Some of you know that I recently went on a 23 days juice detox.

It is part of my new year’s resolution to eat healthy.

Stay fit.

Our body is an amanah from Allah S.W.T.

And we have an obligation to take care of our body through proper nutrition and exercise.

Detoxing my body through juice detox was a totally new experience for me.

For the very first time, I cleansed my body.

Cleansing is a process to remove toxins from my body.

It looks simple. Yet its challenging.

But Alhamdulillah.

With proper guidance from my nutritionist and mentor, I managed to overcome it….

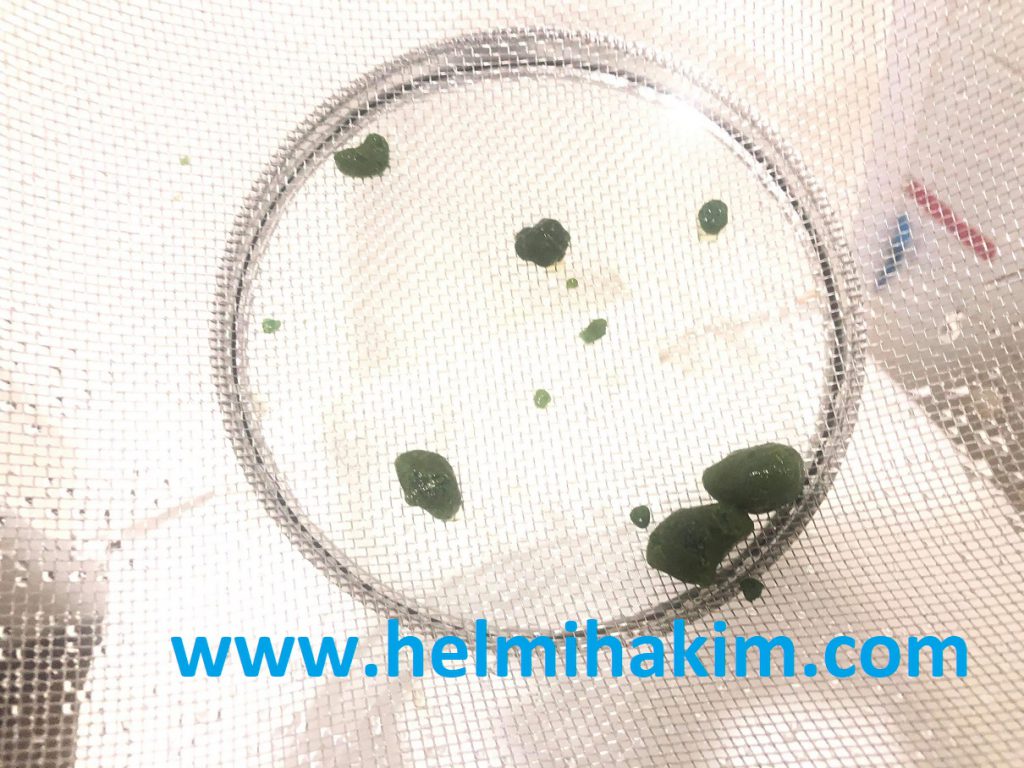

(Gallstones that came out of my body during my 2nd phase of Detox)

.

.

.

Having said that, today I want to share more on the similarities of detoxing your body and Islamic Financial Planning in Singapore. 🙂

.

.

1) Detoxing Your Body and Islamic Financial Planning involve processes

.

Previously I thought that detoxing my body involves simply drinking fruit juice.

Or perhaps lemon juice.

Or perhaps aloe vera juice.

No.

There are many rules and processes to it.

Example, 80:20 rule.

80% of the juice must come from vegetables and 20% from fruits.

I learnt the proper step by step process of detoxing my body.

First 10 days: colon and kidney detox.

Next 7 days: gallbladder and liver detox.

Last 7 days: juicing.

It is a very elaborated process, yet I enjoyed my journey very much! 🙂

(Video of Financial Consultant, Helmi Hakim juicing his juices.)

.

.

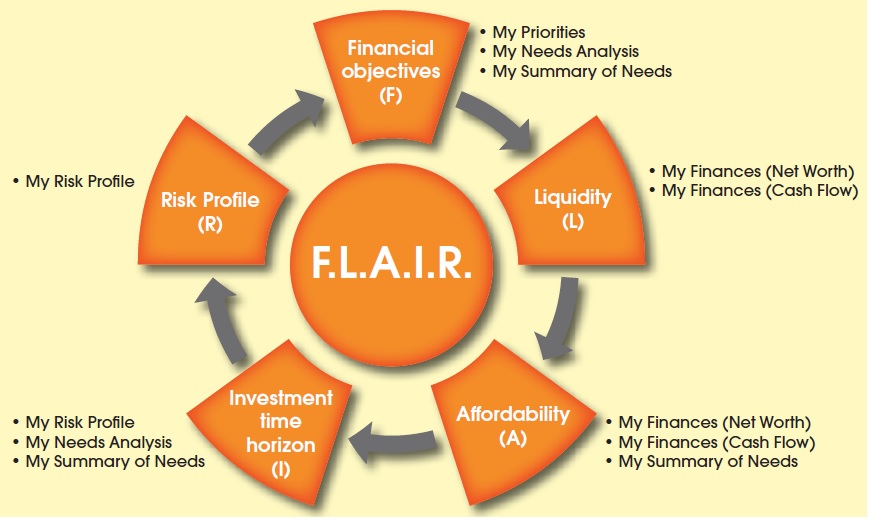

Similarly in Islamic Financial Planning, there are a number of steps and processes that I share with my clients.

Firstly, the FLAIR concept.

.

.

Financial Objectives,

Liquidity,

Affordability,

Investment Time Horizon,

Risk Profile.

(F.L.A.I.R. concept used by Islamic Financial Planners in Singapore)

(Financial Consultant, Helmi Hakim sharing more on FLAIR)

.

For Muslims, we have to understand the prohibition of Riba, Maysir and Gharar.

Riba, meaning payment or receipt of interests is strictly forbidden.

Allah S.W.T said in the glorious Quran, Surah Al Baqarah, Verse 275:

“Allah has permitted trade and has forbidden interest”

Maysir, meaning any form of gambling. And Gharar, meaning uncertainty. Both are not allowed.

As stated in Surah Al-Maeda, Verse 90:

“O ye who believe! Intoxicants and gambling, (dedication of) stones, and (divination by) arrows, are an abomination,- of Satan’s handwork: eschew such (abomination), that ye may prosper.”

……………..

………..

…

We learnt the different type of Shariah Compliant Screening Methodologies like

Dow Jones shariah compliant screening methodology,

MSCI,

AAOIFI, Meezan

and the one by Malaysia Shariah Council.

Understanding the different type of shariah compliant screening methodologies is crucial for

us to build our 100% shariah compliant portfolio.

The entire process is very IMPORTANT!

.

.

Because many have the misconception that

as long as the financial instrument has no pork.

Has no lard.

Automatically it becomes Halal.

.

They call it ‘Muslim friendly’ financial instrument.

.

.

I have to politely remind them ‘Muslim friendly’ NOW, does not mean ‘Muslim friendly’ FOREVER.

and Halal financial instruments go beyond No Pork, No Lard.

There are other additional requirements to it…………

……

….

That is why I advocate shariah compliant financial instruments.

Shariah compliant financial instruments require its financial portfolio

to be closely monitored by a group of Islamic Finance scholars all the time.

These group of Islamic Finance scholars will monitor endorse

that the underlying assets are 100% HALAL at any given point of time.

Today. Tomorrow. The day after.

Forever.

As long as the shariah compliant fund remains to exist.

This gives us investors the peace of mind that our financial portfolio is 100% Halal all the time.

Peace of mind in this dunya.

Peace of mind in the akhirah.

Alhamdulillah! 🙂

And of course we learnt from an investment perspective how you can make your money,

the shariah compliant way in Singapore.

(Halal Financial Plan Card I get my clients to keep at their home. I target to distribute it to every single Muslim household in Singapore. Insya’Allah)

–

.

.

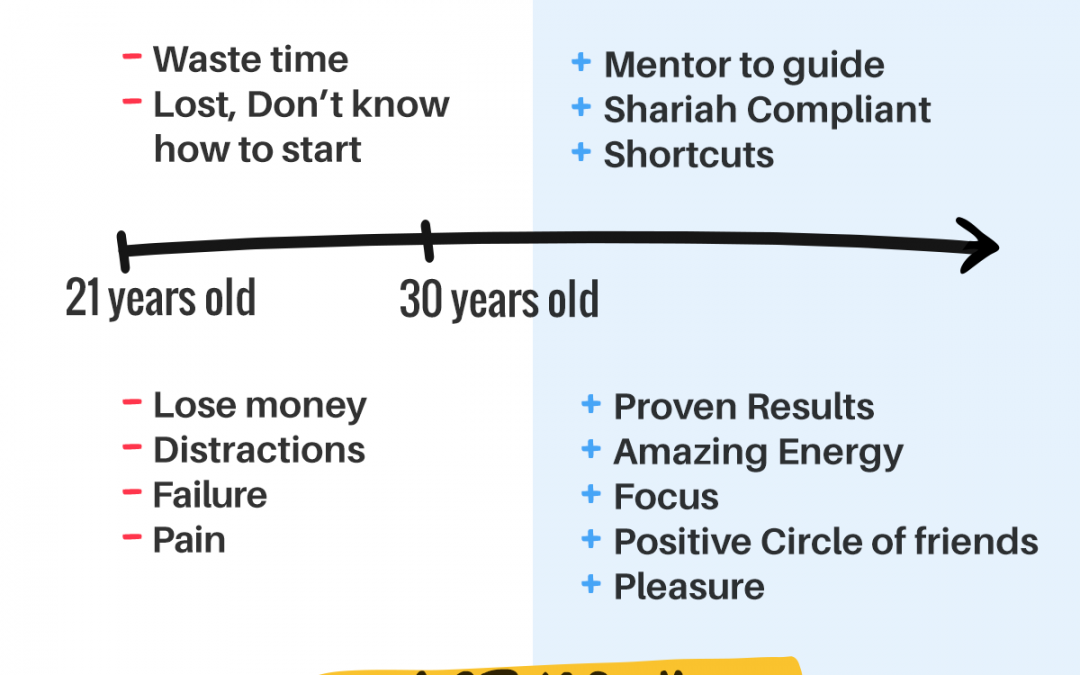

2) You need guidance.

.

I remember snapping photos of 10 different type of bread and Whatsapp-ing them to my nutritionist seeking for approval.

The types of nut butter I can eat.

Or I cannot eat.

What to look out for when reading the ingredients.

I even went for cooking classes to learn how to cook delicious yet healthy food. Some people told me. “Alahhhh Helmi.

You can learn everything from Google.”

The issue here, there are too many different opinions in Google.

And you don’t know which is right. And which is wrong.

That is why you need professionals to guide you step by step in achieving your goals in a seamless process.

(Pictures of healthy food that I learnt to make myself)

.

.

Similarly in managing your finance the shariah compliant way in Singapore, you need a mentor or a coach.

………….

….

Christiano Ronaldo, the world’s famous football player has a coach.

Tiger Woods, the world famous golfer of all times has a coach.

Khabib, the UFC martial artist champion has a coach.

………………….

………….

……….

A mentor and coach can help you with 2 things.

First, show you how to get from Point A to Point B.

Secondly, make you aware on your blindspots and obstacles that you should avoid so that you don’t tumble and fall.

When you have a mentor, you have the “certainty” to know if you are in the right direction or not.

………………..

………

Have you realise that time flies VERY FAST?

So fast, that is now February 2020!!!

Don’t waste time figuring out on your own.

Having a mentor can fast track your journey towards success.

.

Fast Action, Fast Results.

Slow action, little results.

.

Speed… Its now or never!

Find yourself a mentor!

3) Right circle of friends

.

I remember when I first got excited learning all these awesome new health info, I had the inclination to share.

But my idea got immediately shot down by others saying it is a waste of time.

Immediately, I stopped sharing and stayed focus.

………….

………

……

Sometimes, when you start planning your finance the shariah compliant way in Singapore, it is good

to keep things to yourself.

When you are new at something, keep things for yourselves.

After you get some success, then slowly encourage your loved ones.

And also start building your circle of friends who share the same goals as you.

There are many out there who can give you hundreds of reasons on why things won’t work.

…………………………………..

……………..

…….

I treat them as excuses.

Justifications on why things wont work is just “NOISE”.

Don’t give power to noise.

Ignore them. Treat it with a pinch of salt.

When people say, “Islamic Finance is impossible in Singapore…”

My head goes “blah blah blah….”

When people say, “Riba is now acceptable…”

My head goes “blah blah blah…”

When people say, “You are never good enough…”

My head goes “blah blah blah….”

The “noises” are like the “blah blah blah….” in this song.

My favourite song currently.

Listen to it! 🙂

…

..

4) Your BIG WHY is important

.

Part of my detox process involves swallowing the mixture of olive oil and lemon juice.

My gosh! That was the most challenging part of my detox.

I was like “Yucks!!!”

Felt like vomiting.

At that point of time, the question “why am I doing this?” played in my mind.

Felt like giving up. To me, giving up is easy.

So I took a bit of time to remember my BIG WHY.

………….

……..

…..

Similarly, when you want to plan your finances, the shariah compliant way in Singapore, your WHY is important.

.

My friends….

When you know your WHY,

your HOW will suddenly come knocking at your door. 🙂

.

.

Your BIG WHY will give you the energy to follow through the goals that you set in the first place.

Why are you doing what you are doing now?

Are you saving up for your child’s education? Why save up for your child’s education?

(My daughter loves her new school bag)

.

You save up because you want to see your child be able to study in a good university in the future.

You want your child to be a doctor. A teacher. A lawyer.

An engineer.

An artist.

You want your child to be a successful individual who can add value to the society.

Or are you doing it for your retirement? Why save up for your retirement?

What type of retirement do you want to lead in the future?

When are you going to retire?

Bottom line, WHY you are doing something comes before HOW to achieve it.

Explore the reasons.

It will bring you far.

5) Successful people begin something and do it till they meet success.

.

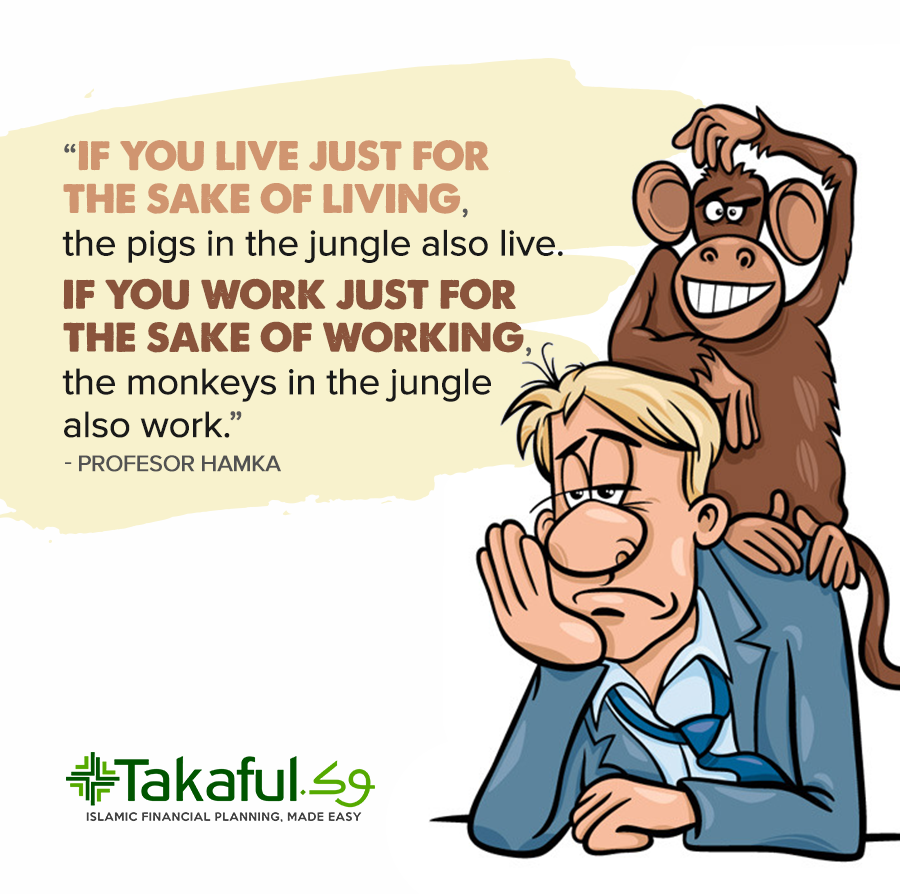

I like a quote by Profesor Hamka, a renowned Southeast Asian Muslim scholar and cleric.

……………………….

……………..

……

Kalau hidup sekedar hidup, babi di hutan pun hidup.

jika kerja sekedar kerja, kera juga berkerja.

Which means…

…………………………………….

…………………..

……………..

It only means that whatever you want to achieve in life, work towards it relentlessly.

If we do things for the sake of doing, sambil lewa,

how are we different than the animals in the jungle?

When I was doing my 23 days detox, there are a number of times I felt like giving up.

Especially towards the last few days when we were only allowed to drink juices.

No solid food.

When I was fasting during the month of Ramadan, at least I could look forward to iftar.

Last few days of my detox process, I was on a liquid diet.

Not easy.

………………………………

……………

……..

Last kopek already. Jangan hangat hangat tahi ayam.

Genggam bara api biar sampai jadi arang.

Successful people begin something and do it till they meet success.

How you do anything is how you do everything.

It’s now or never!

You start it. You finish it….

AS A CHAMPION! 🙂

…………………..

……………..

………….

Now… I hope you have benefited from my sharing on Detox Your Body and Islamic Financial Planning in Singapore For Year 2020.

If you are seeking a mentor, coach, consultant to share with you practical aspects on how you can plan your finance, the shariah compliant way in Singapore, I am always ready to help you.

You can always whatsapp/sms me at 96520134 to schedule a FREE consultation.

Or perhaps click here to schedule an appointment.

You will want to schedule it asap because I can only accommodate 5 slots for the following month.

Click here to schedule your FREE consultation today!

Take Care!