…………….

………

…..

Now what I want you to do is to change your strategy.

Get some sugar.

And I want you to pour them all over your house.

Wait until tomorrow.

And see what happens.

Definitely, you will see a lot of ants! 🙂

…

…

…

My brothers and sisters,

Similar to our rezeki. Our sustenance.

In order to have more rezeki,

we have to position ourselves to receive more rezeki from Allah S.W.T

FIRST!

BEFORE anything else!

We do so by taking care of our relationship with Allah S.W.T.

By obeying Allah’s commandments

and staying away from what is prohibited.

My brothers and sisters,

You can implement 1001 strategies.

Toil day and night.

If Allah doesn’t allow it to happen, it won’t happen.

How do we do obey Allah’s commandments

in the context of managing your personal finance?

Always seek prayers from your parents

in whatever business endeavour that you do.

Remember to Zakat your cash/investment/

Halal insurance once you reach the Haul and Kadar Nisab.

Infaq.

Sadaqah. Help those who are in need.

and most importantly by ensuring that every single step in our financial planning journey is shariah compliant.

Free from Riba, Maysir and Gharar.

In short, Halal.

………………………..

……….

……

Only after positioning ourselves to receive rezeki, we put in effort and work hard for it.

Yes work hard for it.

My brothers and sisters…. There is no magic pill that you can swallow.

And suddenly make your your riba based loans disappear.

The Malay proverb says,

Yang bulat tidak datang bergolek,

yang pipih tidak datang melayang.

Kalau tidak dipecahkan ruyungnya,

mana nak dapatkan sagunya?

The Arabic proverb says

Man Jadda, Wa Jadda.

Siapa berusaha, dia dapat.

Put in your 101% effort. Trust the process.

And leave the natijah to Allah S.W.T.

Ya Allah. I surrender. I have done my very best. And I leave it to your decree.

5) Make Your Money Work Harder

.

Last but not least, after you follow my strategies that I shared above, and Masya’Allah, Alhamdulillah…

Tabarakallah…. You become cash rich.

It’s time to make your money work harder for you.

In fact, the secret sauce to wealth creation is to grow the money you have.

Invest in Halal stocks.

Invest in Halal bonds (sukuk).

Invest in Halal commodities (gold, silver, oil etc2).

Invest in Halal businesses.

Subhanallah! 🙂

Question here.

Will all the Halal stocks,

Halal bonds (sukuk),

Halal commodities (gold, silver, oil etc2),

Halal businesses

in the world make money?

No. Of course not!

As a shariah compliant investor, you only want to FOCUS

on Halal stocks, Halal bonds (sukuk), Halal commodities (gold, silver, oil etc2), Halal businesses

that can help you MAKE MONEY.

The one that can lose money,

the ones that will FAIL,

you want to AVOID them!

That is why you need experienced Islamic Financial Consultant like us to understand your needs, assess your risk profile and guide you.

Show you the way.

Alah………. It’s like you want to want climb Mount Kinabalu.

(Myself at Mount Kinabalu, one of the highest mountains in Southeast Asia)

You need an experienced guide to show you the way.

Educate you on what to do and what not to do.

Share with you tips and secret strategies to not only ensure you reach the peak safely.

You also want to make sure your journey up and down the mountain becomes a memorable and enjoyable one.

Capture pictures that you can share with your children and grandchildren in times to come.

Isn’t that beautiful? 🙂

………………….

……….

…..

Now, scaling Mount Kinabalu is very similar to

growing your hard earned money the Halal way

with the intention to finally clearing your riba based loans.

You need a guide.

A competent Islamic Financial planner can help you 10 X your shariah compliant investment power

by sharing with you up to date, tactical and long term investment strategies.

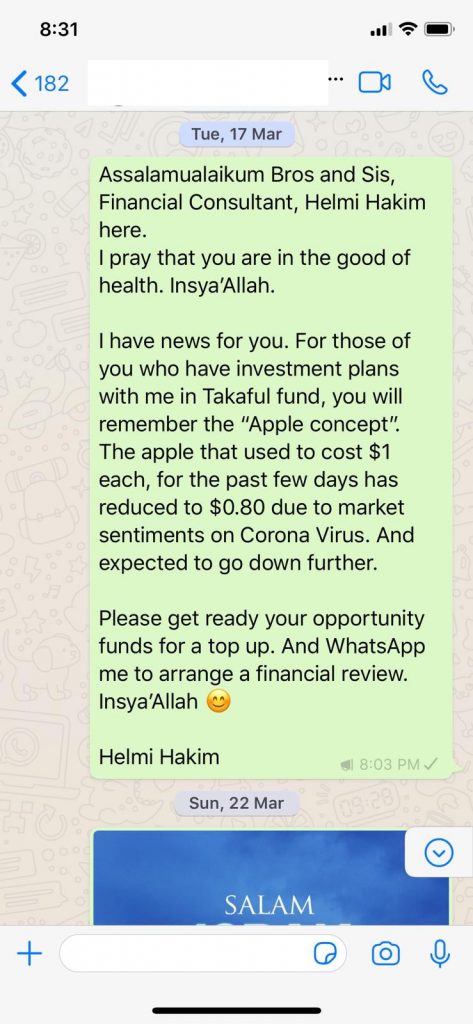

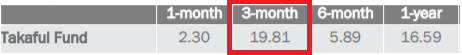

(Example of whatsapp msg I broadcasted to my clients on 17th March 2020)

(And in 3 months, Halal investment portfolio value increases by 20% in terms of capital appreciation. Alhamdulillah….)

An Islamic Financial planner in Singapore is like a GPS for your financial success.

An Islamic Financial planner in Singapore shows you the first lane on the expressway to financial success

by revealing jealously guarded money making secrets you should know.

An Islamic Financial planner in Singapore shares with you common money mistakes people make and how to avoid them.

(You dont need to bang the wall a lot of times or worst go to a dead end. )

……….

….

My Bros and Sis.

If you do things that you never done before, you will get the things that you never gotten before.

Your life changes when you adopt rich Muslim money habits.

And it doesnt stop there.

Good money habits you learnt today, you can pass it to your children.

And they can pass it down to their children.

The cycle continues.

Can you imagine our future generation, living life without riba? Masya’Allah! 🙂

And today is the start of that wonderful journey.

Remember the 5 seeds of riba free lifestyle tree that I gave you earlier?

Start planting them now! Bismillahirahmanirahim….

…………………..

……………..

………….

Now… I hope you have benefited from my personal sharing, How To Make It Easier To Be Debt Free in Singapore…

If you are seeking a mentor, coach, consultant to share with you practical aspects on how you can plan your finance, the shariah compliant way in Singapore, I am always ready to help you.

You can always whatsapp/sms me at 96520134 to schedule a FREE consultation.

Or perhaps click here to schedule an appointment.

You will want to schedule it asap because I can only accommodate 5 slots for the following month.

Click here to schedule your FREE consultation today!

Take Care!