by Helmi Hakim | Nov 5, 2017 | Insurance, Investment, Miscellaneous, Motivation

I am intending to create a series of videos to answer Islamic Finance related questions in Singapore.

It can revolves on shariah compliance (what makes it Halal) and viability (can make money or not).

Do you have any? Leave at the comments section below.

Insya’Allah! 🙂

by Helmi Hakim | Jun 25, 2017 | Investment, Miscellaneous

Alhamdulillah, today is Hari Raya Puasa. One of the best things about celebrating Hari Raya is the mountain of delicious food we get to eat. Haha! 🙂

What are some of your favourite Hari Raya food?

Mine includes lodeh,

sambal goreng

and of course,

ayam masak merah!!!

My favourite! 🙂

………………………………………………

……………………………..

…………………..

These are best eaten with ketupat and perhaps with a generous heap of serunding.

Oh! Talking about ketupat, I love my mother-in-law’s ketupat.

Because her ketupat is unique.

It is special.

It is ketupat with santan.

Very different from the normal ones, because it originates from Malacca, my father-in-law’s hometown! 🙂

(My mother in law’s ketupat santan)

(Serunding)

……………………………………………………

…………………………………….

……………………………..

Do you know how to make these dishes?

Every year, I rely on my mother to cook for us these tantalising, traditional home-cooked dishes.

But I do know these dishes are the magical results of combining several ingredients.

……………………………………

……………….

…………

Lodeh

Lodeh is a simple but filling dish.

It’s got tons of veggies in it – cabbage, carrot, long beans etc – and also tempe, tauhu and chillies.

This dish requires the use of coconut milk to give it that ‘lemak’ taste, and frankly, lodeh wouldn’t be lodeh without it.

…………………….

…………..

……..

Rendang

(My mother’s home cooked Rendang)

Rendang is the quintessential Raya dish – it seems like it wouldn’t be Raya without this rich and aromatic spicy meat dish.

You can either use beef or chicken for rendang. This is quite a difficult dish to make, because the flavors need to balanced owing to the use of numerous spices and herbs.

Some of the ingredients used include lemongrass, garlic, turmeric, ginger and galangal. And not forgetting coconut milk!

……………………….

…………….

………

Ayam Masak Merah

Ayam masak merah is a delight on our tongues – spicy, sweet and sour all at the same time!

Once again, this a recipe that needs to have the flavors balanced nicely.

Two main star ingredients include chillies (dried and paste) and tomato ketchup – without either one, your dish will fall flat.

………………………………………….

……………………………….

………………………..

Ketupat

Ketupat is perhaps the easiest dish to make – you just need rice, a bit of salt and water.

…………………………………………….

………………………..

…………………….

Serunding

As for serunding, though there is the beef version, usually the kind that is served as condiment along with ketupat and other dishes is the spiced coconut one (serunding kelapa).

Serunding kelapa requires a mix of various spices and then cooked over low heat for a period of time until the coconut dries up and absorbs the flavors.

……………………………………………………………..

………………………………………..

………………………

…………….

Cooking is an art, really.

You take different ingredients but in the precise quantity and when done right, you’ll get a delicious dish guaranteed to satisfy the tummy.

And you mixed all the dishes together,

the ketupat,

the lodeh,

the rendang,

the ayam masak merah

and serunding.

You feel like you are in heaven!!! 🙂

……………………………………………………………………………….

……………………………………………………….

………………………………………….

Similarly, think of making money the shariah compliant way in Singapore as putting together a great dish.

In order to successfully plan for your financial future, you cannot just rely on ONE ingredient or strategy.

Sure you can put all your money in shariah compliant Al Wadiah savings account.

But with a Hibah of only 0.6-0.7%/annum, its difficult for you to be rich.

Or achieve the financial goals that you set for yourself.

…………………………………………………………..

…………………………………………..

………………………….

The best way to achieve your financial goal is to combine a FEW powerful strategies into one.

You can invest your money in shariah compliant shares or Halal REITS

(My personal watchlist of shariah compliant shares that I share with my clients)

Buy in shariah compliant funds

Invest in commodities

Earn rental income from investment properties

Or perhaps run your own profit making business.

………………………………

……………………….

……………

When cooking rendang, you need to do step A, B, C, D and E, if not your rendang tak menjadi.

Similarly when you select a particular stock, you have to ensure it is shariah compliant by going through a few steps

called shariah compliant screening methodology.

Which shariah compliant screening methodology do you adopt?

S&P?

Dow Jones?

MSCI?

AAOIFI?

or perhaps Malaysia’s Shariah screening methodology for stocks listed on Bursa Malaysia established by the Shariah Advisory Council of the Securities Commission Malaysia?

……………………………………………

……………………………….

…………………………

You want to calculate the intrinsic value of the stock. Which model are you using?

Discounting Cashflow Model?

Gordon Growth Model?

Dividend Discount Model?

Residual Income Model?

All these steps that you take before investing your hard earned money into stocks is just like cooking.

You need to know the ingredients, the quantity required and a bit of love to ensure that your dish tastes delicious!

There are clearly steps you need to take when investing in stocks, the shariah compliant way in Singapore.

…………………………………………………..

………………………………..

………………………..

After you invest in shares, that is not enough.

You diversify your portfolio. You look at diferent types of shariah compliant vehicles to achieve your financial goals.

Ketupat alone doesnt taste nice. Ketupat with lodeh, with sambal, with serunding, with rendang….OMG!!! It tastes awesome!!! 🙂

You do similar due dilligence when investing in commodities, investment funds, properties or even running your own business.

…………………………………………….

…………………………..

………………….

Example, when you will like to set up a business, you wont haphazardly just invest your money blindly to rent a shop and start your brick and motar business.

You have to do your research first.

For me, I share with my clients these 6 steps on how you can start a business which generate consistent profits for you.

If you can understand Malay Language, you can click this link.

First Part: https://www.youtube.com/watch?v=vMAH3EYxHrU

Second Part: https://www.youtube.com/watch?v=MQdZcF2nxQE

Final Part: https://www.youtube.com/watch?v=i8rHN_vwPFw

If you dont understand Malay, these are the 6 Steps.

1) Check whether the business or product/service you gonna sell, got Demand or not

2) Unique Selling Proposition (You got to differentiate yourself, dont be a commodity)

3) Market Can See You All The Time (Ensure your target market always see your brand)

4) Add Massive Value To Your Customers

5) Cross Sell, Upsell, Downsell

6) Referral

The point here, these 6 steps is like you cooking your rendang.

When cooking rendang, you need to do step A, B, C, D and E, if not your rendang tak menjadi.

And when you add your rendang together with other dishes, it tastes AWESOME!

Similarly, when you combine making money through profit making business + shariah compliant investment,

it becomes a SUPER COMBO POWER!!!

………………………………………

…………………………

…………..

So my friends.

If you are looking for a shariah compliant financial expert to help you save, accumulate and grow your money the shariah compliant way,

you can always whatsapp/sms me at 96520134 to schedule a FREE consultation.

Or perhaps click here to schedule an appointment.

You will want to schedule it asap because I can only accomodate 5 slots per week.

And next week, I need to go for my compulsory army reservist.

Click here to schedule your FREE consultation today! 🙂

………………………………………………………..

……………………………

………………….

Last but not least, I will like to wish all my Muslim friends,

Selamat Hari Raya Aidilfitri Minal ‘Aidin Wal Faizin Kullu ‘Amin wa antum bi khair.

And my Non Muslim friends, Happy Holidays! 🙂

by Helmi Hakim | Jun 11, 2017 | Insurance, Investment, Miscellaneous, Motivation

Alhamdulillah. Ramadan is a blessed guest that comes once a year.

In this beautiful month, we Muslims are encouraged to increase our worship

and to be more charitable.

It’s a month filled with barakah, where your deeds are multiplied.

And your sins will be forgiven if you are sincere.

When we abstain from food and drink, it’s a reminder to be mindful of those around us who are less fortunate.

We also have to watch our words and temper. Ramadan helps us to develop our better self.

So don’t be surprise some of our best practices in Ramadan are also useful principles in managing your personal finances.

I termed the concept with the acronym R.A.M.A.D.A.N. so that it is easier to remember. 🙂

Reflect

Ramadan is a time of reflection.

It is a time for introspection.

It is a time where we should take stock of ourselves.

And have an honest assessment of our shortcomings.

It is the time of the year in which we recharge our iman.

And prepare for the challenges facing us over the next 334 days.

Challenges that will test us in the next 8016 hours.

Getting ourselves prepared every single moment.Every single 480,960 minutes to come!

This can only be done if we muhasabah…. pause, reflect on our own faults,

introduce feedforward controls

and implement solutions during this important month.

(Beautiful side view of Sultan Mosque)

……………………………………..

…………………………..

…………..

Similar to managing our personal finance, we should reflect and ask ourselves these questions.

Do I have 3-6 months of emergency expenses in my bank account? (Basic Liquidity Ratio)

Have I been saving 20% of my monthly income? (Savings Ratio)

Is my debt service ratio above the recommended rate? Am I highly leverage?

And most importantly, from a perspective of a Muslim, we need to reflect on this.

Have I been paying zakat for my cooperative insurance policies

and shariah compliant investable assets when it hits the nisab value and reach the haul of 1 year?

……………………………………………………

…………………………………

…………………………..

(The kadar nisab as of today, 11th June 2017)

……………………………………………..

……………………………

……………….

These are important questions that you have to ask yourself.

.

The reason why I am bringing this up is because I just received a call from one of my blog readers.

She told me, she paid for zakat fitrah all along.

BUT she has OVERLOOKED paying her zakat harta for her cooperative insurance policies

and shariah compliant investable assets for the past 20 years!

Paying zakat is one of the pillars of Islam.

She is clueless and seeked my advice on what she could do.

Of course, now is the best time for us to reflect on ourselves too! 🙂

…………………………………………….

………………………….

…………………

Absolute Patience

Ramadan is about overcoming base instincts and have patience.

(My newborn baby daughter, Yaslyn Inara relaxing by the sea.)

.

.

It’s not easy to withhold hunger and thirst, and to watch your behavior and grab at any opportunity you can to do good.

We are so used to eating and drinking whenever we want.

And also we rarely watch the things we say.

And we tend to be lazy or procrastinate.

So Ramadan forces us to hold back and in doing so, it requires patience on our part.

Absolute patience. No two ways about that! 🙂

……………………………………

…………………….

……………….

Managing your finances is also about overcoming a basic instinct and have patience.

Humans are naturally inclined to instant gratification.

We want things NOW!

We hardly blink an eye eating out everyday or splurging on staycation / new bag / new gadget.

But the moment we need to set aside money for the future, most of us start coming up with all sorts of excuses.

The reason why we are adverse in saving up is because we don’t see its immediate benefit.

Although logically we know it’s to help us in the future, our base instinct is to enjoy things now.

So understand that in financial planning, you need to have absolute patience.

Be stronger than your basic instinct and commit yourself to save up or invest every month.

…………………………………………………….

………………………………..

……………………

Moderation

Ramadan is about moderation.

Everyday, after Azan Maghrib, I listened to the radio ads on Warna 94.2FM by Health Promotion Board.

It states that 1 out 6 Singaporean Malays from age 18-69 have diabetes.

This is a trend that is unhealthy and worrying.

As someone who loves to eat delicious food, enjoy sumptious buffets with beautiful, tantalising arrays of food,

I find Ramadan not only an opportunity for me to increase my Ibadah.

It is opportunity for me to watch my diet and eat moderately.

We eat heartily for suhoor, as we need energy to get on with the day.

And when we break for iftaar, the food we consume should be in moderation, enough for us to sustain our energy levels for the taraweeh prayers.

………………………………………..

………………………..

Our beloved Prophet Muhammad (Please And Blessings Be Upon Him) has taught us the formula for moderation when we eat our food.

We should fill our stomachs with 1/3 of food, 1/3 of drink and leave 1/3 for breath.

Prophet Muhammad (Please And Blessings Be Upon Him) said: “No human ever filled a vessel worse than the stomach. Sufficient for any son of Adam are some morsels to keep his back straight. But if it must be, then one third for his food, one third for his drink and one third for his breath.”

[Ahmad, At-Tirmidhi, An-Nasaa’I, Ibn Majah – Hadith sahih]

(Myself Iftar with my family near Changi)

……………………………………

………………………….

……………….

Similarly, in managing our finances, we have to practice moderation.

Usually when I encounter very ambitious prospects who wants to start a shariah compliant investment plan with a big monthly contribution,

as a finanial planner, I will dig deep in their finance first.

How much are you earning?

What is your monthly expenses like? After deducting your monthly expenses, how much are you left with?

Do you have 3-6 months of emergency expenses set aside in your bank account?

You mentioned to me that you want to save $XXXX/month. Have you been saving $XXXX/mth for the last 6 months?

Yes? No? Why No?

If they are not ready, usually I would decline them as my client first and share with them strategies on how to accumulate money fast, over the short term period.

Of course, do it the shariah compliant way in Singapore.

Once they are financially stable, meet me again, and I share simple yet powerful financial strategies that I personally use to grow my wealth the shariah compliant way in Singapore.

My role, my relationship with them as a financial consultant is to help grow their investable assets and networth the shariah compliant way in Singapore.

And moderation is key.

Slow and steady always win the race. 🙂

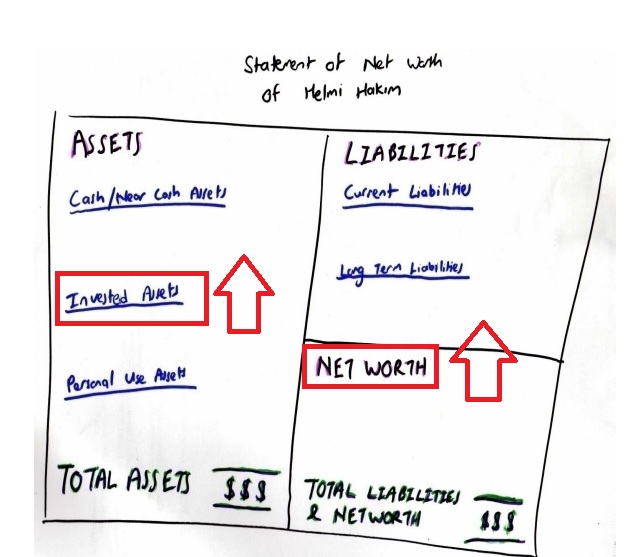

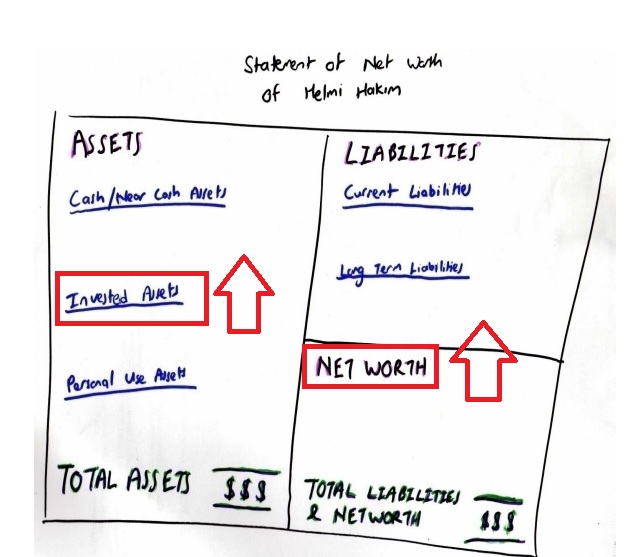

(You can download a free report of me sharing how you can create your own personal networth statement and cashflow statement in less than 10 minutes even if you have no financial background. Click here. )

………………………………………….

……………………..

……………….

Act On Opportunities

Ramadan is about taking advantage of opportunities.

As mentioned, it’s a month where your deeds are doubled in reward and you’ll be forgiven for your sins if you’re sincere in your taubah. Let’s not be fools like the ones mentioned in the following hadith:

Abu Huraira (r.a.) related that Rasulullah (s.a.w) said: Many people who fast get nothing from their fast except hunger and thirst, and many people who pray at night get nothing from it except wakefulness (Darimi).

………………………………………………..

…………………………………..

…………………

Similarly, effective financial planning is about taking advantage of opportunities. You’re not going to be young forever.

For example, if you’re taking up a shariah compliant insurance plan, you pay less in terms of mortality charges if you’re in your early thirties as compared to when you’re in your forties. So instead of paying more in the future, why not start early and pay lesser yet still accumulate much more?

………………………………………..

……………………………..

………………………….

Talking about opportunities, a lot of you might be aware that in the year 2008 (subprime mortgage crisis)

which leads to global economic crisis (year 2009),

I help a lot of my clients make money. They make a lot of money.

Yet, I dont make much money.

(Myself and my fellow colleagues doing roadshows 10 years ago)

……………………………………………………………

……………………………………………

……………………………………….

At that time, I was 21 years old, just completed my 2 years army, and new to my job as a financial consultant.

In army, we only received about $500/mth, thus naturally I dont have much opportunity funds.

Nevertheless, I have financial knowledge (Diploma in Accountancy), and I managed to convince a lot of people to invest with me.

Yet, I dont have much to invest.

I remembered that Abang who came to me.

“Helmi…. Thank you so much lah for helping Abang make so much money via investment. Very good!

Btw, just want to check with you lah, how much percentage in terms of share of my profit, do you get??”

I answered, “Not a single cent”.

I was disappointed. I was sad for myself, yet happy for my clients.

I consoled myself by telling myself,

“Its okay Helmi. Now you are young.

Start saving as much opportunity funds as possible.

In investment, there are market cycles. In the future, when there is a market downturn, make sure you have a lot of money to capitalise on the OPPORTUNITY.”

Yes! Prepare and grab opportunities as it comes by! 🙂

Discipline and awesome time management

Ramadan teaches us to be disciplined. It’s not easy to go hungry and thirsty, and on top of that be on our best behavior.

This is only achieved through discipline, which comes from the taqwa (consciousness) of Allah.

In addition to that, Ramadan nurtures us to be discipline in how we manage our time.

We have to wake up earlier than usual to do our suhoor, then at night, our time is spent at taraweeh prayers.

So it’s very important for us to plan our day right, and this is where being discipline in managing our time well comes in. Otherwise, you’ll end up sleeping late and missing suhoor, or you’ll be too tired to do taraweeh because you were doing way too much during the day.

…………………

………….

………

(What I had for suhoor earlier, my protein shake and a drink)

………………………………………………………..

…………………………………..

…………………

Managing your personal finances is also about discipline.

A lot of people thought if someone earns a lot, he automatically becomes rich.

That is a myth. My experiences as a financial consultant tells me otherwise.

I have met someone who earns >$10,000/mth who cannot afford to get savings plan from me (always lapsing his policy and I have to chase for payment).

And at the same time, someone just earning $1,500 who has a few policies with me.

In fact, if you look at that same person, who earns >$10,000/mth facebook, you will be thinking,

“Woah! He is so lucky! So rich! Driving flashy cars and always travelling on expensive holidays all over the world”.

The beautiful part of being a financial consultant is that we dont look at you on the surface.

Expensive cars, branded goods to showcase etc2.

Those are good to have but superficial.

We look directly at your personal financial statements.

Anybody can start a savings or investment plan, but it takes character and utmost discipline to maintain it.

………………………

…………

..

Abstinence from haram stuffs

Similarly, when running a business or making money through investments, we have to ensure that it is Halal.

It is shariah compliant. Free from Riba. Maysir. And Gharar.

On the day of judgement, five basic queries that will be made to every being as per the following Saying of Prophet Muhammad (PBUH):

“The son of Adam will not pass away from Allah until he is asked about five things: how he lived his life, and how he utilized his youth, with what means did he earn his wealth, how did he spend his wealth, and what did he do with his knowledge.” (Tirmidhi)

Thus when a lot of people meet me, they realised I am a financial consultant that is different compared to majority of the other financial consultants in Singapore.

I have a different set of philosophies and principles .

When others advice their clients to take as much loans as possible as a form of leverage (as long as fulfil DSR), I advice my clients not to take interest bearing loans. Even if the interest rate is super low. It is because interest is riba. If you have it, clear it asap.

When others advice their clients on financial instruments that involved maysir and gharar, I advice my clients against that.

No short selling of stocks. No speculative financial instruments.

And I advice my clients on how they can scrutinise their portfolio of investments via various shariah compliant screening methodologies like Dow Jones Islamic Markets, Securities Commission Malaysia etc2.

This is important because at the end of the day, we not only want to make money. We want the baraqah and Allah’s blessing together with it.

Amin. Insya’Allah.

……………………………………………………………………………………….

…………………………………………………………………..

…………………………….

…………..

Night Of Destiny

A Malay proverb says, “Kita hanya merancang, tuhan menentukan”.

I always share with my clients. In life, we can only plan.

Allah S.W.T. is the Master of Destiny.

As we are approaching the last 10 nights of Ramadan, we Muslims believe there is this one night known as Night of Destiny (Laylat al-Qadr).

On this special night the blessings and mercy of Allah are abundant, sins are forgiven, supplications are accepted, and that the annual decree is revealed to the angels who also descend to earth.

Make Tahajud prayers. Make Hajat prayers.

And when making doa to Allah S.W.T., I share with my clients, family and friends.

Dont make doa like,

“Ya Allah. Make me rich. Give me long life…. and the list continues”

Add these words.

“Ya Allah.

If this is good for me, good for my parents, good for my religion, grant me (what you wish)”

Put your trust in Allah S.W.T.

Biiznillah your doa will be maqbul. And if not, Allah S.W.T will replace with something better.

Insya’Allah. 🙂

……………………

………………

From a spiritual level, the Night Of Destiny is extremely powerful.

From the Imam of Makkah, he said for the last 10 nights of Ramadan,

1) If you donate $1 every night, and it falls under the night of destiny, it means as if you have donated every day for 84 years.

2) 2 rakaat of prayers every night, and it falls under the night of destiny, it means we pray every day for 84 years.

3) Read Surah Al-Ikhlas 3 times per night, and it falls under the night of destiny, it means we have read the entire Al-Quran everyday for 84 years.

(Translated from Ustazah Siti Nor Bahyah Mahamood facebook’s sharing, 18th June)

…………………………….

……………………………

………………

So that sums up my R.A.M.A.D.A.N formula.

And how you can learn the good principles of this beautiful month and apply it when managing your personal finance, the shariah compliant way in Singapore.

May Allah S.W.T accept our ibadah and good deeds that we performed in Ramadan. Insya’Allah! 🙂

p.s. By the way, if you wish to discover a simple & halal way to create a positive monthly cashflow and calculate your net worth for FREE, then please click here…

by Helmi Hakim | May 28, 2017 | Miscellaneous

Alhamdulillah. Time flies. 🙂

Ramadan is here again. We, Muslims fast during the month of Ramadan.

Fasting in the month of Ramadan is the 4th pillar of Islam.

The 5 Pillars of Islam are:

1) Shahadah, declaration of faith and trust that professes that there is only one God (Allah) and that Prophet Muhammad is God’s messenger.

2) Salat which is the Islamic prayer.

Salat consists of five daily prayers; the names are according to the prayer times: Fajr (dawn), Dhuhr (noon), Asar (afternoon), Maghrib (evening), and Isha’ (night).

3) Paying Zakat, purifying your wealth and soul by giving a portion of your wealth to those in need.

4) Fasting in the month of Ramadhan

5) Hajj, which is pilmigrage to Mecca. It occurs during the Islamic month of Dhu al-Hijjah.

Every able-bodied Muslim is obliged to make the pilgrimage to Mecca at least once in their life.

…………………………………………………………………………………

…………………………………………………………………………..

………………………………………………………..

………

Today, I am going to share with you on the 4th pillar of Islam, which is fasting in the month of Ramadan.

Ramadan is the ninth month of the Islamic calendar and is observed by Muslims worldwide as a month of fasting to commemorate the first revelation of the Quran to Prophet Muhammad (P.B.U.H).

We believe Quran is God’s words, and Prophet Muhammad (P.B.U.H) is the last messenger of God.

During the blessed month of Ramadan, Muslims all over the world abstain from all food, drink, and other physical needs during the daylight hours (such as smoking or sex).

Daily fasts begin at dawn and end with sunset.

Ramadan is much more than just not eating and drinking; it is a time to purify our soul, refocus our attention on Allah S.W.T., and practice self-discipline and sacrifice.

At night, we, Muslims will go to the mosque to perform our special prayers known as Taraweeh.

This is a month when a Muslim should try to AVOID practices like:

smoking,

swearing,

treating people with disrespect

being mean

harming or hurting living things

being cruel

un-courteous and selfish.

Fasting has also many special benefits.

Among these, the most important is that it is a means of learning self-control.

Ramadan is also a time of intensive worship, reading of the Quran, giving charity, purifying one’s behavior, and doing good deeds.

For Muslims, Ramadan is an opportunity to gain by giving up, to prosper by going without and to grow stronger by enduring weakness.

As a secondary goal, fasting is a way of experiencing hunger and developing sympathy for the less fortunate, and learning to thankfulness and appreciation for all of God’s bounties.

Fasting is also beneficial to health and provides a break in the cycle of rigid habits or overindulgence.

So…To All Muslims Brothers and Sisters.

Happy Fasting! 🙂

p.s. By the way, if you wish to discover a simple & halal way to create a positive monthly cashflow and calculate your net worth for FREE, then please click here…

by Helmi Hakim | Dec 21, 2016 | Miscellaneous

I just came back from Indonesia for holidays.

And had a good chat with a fellow Singaporean entrepreneur who recently set up his food business there. We had a good chat on shariah compliant franchise business model.

………………………………………………….

………………………………

…………………….

Many of you might have known me, as the financial consultant that helps Muslim families plan their finance in a shariah compliant way in Singapore.

So. This time round, when I heard about shariah compliant franchise business model, I got very excited.

I began to ask questions.

“What is the difference between normal, conventional franchise business model and shariah compliant franchise business model?

What are the advantages and disadvantages of shariah compliant franchise business model?

How do you avoid riba, maysir and gharar in shariah compliant franchise business model?”

……………………………………………………….

………………………………………….

……………………

I began to understand that under normal, conventional franchise business model, the franchisor charges a one time fee, and then a specific %, recurring fee on the monthly SALES of the franchisee.

Regardless, the franchisee makes a profit or loss, franchisee has to pay franchisor money because the recurring fee is on the SALES amount before deduction of operating expenses.

That goes against the spirit of Islamic Finance. Profit and Loss Sharing.

For a shariah compliant franchise business model, the franchisor charges a one time fee, and then a specific %, recurring fee on the monthly PROFIT of the franchisee instead.

Other than the one time fee, franchisor never earns anything if the franchisee don’t make a profit.

So it is to the best interest that the franchisor really helps the franchisee makes a profit from the business.

We discussed many more details but the above is just the essence…

………………………………………………………………………………..

……………………………………………….

………………………………….

Over the years, I have many people who asked, how to set up a business, the shariah compliant way in Singapore?

Is my marketing technique halal or haram?

What are the best practices to conduct business transactions in accordance to Quran and Sunnah of our beloved Prophet Muhammad (P.B.U.H)?

What are my roles as a Singaporean Muslim entrepreneur?

Many more business related questions… Usually I would refer to my esteemed friends. 🙂

Alhamdulillah… Today, I have good news to share with you.

SIM Malay Cultural & Muslim Society in conjunction with Takaful.sg would like to present to you a FREE seminar series, *”Pillars of Entrepreneurship”* on this Saturday, 24th December 2016.

This event is FREE but only reserved for the 150 places. RSVP at mcms@mymail.sim.edu.sg.

Walk-ins are welcome too.

…

See you around. Insya’Allah… 🙂

by Helmi Hakim | Oct 10, 2016 | Investment, Miscellaneous

First and foremost, I will to wish all my Muslim clients, Happy Asyura Fasting!

Muslims are encouraged to fast today.

The fasting is to commemorate the day when Prophet Moses (P.B.U.H) and his followers were saved from Pharaoh by Allah S.W.T by creating a path in the Red Sea.

Prophet Muhammad (P.B.U.H) said,

“The (act of) fast of ‘Asyura, how I dearly hope to Allah to forgive all my sins of the year before” (HR. Muslim no. 1975).

This is from the bounty of Allah towards us: for fasting one day He gives us expiation for the sins of a whole year. And Allah is the Owner of Great Bounty.

……………………………………………….

……………………………..

……………….

Now, back to the topic! 🙂

In my mission to be debt free, I read a lot of books, biographies of successful individual leading a debt free lifestyle.

One of the books that I love is 4 Laws of Debt FREE Prosperity, by Blame Harris and Charles Car.

…………………………………………………………

………………………………………

……………………..

There are basically 4 Laws of Debt FREE Prosperity! 🙂

Law #1: Tracking- the first law of debt free prosperity

For quite a while, a lot of people have asked me.

Since in Singapore, there is no shariah compliant financing facilities to buy a house, how do we clear our interest based housing loans as soon as possible?

What are the strategies?

Before I even lay down my strategies on how to save, accumulate and grow their money the shariah compliant way, I always ask them one question.

Do you track your housing loan repayment?

Most don’t.

Its a cycle. A routine. Every month, get their salary, they will just automatically pay their monthly mortgage.

They are not aware, how much of their monthly instalment are used to pay off principal, how much to pay for interest.

At the end of 5 years, 10 years, 15 years or 20 years, many are clueless to the balance outstanding amount.

If you don’t know, the outstanding amount, how to clear your housing loan?

That is why the first law of debt free prosperity, Tracking, is important.

You got to measure it BEFORE you can manage it.

When performance is measured, it improves.

So, if you want to clear your housing loan, you must track!

(Part of an excel spreadsheet, I have done for my client. If you like to have one, go to Takaful.sg and sign up for “Your Financial M.A.P.” session with me for FREE! )

………………………………

……………….

……….

Law #2: Targeting- the second law of debt free prosperity

The second law of debt free prosperity is Targeting!

Setting goals is IMPORTANT!!!

When do you want to clear your riba based housing loans? In 5 years?

10 years? 15 years? Or perhaps 20 years?

The goals must be written. Goals not written down are wishes.

They must be your own.

They must be measurable and specific.

They must be stated in the most visible terms available.

AND they must contain a deadline.

Personally, I target to clear my housing loan of $300,000 by 31st Dec 2020.

(hahahh… It’s a good thing that I blog here. I am confident of my strategies to achieve it and I will revisit this space again in the future.)

…………………………………….

…………………….

…………

Law #3: Trimming- the third law of debt free prosperity

Live on less than you earn so you can have a surplus to get you out of debt and invest in assets that appreciate.

A lot of people thought, if someone earns big, immediately he or she will become rich.

My experience as a financial consultant tells me otherwise.

I have met someone who earns more than $10,000/mth who cannot afford to get savings plan from me and at the same time, someone just earning $1,500/mth who has a few policies with me.

Your lifestyle determines how rich you are, not your income.

No one, regardless of income, can be financially successful unless they live on less than they earn.

Pay yourself first, and then live in what’s left over.

Law #4: Training- the fourth law of debt free prosperity

The book mentions that “The people who understand money spend it on assets that generate wealth. Those who don’t understand money, spend it on things that consume wealth, and thus the rich get richer and the poor get poorer.”

I have to agree with the statement in the book.

We all know that Singapore has one of the highest Gini Coefficient in the world.

Meaning the income disparity between the rich and the poor is wide!

To me the only solution is to continually upgrade ourselves in terms of our financial literacy.

Learn. Learn. And continue to learn. There are no shortcuts.

……………………………………

……………..

……

I hope you learn something from my sharing. If you will like to learn how to manage your finances better, and clear your riba based loans, visit Takaful.sg to schedule “Your Financial M.A.P.” session with me, Financial Consultant, Helmi Hakim for FREE!

You can also SMS/Whatsapp me directly at 96520134.

Insya’Allah! 🙂