by Helmi Hakim | Mar 21, 2019 | Investment

Our thoughts about money have more power than we think.

For example, if we have positive thoughts about saving money, we’ll be motivated to accumulate money. When we are motivated, we will look for all sorts of creative ways to save money everyday and even feel good about it!

In a visual way, we can represent it like this:

Positive thoughts (“I can save money easily”), positive feelings (Motivated towards saving money),desirable actions (You look for ways to save money & also feel great about it)

But what if we have negative thoughts about money?

Examples of negative money thoughts are:

“Money is difficult to save – everything in Singapore is expensive.”

“I’m fated to be broke my entire life.”

“Rich people make money by cheating others.”

“I’m terrible at making money.”

“Money is the root of all evil.” (does this sound very familiar? =P)

Money in itself is a neutral object..

The meaning we attach to money will determine how we handle money in our lives.

If we think money is evil, chances are: it will be hard for us to make money. That’s because our minds link money with something bad!

If we think we are blessed and surrounded with abundance and rezeki, we will feel at peace even if we live in a small makeshift hut in a forest.

Our minds and thoughts have great power over our feelings and actions. That’s why it’s important to have a healthy mindset about money.

But what if we already have negative beliefs about money drilled in our minds since young?

There are 2 stages how you can change your unhelpful money mindset.

STAGE 1 : Catch Your Unhelpful Thoughts

Stage 1 is about catching our unhelpful thoughts.

This is not as easy as it seems. Our thoughts happen in a flash and we are not used to catching them. If you have many thoughts in your mind, identify the ones which make you feel the worst.

If you are still not sure how to start, below is an example.

How do we catch our unhelpful or negative thoughts?

There are a few characteristics to look out for:

a. Negative thoughts happen immediately after an event.

For example: Let’s say you have to pay $xxxx for an unexpected surgery. Your immediate negative thought might be “Money is hard to save in Singapore.”

b. Negative thoughts are believable and true at that point of time.

For example: At the point of time when you were informed of the cost of surgery, your thought that “Money is hard to save in Singapore” was loud and true.

c. Unhelpful thoughts are linked to bad feelings

For example: If you feel stressed and anxious about the cost of surgery in the example above, it’s because you are having negative thoughts. Your unhelpful thoughts can be: “I’m a burden because I am costing my family a lot of money this month,” “My wife and kids will be unhappy because I’ll have to cut down our entertainment expenses this month,” “I’m destined to be broke because I can’t save money like other people can.”

Our negative thoughts usually have a similar pattern.

At this stage, just be aware of them.

STAGE 2 : Create new, realistic & balanced thoughts

In Stage 2, we will use evidence and facts to change our unhelpful thoughts.

For this to work, we can’t change from one thought to the opposite thought – that will be too drastic.

For example, we can’t change a negative thought from “Money is hard to save” to “Money is easy to save” in an instant.

Our aim is to create a new, realistic thought which is more balanced using evidence and facts.

Why do we use evidence and facts?

Because we can’t argue with evidence and facts. They are objective. This is a way for us to ‘trick’ our minds to change a negative thought and create a new one.

For example, let’s say we have a negative thought that says “Money is hard to save.” How do we use evidence and facts to change this belief?

EXAMPLE:

My negative thought: “MONEY IS HARD TO SAVE.”

Step 1: Find evidence that money is hard to save.

Your list might look like this:

a. I can only save $200 every month even after cutting my budget.

b. I have to relieve stress by spending a lot of money on holidays and luxury goods.

c. Singapore is an expensive country – everything costs money.

Step 2: Find evidence that money is EASY to save.

For example:

a. I have saved $500 once – which is more than my usual $200.

b. I can research for stress-relieving activities which don’t cost a lot of money (surprisingly, some of these activities are way better than shopping sprees)

c. I can choose to prepare and bring my own food to work even though it takes more effort.

d. I can choose to reduce my $6 a day coffee habit.

And so on.

Step 3: CREATE new, realistic thoughts which are balanced.

For example:

a. Singapore is an expensive country, but if I make small changes like reducing my indulgent eating habits, I can save more money than usual.

b. I like to go shopping and go for holidays to escape stress. But if I make the effort to research for stress-relieving methods which don’t cost much money, money is easier to save.

Visually, the whole process can be condensed into the table below:

| Situation |

Emotion |

Automatic Negative Thoughts |

Supporting evidence for “Money is hard to save.” |

Opposing evidence for “Money is hard to save.” |

New, balanced thoughts |

| Had to pay $4000 for a medical procedure |

Helpless

Stressed

Demoralised |

“Money is hard to save in Singapore.” |

a. I can only save $200 every month even after cutting my budget.

b. I have to relieve stress by spending a lot of money on holidays and luxury goods. No choice.

c. Singapore is an expensive country – everything costs money. |

a. I have saved $500 once – which is more than my usual $200.

b. I can research for stress-relieving activities which don’t cost a lot of money.

c. I can choose to prepare and bring my own food to work even though it takes more effort. That can easily help me save money.

d. I can choose to reduce my $6 a day coffee habit. This is an easy thing way to save extra cash. |

a. Singapore is an expensive country, but if I make small changes like reducing my indulgent eating habits, I can save more money than usual.

b. I like to go shopping and go for holidays to escape stress. But if I make the effort to research for stress-relieving methods which don’t cost much money, money is easier to save. |

In short…

I’ve met many prospects who have a negative viewpoint of money. I’ve also met people who have a healthy connection with money.

Usually, those with a healthier mindset about money will find it easier to save and pay off their debts.

Because thoughts lead to feelings which lead to behaviour.

Positive thoughts about saving money —> Positive feelings about saving money —>More effort to save and plan their income.

If you need a coach and mentor to help you to plan your finances the shariah-compliant way in Singapore, you can Whatsapp me at 96520134.

See you soon, Insya Allah.

by Helmi Hakim | Feb 25, 2019 | Investment, Motivation

In my profession as a financial consultant,

I get to meet a lot of people.

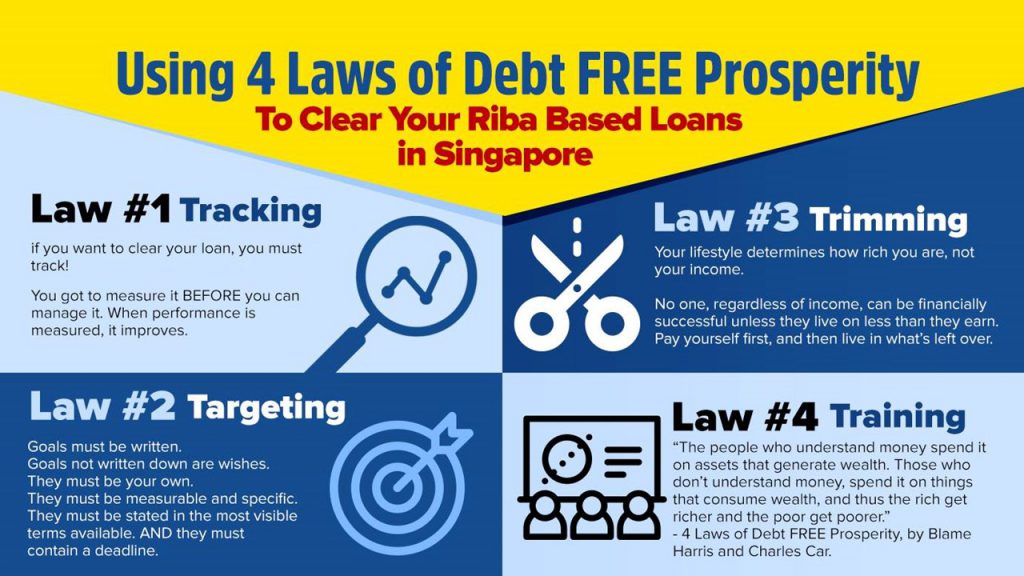

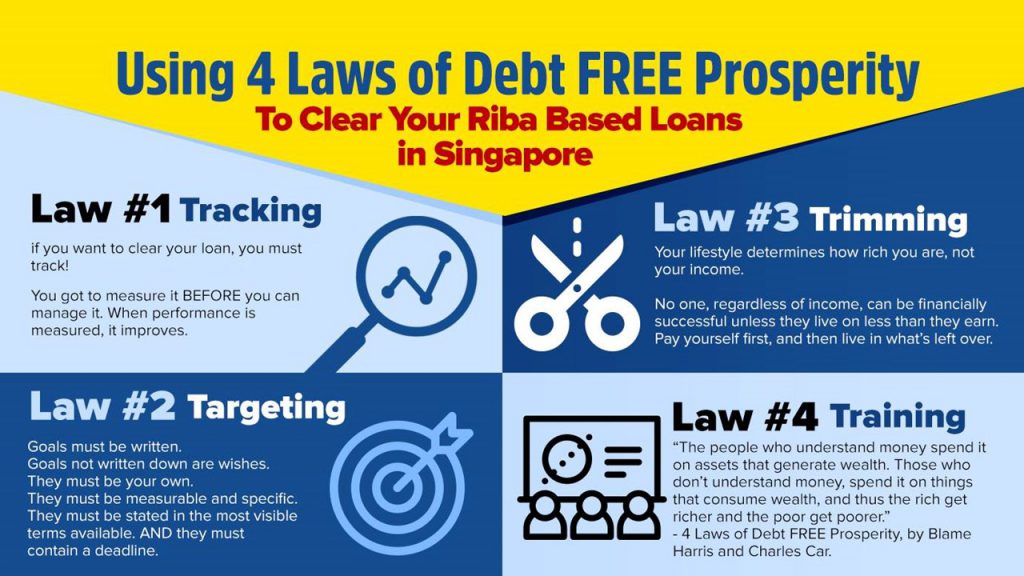

People seeking financial advice from me on how to clear their riba based loans in Singapore.

(a number of them undergoing CCS program now).

Or seeking financial advice on how to save, accumulate and grow their money, the shariah compliant way in Singapore.

Most of them have 1 small yet troubling problem.

They don’t have money.

Whatever shariah compliant financial strategies I share with them, it remains difficult for them to have money.

The reason is not because they don’t have financial discipline.

And not because they are not committed to their financial goals.

The reason is simply because they don’t have a HIGH DISPOSABLE INCOME (money that goes inside your pocket every month).

So, today I want to share with you a topic that is close to my heart,

“7 Ways To Double Your Income, The Shariah Compliant Way in Singapore”

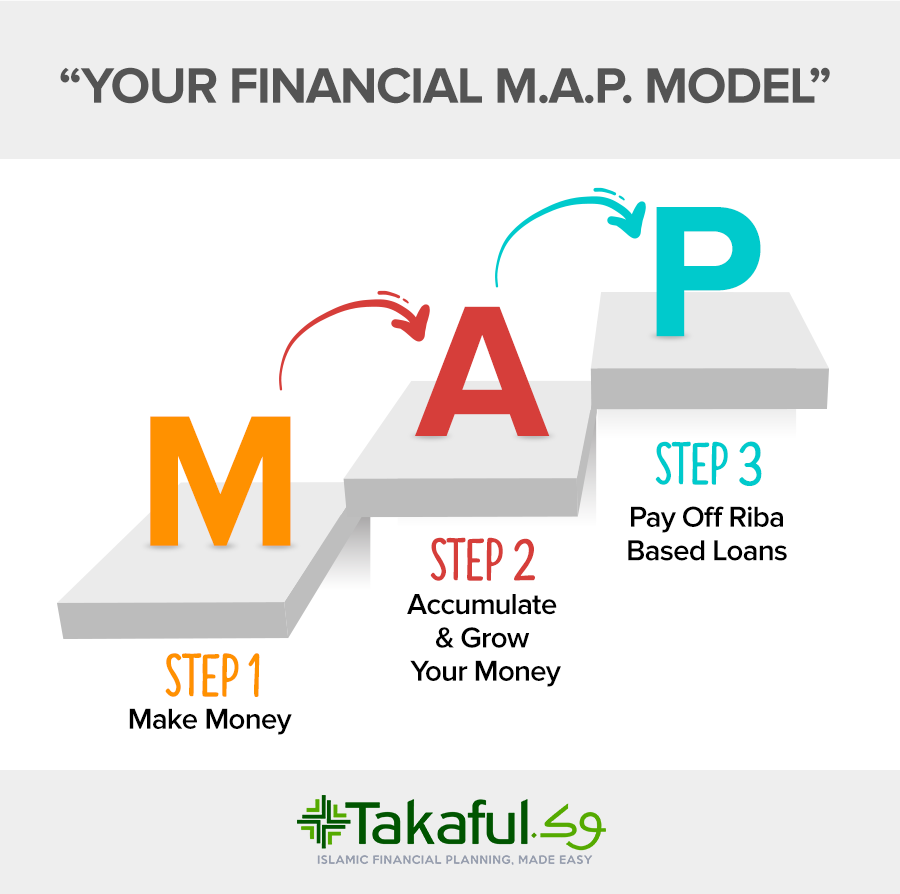

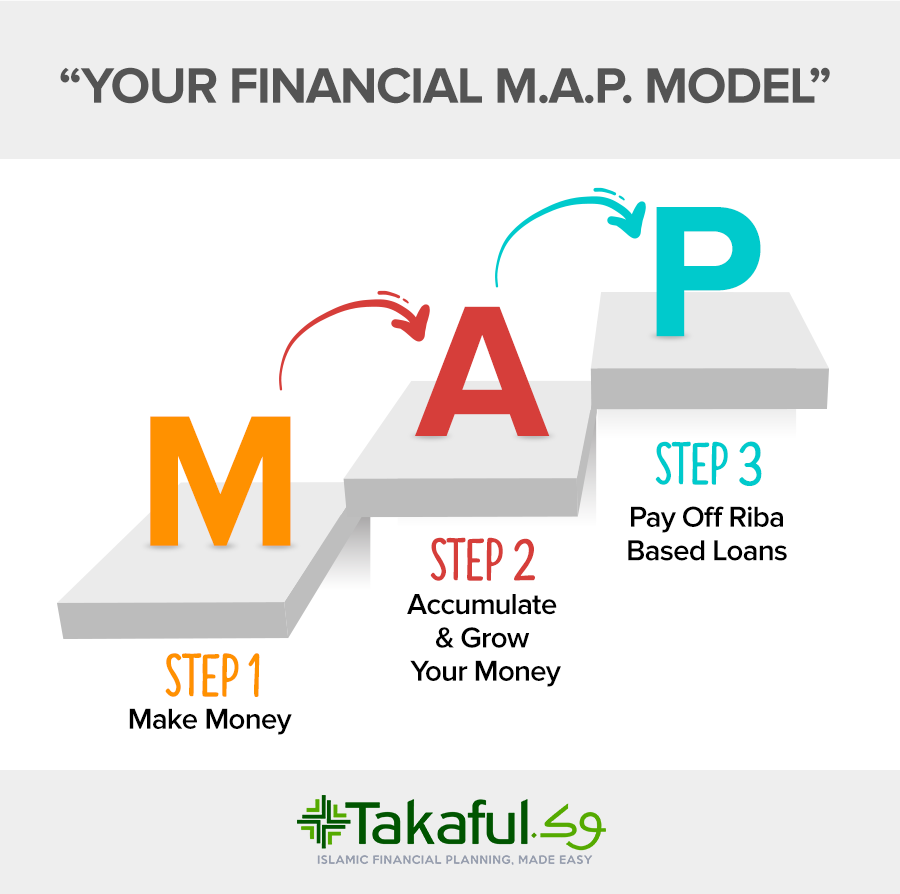

Today, we shall focus on 1st part of Takaful.sg Financial M.A.P. model! 🙂

……………………………………………………………

……………………..

….

It is a not a magic formula.

Yet I am highly confident, if you read and apply the strategies that I am about to share.

It will work like magic for you!

Allah Ya Mujeeb! (Allah The Responsive One)

………………………………….

………………….

……..

1) Work as if….

.

.

First thing first you have to understand this.

In business, people pay for value.

How much you are paid commensurates with the value you deliver to the marketplace.

What I want you to do

Be it if you are self employed OR a full time employee….

If you earn $2000/mth, work as if you are paid $4000/mth.

If you earn $5000/mth, work as if you are paid $10,000/mth.

If you earn $10,000/mth, work as if you are paid $20,000/mth.

Yet sometimes, I have people who told me.

I work for more than I’m paid.

“My boss doesn’t appreciate me. Pay increment is not in his dictionary.”

Well…

If you are an employee, it is time for you to build up your emergency funds (6-12 months expenses), and find a new boss.

If you are a business person, it is time for you to review your business strategies.

Yet, 1 common denominator that I strongly advocate is HARD WORK.

‘Man Jadda, Wa Jadda’ whoever strives shall succeed.

The more value, you deliver, the more money you make.

Below is an idea I get while reading Russel Brunsen’s book, and I find it super relevant.

It is called the “Value Ladder”.

I call it, “The More Value You Give, The More Money You Make“ Financial Ladder. 🙂

(“The More Value You Give, The More Money You Make“ Financial Ladder)

When you are at work, always, always EXCEED expectations.

Deliver more value than you are required to.

Do your best wherever you are! And in whatever you do!

Soon, Allah S.W.T. will show you the path to people who will pay you for what you are worth.

Insya’Allah

.

.

.

2) Mix with people who earn double or triple your income

.

In your industry, definitely there are people earning double or triple your income.

Make friends with them.

Okay. If they are self employed like you.

Yet earn double or triple your income.

They know something that you don’t.

They think differently from you.

Yet, most probably they are busi….er than you.

Eat the humble pie.

Make it easier for them to help you.

Give first.

Add value to their business first. Then seek help.

Most people called it “Law of Reciprocity”.

I call it, “You help me. I help you.” concept.

It works. 🙂

……………………………

…………………

………….

Another super fast way for you to mix with people who earn double or triple your income is to join personal development/ investment or business seminars.

Usually for seminars, they have success stories.

They have testimonials.

Better still, if they have rag to riches story.

Last time, Person A was not doing so well.

Alhamdulillah after joining a certain seminar, Person A is now doing well.

Learn wholeheartedly from the seminar, and make a conscious effort to befriend “Person A” and others.

What we want is the connection.

The circle.

Circle is important.

I know many parents who send their children to good schools because good schools have students with well connected parents.

And the students have a head start to becoming successful, well known, established individuals in the future.

The parents want their child to have a good circle in the future.

If you want to double or triple your income, you can consciously alter your circle.

I am not asking you to dump your friends!

I am asking you to make more friends with people who are MORE SUCCESSFUL than you.

It is like thermostat adjusting to a certain temperature.

Soon, you will realise that your income will match the circle of friends that you have just built from scratch.

Choose your circle carefully. Because your circle will shape who you become, and your family generations to come.

.

.

3) Write down your gratitude list every morning when you wake up from sleep

.

.

I read from “The Secret”.

They mentioned that to change your life fast:

Use gratitude to shift your energy.

When you put all your energy into gratitude,

you will see miracles taking place in your life.

Joy attracts more joy.

Happiness attracts more happiness.

Peace attracts more peace.

Gratitude attracts more gratitude.

Kindness attracts more kindness.

Love attracts more love.

I learnt that as the “Law Of Attraction”.

………………….

…….

When I learn more about our beautiful religion Islam, I realize a bit of similarity.

Allah S.W.T say in Surah Ibrahim, Chapter 14, Verse 7

If you are grateful, Allah will certainly give to you more.

I want you to write down your gratitude list every morning when you wake up from sleep.

Example how to write your GRATITUDE list:

Alhamdulillah, Ya ALLAH. I am grateful because I am alive today.

Alhamdulillah, Ya ALLAH. I am grateful because I believe Allah is God and Prophet Muhammad (Peace be Upon Him) is the messenger of God.

Alhamdulillah, Ya ALLAH. I am grateful because I have a loving family.

Alhamdulillah, Ya ALLAH. I am grateful because I have a fully paid car.

Alhamdulillah, Ya ALLAH, I am grateful because I like my job as a financial consultant. And I have very friendly and understanding clients.

and you have to remember this.

Allah mengikut sangkaan hambanya. (Muttafaqun ‘alaih).

………………………………..

…………………

……….

When you write your GRATITUDE list every morning,

you will attract the good in your life.

Because you thank Allah S.W.T. the goodness that you have in your life.

And you believe that Allah S.W.T. will continue to bring goodness in your life.

What you write, you think, you feel.

You say and do, they are DOA that Insya’Allah will be granted by Allah S.W.T.

Write good.

Think good.

Feel good.

Say good.

and do Good!

It will become a DOA.

Allah Ya Mujeeb! (Allah The Responsive One)

Grant the doa of all my blog readers reading my blog now.

Amin. Amin. Insya’Allah.

.

.

4) Outsource

.

.

If you earnestly do the first 3 actionable ideas I shared with you above, I assure your income will increase. Time will be my witness.

We are still focusing on the 1st step of Takaful.sg “Your Financial M.A.P.” model.

Make Money. So what can you do to Make More Money?

…………..

…..

.

The next idea is very relevant especially if you are self employed or running your business.

You have to understand this.

”’

You are not Superman.

You are not Batman.

You are not Ultraman.

Captain Planet.

Teenage Mutant Ninja Turtles.

Or POWER RANGERS! (my favourite)

””

You and me. We are just normal human beings.

Normal human beings with our strengths and limitations~~~

Learn to OUTSOURCE!

…………………………..

……………………..

………………..

I remember one of the quotes of wisdom,by a Singaporean entrepreneur, Sant Qiu,

“Whatever you can do, you can do it bigger, better, faster……

with the right team.

So assemble the right team as early as you can and achieve bigger, better results FASTER!”

………………………..

…………….

………..

Yes. Don’t work alone.

No man is an island.

Even if you follow the movies, you will realise something.

Superheros nowadays don’t work alone! 🙂

Gone are the days, where Superheros have their own turfs.

Superman takes care of Metropolis.

Batman takes care of Gotham City.

Captain America, Thor, Hulk, Black Panther all have their own turfs.

Today, we see Ironman assemble his team

and combine all these superheros together,

to become AVENGERS!

As Avengers, they are now the elite team to guard the world

and make it a safe place for all of us.

My question for you.

Do you still want to work alone? 🙂

……………………..

……………….

…………

Last time, when I have a goal, my brain will think this way.

“How can I achieve this?”

Now with a team. I think this way.

“How can my team and I achieve this?”

.

.

5) Focus on 80:20

.

.

When you focus on everything, nothing changes.

When you focus on one thing, EVERYTHING WILL CHANGE!

In you are in business, you have to realize that 20% of your activities give 80% of your results.

I define this as my “give me a lot of results” task.

I call it, “give me a lot of results” task because I know if I complete these tasks,

I will get a lot of things done for the day!

So everyday, when I have my to do list, I will make sure that I complete my “give me a lot of results” task FIRST.

Then, everything else.

By prioritising to complete a task that matters FIRST, I assure you that you will be more productive. And in return your income will increase. I am very confident in that.

.

.

6) Start your day early, don’t sleep after Subuh prayers and perform your Duha prayers

.

.

All the successful people whom I’ve met and had the opportunity to ask questions, I realise they have common traits.

Common patterns.

Things that you can follow and model upon.

1st things 1st, they start their days early. They don’t go back to sleep after their Subuh prayers.

Secondly, Solat Duha.

If you feel too narrow in rezeki, pray 8 rakaat.

If not, 4 rakaat.

Minimum 2 rakaat.

Do it daily.

And consistently.

May Allah S.W.T. bless us with bountiful rezeki!

Allah Ya Mujeeb! (Allah The Responsive One)

.

.

.

7) Istighfar,

Avoid the Haram and Sadaqah

.

.

Istighfar means I seek forgiveness from Allah S.W.T.

The more you Istighfar, Insya’Allah… the more rezeki you will have.

Refer to Surah Nooh, verse 10-12

Second thing is Taqwa.

Avoiding the Haram.

Do what Allah like, and Allah will give us what you like.

Have faith in Allah S.W.T.

And finally Sadaqah.

Strategy No 3, I shared with you about Law Of Reciprocity.

Give first and you shall receive back.

Law with reciprocity with a fellow human being on this earth is very different with law of reciprocity with Allah S.W.T.

Law of reciprocity with a human being… 1- 1 = 0

Today, you help me. Tomorrow, I help you.

We are done. We are even.

Law of reciprocity with Allah S.W.T. through our sadaqah jariah is different.

Law of reciprocity with Allah S.W.T. … 1 – 1 = 10

You give 1, Allah S.W.T. will return you in 10 manifolds.

Bi’iznillah.

Continue to give value. Trust the process.

Make the world a better place to live in.

And Allah S.W.T. will path the way to people who appreciate you for who you are

and the services you offer.

Allah Ya Mujeeb! (Allah The Responsive One)

Grant the doa of all my blog readers reading my blog now.

Amin. Amin. Insya’Allah.

…………………………………………..

……………………

……….

Now… I hope you have benefited from my sharing on 7 Ways To Double Your Income, The Shariah Compliant Way in Singapore……

If you like to go to the next step of “Your Financial M.A.P” model, how you can accumulate and grow your money, the shariah compliant way in Singapore, I am always ready to help you.

You can always whatsapp/sms me at 96520134 to schedule a FREE consultation.

Or perhaps click here to schedule an appointment.

You will want to schedule it asap because I can only accommodate 5 slots for the following month.

Click here to schedule your FREE consultation today!

Take Care!

by Helmi Hakim | Jan 31, 2019 | Investment

I was watching the trending Netflix series on Marie Kondo, who is famously known as the tidiest woman in the world.

Marie Kondo, from Japan is an expert in tidying things up.

It amazes me on how she has 6 months wait list for potential clients.

………..

…

….

I mean there are people in this world who want to learn her “life changing habits of tidying up”?

They want to learn seemingly simple tasks like…

How to fold your clothes. How to arrange your books.

How to get rid of clutter.

Or in her words… “getting rid of items that don’t spark joy.”

All in all using the KonMari method…

I was like, WOW!

I got intrigued and researched more about it.

And today, I will like to share with you my own version as an Islamic Finance Practitioner in Singapore.

Presenting….

“5 Ways To Marie Kondo Your Finances, The Shariah Compliant Way In Singapore...”

…………………

……….

…..

1) Marie Kondo your haram financial instruments away

.

First thing first, as an investor, we want to make money.

We want to make lots of them. The more, the BETTER!

Yet you and I know that we CANNOT set our qiblat on money alone.

We have to be aware on what is Halal.

And what is Haram.

Why?

Because we will be questioned during yaumul qiayamah.

For me once I learnt about shariah compliant screening methodologies, I Marie Kondo-ed away my non shariah compliant investments that have broken even.

And FOCUS my effort 100% on shariah compliant financial instruments.

When I know all the money that I make is Halal, it brings peace to me.

Or in Marie Kondo’s words, “It sparks joy for me!” 🙂

……..

.

.

2) Marie Kondo your past achievements away. What is important is now and the future.

.

Some people say…

Last time, there was an Islamic Bank in Singapore.

Last time, there were MORE shariah compliant financial instruments in Singapore.

Last time…..this and that.

I told them:

“If you want to talk about last time, I would say last time, my grandmother was also beautiful!!”

She is 90 years old now, so praising her for her physical beauty is not relevant now. 🙂

What we should be focusing now is the present. What can we do today as an ummah to uplift Islamic Finance in Singapore?

Focus.

Marie Kondo away your past glory. And focus on what we can do now.

And for our future.

…………..

…

.

3) Marie Kondo your ego away

.

You know. Sometimes, when I meet people.

They yayapapaya assume they know everything about Islamic Finance.

They think they know EVERYTHING!

When fact is, they barely know a thing.

To me Knowledge is power. Yet in order to receive it, one must first, be humble and ‘Marie Kondo’ one’s ego away.

Imam Syafi’i RA said,

“If you want happiness in this world,you need knowledge.

If you want happiness in the hereafter, you need knowledge.

If you want happiness in this world and hereafter, you need knowledge.”

……………..

……….

……

….and only when you are humble, open to learning new things, and when you are ready.

Your teacher will appear. 🙂

…………….

……….

….

4) Be thankful and Marie Kondo your negative thoughts away

.

If you have watched the first episode, the “process” begins with you greeting your house first.

Communicate with your house.

By thanking your house for always protecting you.

Appreciate what you have.

When you throw your clothes away, you must thank the clothes for letting you wear them.

Thank your clothing item 1 by 1.

When you fold your clothes, take the opportunity to thank them.

I like Marie Kondo’s approach because I believe everything in this world is a creation of Allah S.W.T.

Be it our clothes.

Our house. Our money. The air that we breathe.

Everything is a creation of Allah S.W.T.

We have to be thankful for them.

Say Alhamdulillah…. 🙂

……………………………

………..

…

This is what I do during my signature program, “Your Financial M.A.P.”

I shared with my clients plenty of money saving tips.

And one thing, I told them is the importance of GRATITUDE.

You must feel thankful even if you manage to save $50.

$20. Or even $10.

Because Allah S.W.T. said in the Quran: “If you are grateful, I would certainly give you more”

I’ve always believed that every big success stems from us being grateful for our small success.

Small successes will attract big successes as time passes.

Allah will bless us with more wealth if we are thankful. We have to be thankful even for small successes. Celebrate all our wins! 🙂

….

…

5) Marie Kondo your negative friends away and build deeper relationship with Allah S.W.T.

.

Your circle is important.

Who you mix with everyday is going to determine who you become in the future.

Marie Kondo away your negative friends.

I am not asking you to cut silaturahim.

Just spend lesser time with them.

In addition to that, build a deeper relationship with Allah S.W.T.

Our financial planning partner in our life is not our wife.

Not our mum. Not our dad.

Our financial planning partner is Allah S.W.T.

Build deeper relationship with Allah S.W.T. through our tahajjud prayers.

Through our taubat prayers. Through our hajat prayers.

Always Istighfar. Selawat.

Recite Al Fatihah. Ayatul Kursi.

Surah Al Ikhlas. Surah An Nas. Surah Al Falaq.

Surah Yasin. Surah Kahfi.

Everything we want to do…

Remember this…

”

Allah first.

Allah again.

Allah always...

“

Allah says Allah is nearer to us than our jugular vein. (Surah Qaf, Verse 16)

Allah knows best! 🙂

…………………………………….

…………………..

…………

Now… I hope you have benefited from my sharing on 5 Ways To Marie Kondo Your Finance, The Shariah Compliant Way In Singapore…

If you are seeking a mentor, coach, consultant to share with you practical aspects on how you can plan your finance, the shariah compliant way in Singapore, I am always ready to help you.

You can always whatsapp/sms me at 96520134 to schedule a FREE consultation.

Or perhaps click here to schedule an appointment.

You will want to schedule it asap because I can only accommodate 5 slots for the following month.

Click here to schedule your FREE consultation today!

Take Care!

by Helmi Hakim | Jan 14, 2019 | Investment

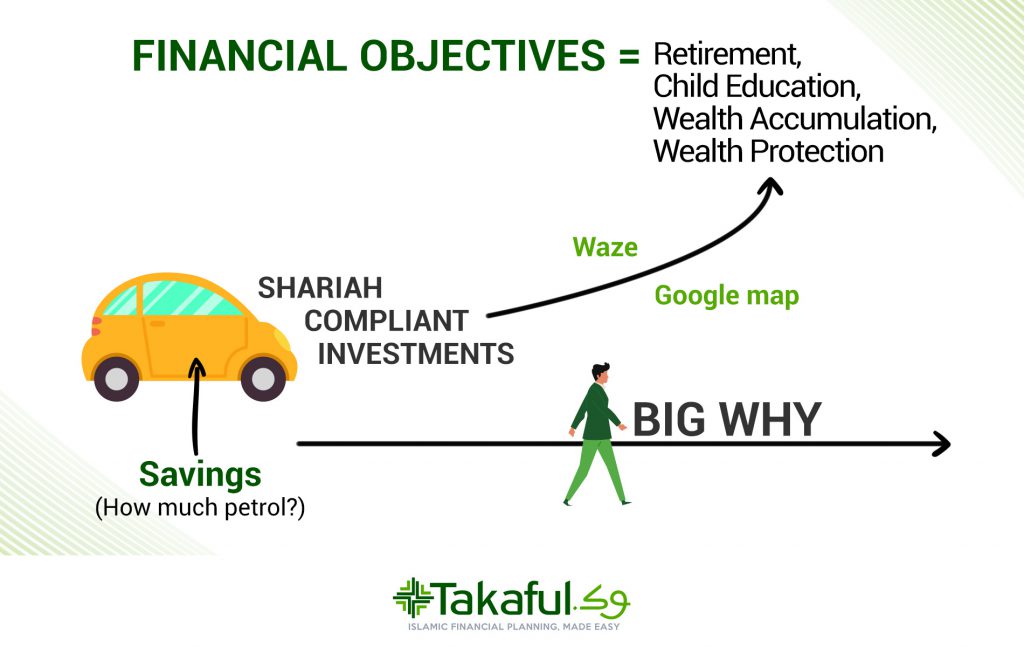

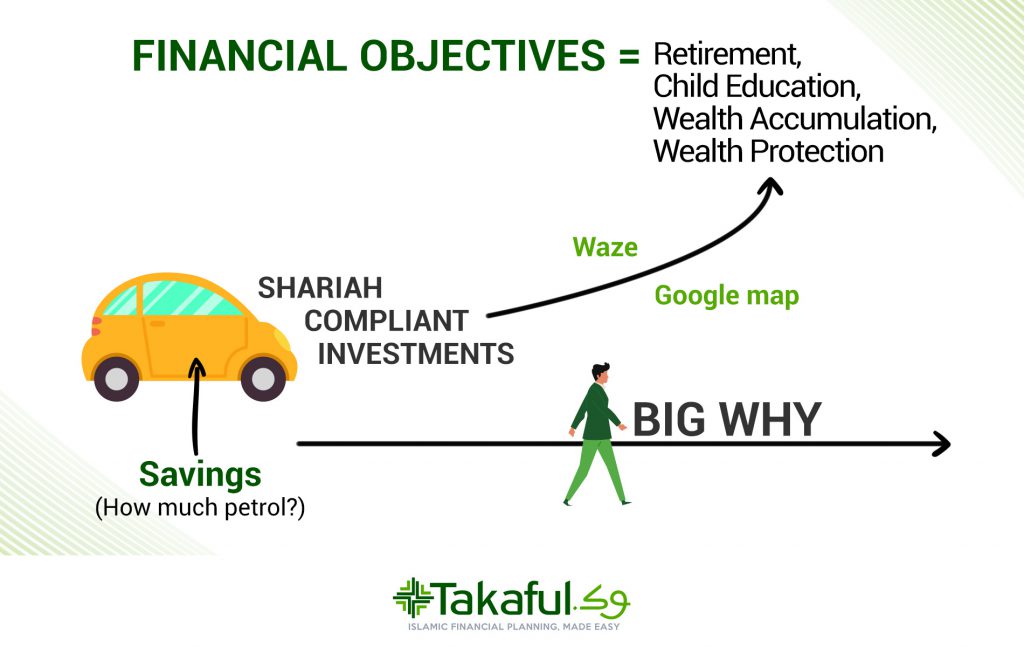

Achieving your Halal financial goals in Singapore is like driving a car.

After driving for some time, Alhamdulillah… finally you reach your destination safely.

There are 7 simple yet IMPORTANT things that you need to have to ensure that you reach your destination safely.

I have created the infographic below to sum up this blog post. 🙂

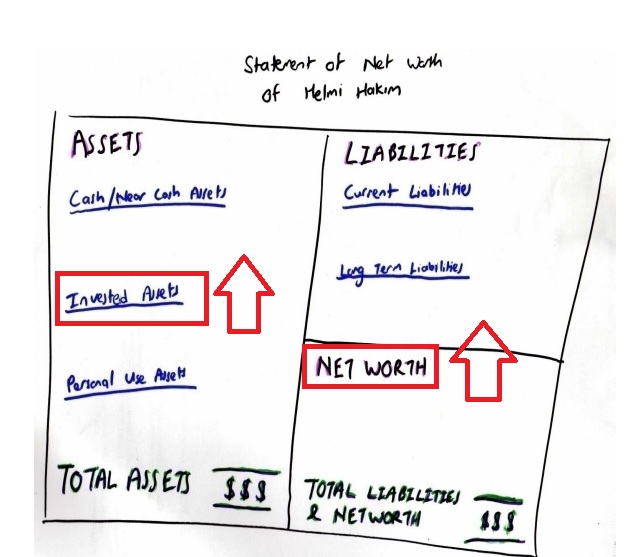

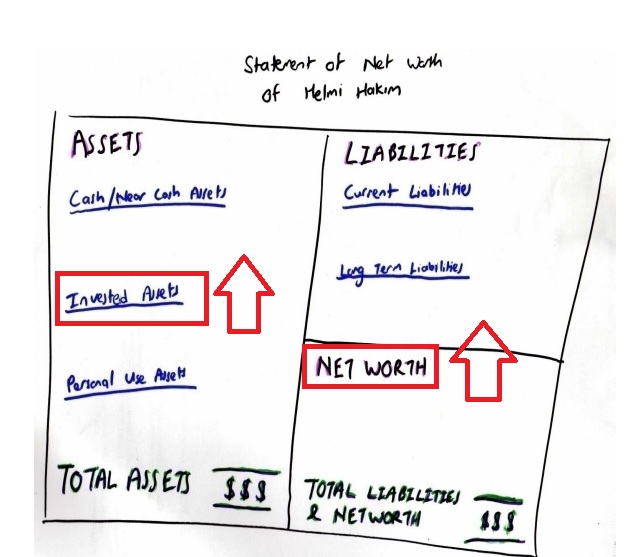

1) You need to know where you are

.

If you call me today. And you ask me…

“Helmi. How do I get to Masjid Al-Islah at Punggol?“

The first thing that I will ask you immediately is,

“Where are you now?” 🙂

Similarly, in finance,

you got to first know where you stand exactly in terms of your personal finance.

You can create your personal networth statement and personal cashflow statement.

In short, your networth is Your Total Assets minus your Your Total Liabilities.

Your Final cashflow is Your Total Inflow minus your Your Total Outflow.

What is your PERSONAL NETWORTH (excluding the house you are staying) now?

How about your cashflow? Do you have a positive cashflow or negative cashflow every month?

Start looking at these numbers closely. Because only when performance is measured, it can be improved.

Of course, if you engage a financial consultant like myself, I can help you out with your 7 financial ratios.

…………………………………..

……………………

………………

2) You need to know your destination

.

My overall goal as a financial consultant is to help you

– INCREASE your shariah compliant investible assets in your networth statement

-SHORTCUT and accelerate your process to increase your personal networth in a Halal manner

-Reduce and eliminate your riba based loans once and for all

And at the same time, help you achieve your short term and your long term financial goals.

These short term and long term financial goals are what I term as “your destination”.

Are you saving for your retirement? Saving for your child’s education?

WHERE IS YOUR DESTINATION? 🙂

……………………

……….

….

3) You need a vehicle

.

In order for you to reach a certain destination, you need to have a mode of transport. Are you travelling by bus?

By car?

By motorcycle? By train?

By plane?

Or by ship? 🙂

(My first time boarding Royal Albatross without the need to have a passport)

……………………………….

………………….

…………

WHAT IS YOUR MODE OF TRANSPORTATION? 🙂

For me, I drive my Hyudai Elantra everyday to work.

And if I travel, I like to travel to my favourite destinations with AirAsia.

Of course!! I will savour their delicious serving of Nasi Lemak Pak Nasser while on board.

Nasi Lemak Pak Nasser is my favourite! 🙂

If I am overseas, I have my Grab app and Gojek by my side.

It is super duper convenient! 🙂

………………………

……………..

………….

Similarly when you are saving money for your financial objectives, you need to have a RELIABLE FINANCIAL VEHICLE.

For short term financial objectives like your 3-6 months emergency funds, you can leave your money in the Al Wadiah savings account.

It is shariah compliant because Al Wadiah savings account gives Hibah.

Hibah, Gift = Halal

Riba = Haram

For your long term financial objectives, you want to make sure that your money works harder for you.

Al Wadiah Hibah of 0.6-0.8%/annum is not enough.

You want more.

You need more…. You deserve more!

That is where you will look into shariah compliant stocks/funds/Halal REITS etc2 as part of your portfolio.

If you are clueless on shariah compliant ways to make money, schedule “Your Financial M.A.P.” session, for FREE! 🙂

………………..

……….

…..

4) You need adequate petrol

.

Some people told me, they want to be a millionaire in 15 years time, by investing $150/mth

Let me do the maths for you.

$150/mth X 12 months X 15 years = $27,000

I told them… Hello…

If today you want to drive to Penang from Singapore.

And you only fill up $10 worth of petrol.

Will you reach Penang?

Confirm, you won’t reach. In fact, you CAN’T even reach Malacca with $10 worth of petrol.

But some of them argued…

‘Alah… Helmi… I can only afford $150/mth now…”

Then I told them, its okay to start with $150/mth. Along the way, you have to top up.

Its like driving your car. When you don’t have enough petrol, you need to top up the petrol. 🙂

…………………………..

…………

…….

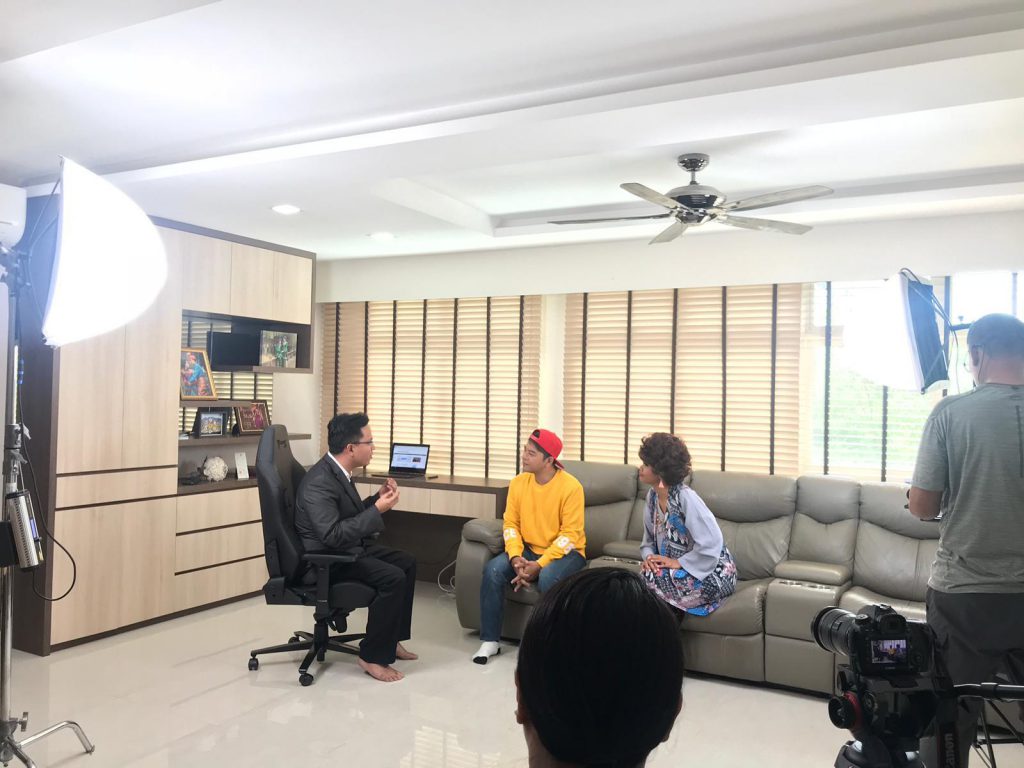

5) You need someone to show directions: Google Map. Waze.

.

That someone is called a mentor, coach or advisor.

There are 20,000 financial consultants in Singapore.

Some people asked me. What is the difference between ME and the rest of the 19,999 financial consultants in Singapore?

The difference is simple.

I specialise in helping Muslim families plan their finance, the shariah compliant way in Singapore.

So that they can lead a blessful life in this dunya.

And also the akhira..

Amin. Allahumma Amin…. 🙂

(Catch me in Mediacorp Suria shows, “Wahhnita” and “Alah Abang, Amboi Kakak” to be aired in February 2019)

……………………..

…………

………..

6) You need to check your blindspot. You might need additional mirrors. Definitely, you need insurance.

.

You need to have Plan A.

Plan B. And Plan C.

Especially if you intend to drive long distance, it is good to have additional mirrors.

Additional precautionary measures in place. Definitely you need insurance.

………………………………..

………………

………..

I remembered many years back then, while was still a student.

Back then when I was in Ngee Ann Poly Business Incubator program.

My partner and I were required to present our business plan to a group of investors.

I was in charge of the pro forma financial statements.

I had to forecast the trading, profit & loss statement for the next 3 years.

5 years. And 10 years.

I had to project my forecast into 3.

Pessimistic. Neutral. And optimistic sales figure.

We clinched the deal.

To my mind, that was a super good training ground, because entrepreneurs are usually optimistic.

We always think that everything will fall in place nicely.

Yes. Sometimes it does, with the help of Allah S.W.T.

Yet, sometimes it doesn’t. That it where you need contingency plan.

You need Plan A.

Plan B. Plan C.

And Plan D.

In Malay, we call it, “Sediakan payung sebelum hujan.”! 🙂

…………………….

…………………………

………………..

In today’s investment environment, there are so many variables to account for.

Weakening and strengthening of the USD$.

Interest rate hikes (there were 3 rate hikes from the Fed in year 2018)

Donald Trump Trade war (market follows closely to whatever he tweets)

So many things to read on Bloomberg. On MorningStar. On Business Times.

Financial products keep evolving too.

Yesterday, I met one couple. They mentioned that they want a financial vehicle that covers EVERYTHING..

Covers hospitalisation. Covers personal accident.

Covers their income replacement needs, death, total & permanent disability, critical illness.

Covers retirement. Covers child’s education. Wealth accumulation.

Basically, a SUPER COMBO plan consolidate into 1.

I shared with them, that there is no such plan. If there is, I also want! 🙂

We have to segregate Plan A.

Plan B. Plan C. Plan D. Plan E….

And Plan A, Plan B, Plan C, Plan D, Plan E are within my purview as a financial planner.

Others from other industries such as real estate can share

Plan F.

Plan G and Plan H.

Basically diversify. Don’t put your eggs in 1 basket.

Have contingency plans in place!

…………………….

………

…….

7) You as the driver need to be focused. Drink coffee.

Stay alert.

.

You as the driver need to be focused.

Especially if you drive long distances. Drink coffee.

Stay alert!!

By being focused, you should also know where you want to go

and not be swayed by other people’s opinions.

Some drivers, they drive so far and almost…..reach their destination.

Suddenly one of their passengers distract them.

The passenger said, “Hello!!!! You are going the wrong way!”

Instead of moving forward towards their destination, the driver did a U-Turn.

Imagine…. You are so close to your destination and suddenly you U-Turn.

You U-Turn because your friend gives you wrong advice.

You are so hospitable, so caring, so accommodating to offer your friend a ride on your car.

Instead of thanking you, he “sabo” you by leading you to the wrong direction.

Alamak!!!

…..

Similarly, there are many people in life. At first, they were doing good.

Then, their friends give unqualified opinions.

Alah… Why you do this?

Alah… Why you do that?

Singapore, non Muslim country can do it the Halal way meh?

And they give you 1001 myths on planning the finance, the shariah compliant way in Singapore.

To me the unqualified opinions are like passengers in the car who are clueless.

Yet think they know the direction, and show you the wrong way.

Or if you board a ship, the unqualified opinions are like storms in the sea.

……………………………………..

………………………………

………………….

What I did is that I installed “anchors”.

I install “anchors” in all my financial planning presentations. In a good way.

If you are my client, confirm + chop , you will recognise these anchors.

And you will thank me for that! 🙂

I will share with you one of my “anchors”.

“The Apple Concept”.

This “Apple Concept” is suitable to apply when there is a market downturn.

Market Pandemonium. Everybody kan cheong spider, you relax. 🙂

Example you buy apple (the fruit you can eat) today at $1.

It goes down to 90 cents. Up 91 cents. Down 90.122345.

What do you do?

Dont bother. Ignore!

We are not speculators.

We are not traders.

We are investors!

However, when price of Apple goes down to 50 cents.

Half price. GREAT SINGAPORE SALE!

What do you do? Buy more.

Similarly, when market goes up or down a bit, dont bother.

However, when the fund price selling at cheap price, buy more.

So that can make more money when the price goes up in the future.

(A lot of pple get scared and they sell and they lose money)

There are one of the many anchors that I shared during my financial planning presentation to manage my clients’ expectation and ensure that they remained focus, instead of listening to the “noises” in the market.

………………………

…………………

………

The 2nd thing that I share my clients or reiterate to them to ensure that they remain focus is to remind them of their Niat and their “Big Why”.

You need to know why you do what you do. If you save for your child’s education.

Your child is your BIG WHY.

You save money because you love your child.

Because you want to see your child grow up as a good human being.

Because you want your child to have a good job. Or have a business.

Or even perhaps continue your legacy in this dunya.

When your Big Why is strong, you would not lapse a plan.

What is your Big Why when you get a certain plan or you embark on a certain endeavour?

Your reason or your Big Why must be strong! 🙂

My Big Why is my family. My niat is to establish Islamic Finance in Singapore is because I see that as one of my pathway for me to go to heaven.

Every time, I feel down. I feel like giving up (giving up is easy by the way).

I remind myself of this Hadith.

“From Abdullah Ibn ‘Umar -may Allah be pleased with him- that Allah’s messenger -peace and prayer of Allah be upon him- said, “The trustworthy, honest Muslim merchant will be with the Prophets, the honest men, and martyrs on the Day of Resurrection. ’’

I want to go to Jannah. I want to join the syuhadas.

That is why when I conduct my business,

I do my level best to be as transparent as possible. I left no stone unturn!

In fact, now I treat every single action I take as accumulating saham akhirat.

Come, partner with me.

We can kumpul saham akhirat together! Amin. Amin. Insya’Allah! 🙂

…………………………………….

…………………..

…………

Now… I hope you have benefited from my sharing on 7 Things That Makes It Easier To Achieve Your Halal Financial Goals in Singapore…

If you are seeking a mentor, coach, consultant to share with you practical aspects on how you can protect your wealth using Halal Insurance in Singapore

OR

save, accumulate and grow your money the shariah compliant way in Singapore, I am always ready to help you.

You can always whatsapp/sms me at 96520134 to schedule a FREE consultation.

Or perhaps click here to schedule an appointment.

You will want to schedule it asap because I can only accommodate 5 slots for this month.

Click here to schedule your FREE consultation today!

Take Care!

by Helmi Hakim | Nov 28, 2018 | Investment

One of my favourite topics is on retirement planning.

Recently, a lot of people came to me asking for tips, strategies on how they can save money for their retirement.

In this blog post, I will share with you,

5 Most Important Rules To Halal Savings For Your Retirement In Singapore…

…………………………….

……………………………

…………..

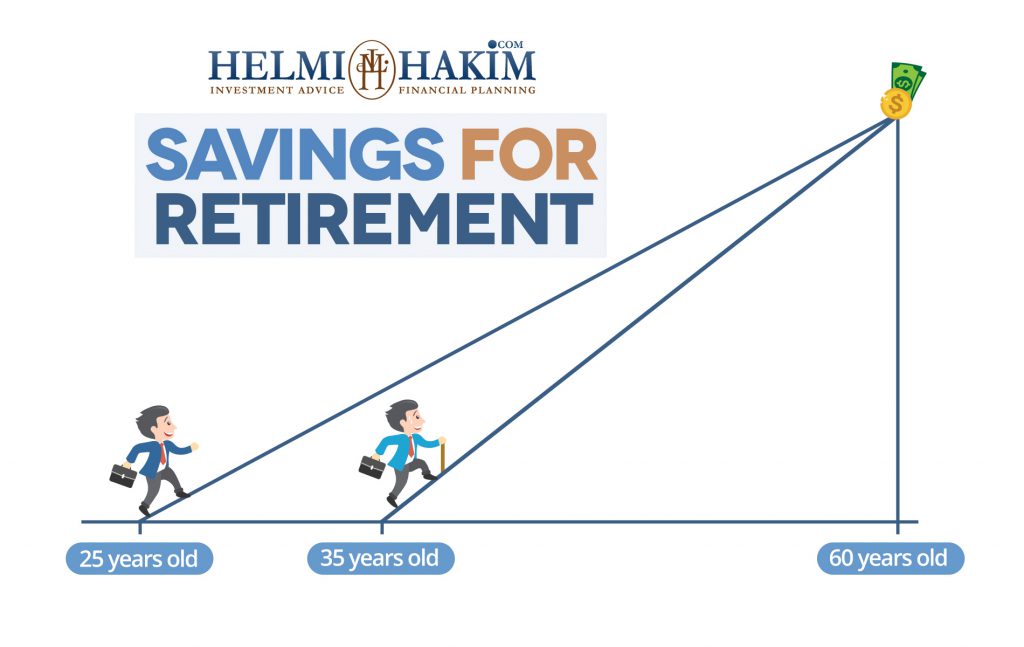

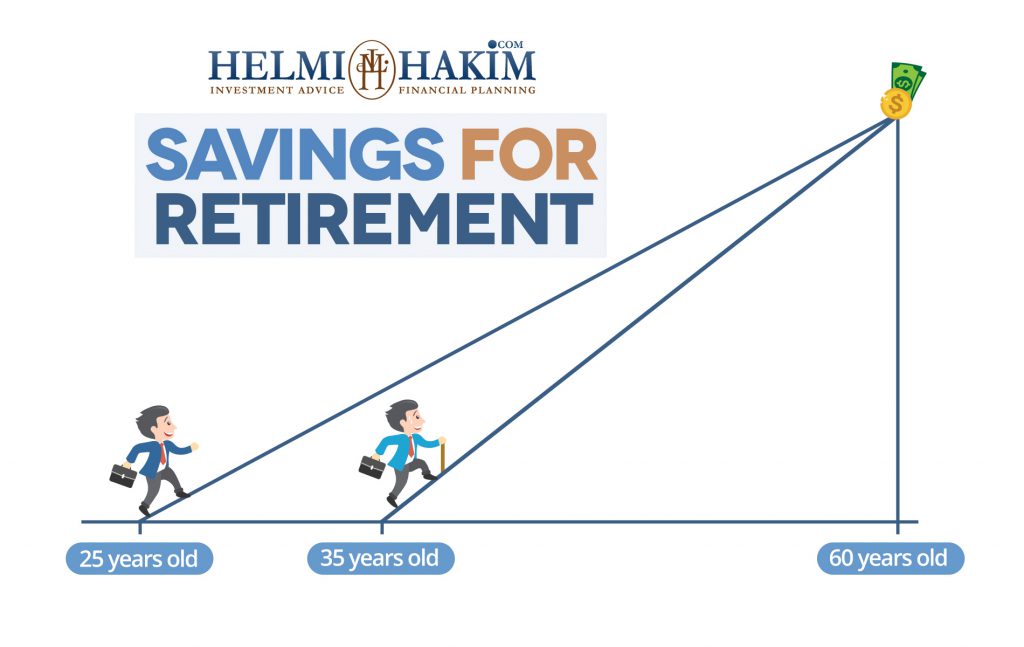

Rule #1. Start Early

This is my story.

During my early years as a financial consultant, I always advise my clients of the importance and advantages of saving money EARLY for their retirement.

Yet at times, I myself faced challenges when I wanted to save money. I came out with lots of “EXCUSES”!

……………………………………………….

………………………..

“Alah… Wait lah… Im still young. YOLO!!!!

Enjoy first. Later, when I am in my thirties, then I will start saving for my retirement.”

“Alah…. My pay is so little now. Wait when my income increases to a substantial amount, then I will start saving for my retirement.”

………………………………………………

………………………..

Yet deep down in my heart, I know that the best time for me to start saving money for my retirement is when I step into the workforce.

This is because, at that point of time, we DO NOT have high money commitments.

We don’t have a wife to give nafkah.

We don’t have children to provide for their daily living expenses.

We don’t have a house to pay for monthly mortgages.

…………………………………………

……………………….

The facts and figures are as clear as daylight.

If you want to retire comfortably in the future.

No shortcuts!

Start saving money for your retirement as EARLY AS POSSIBLE! 🙂

(The hill gets steeper if you choose to procrastinate and delay your savings for your retirement)

…………………

…………

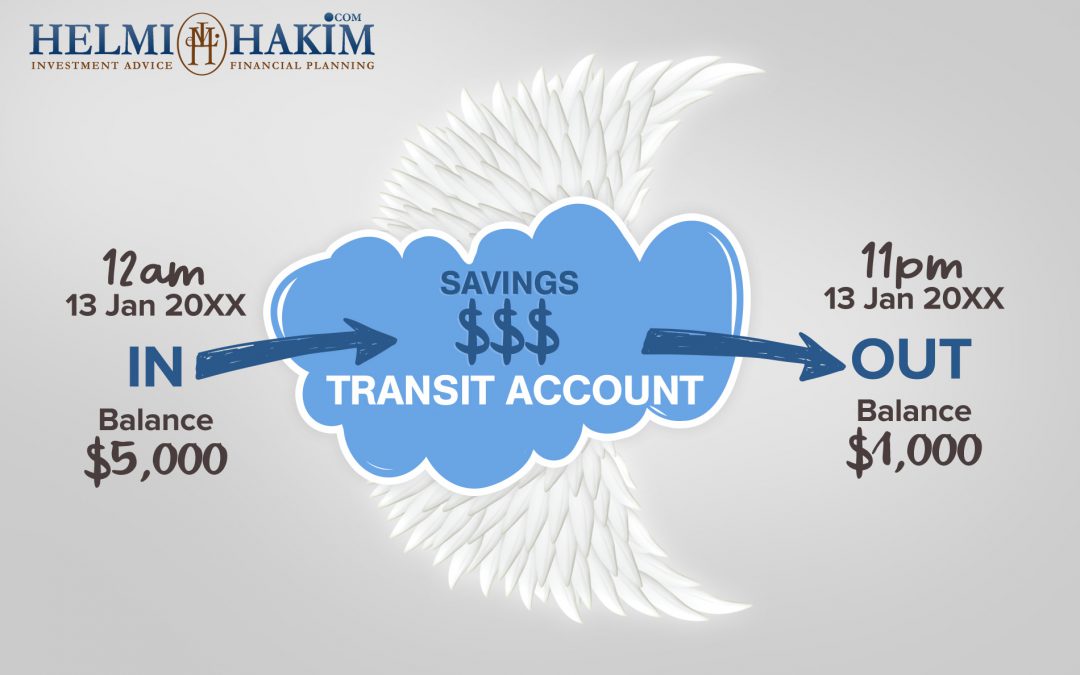

Rule #2. Follow A Proven System and Personalize It

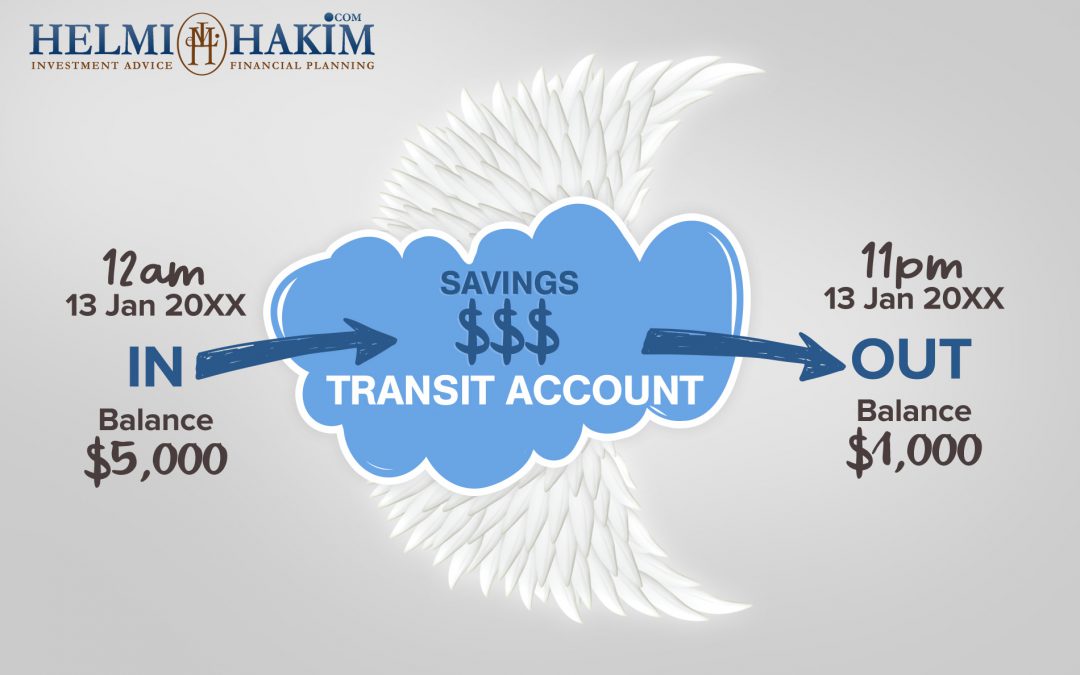

As you know, I struggled to save money during my early 20s.

Yes. I had my savings account. (I opened one at that point of time because I knew the importance of saving money for rainy days. In Malay, we call it, ‘Sediakan payung sebelum hujan’)

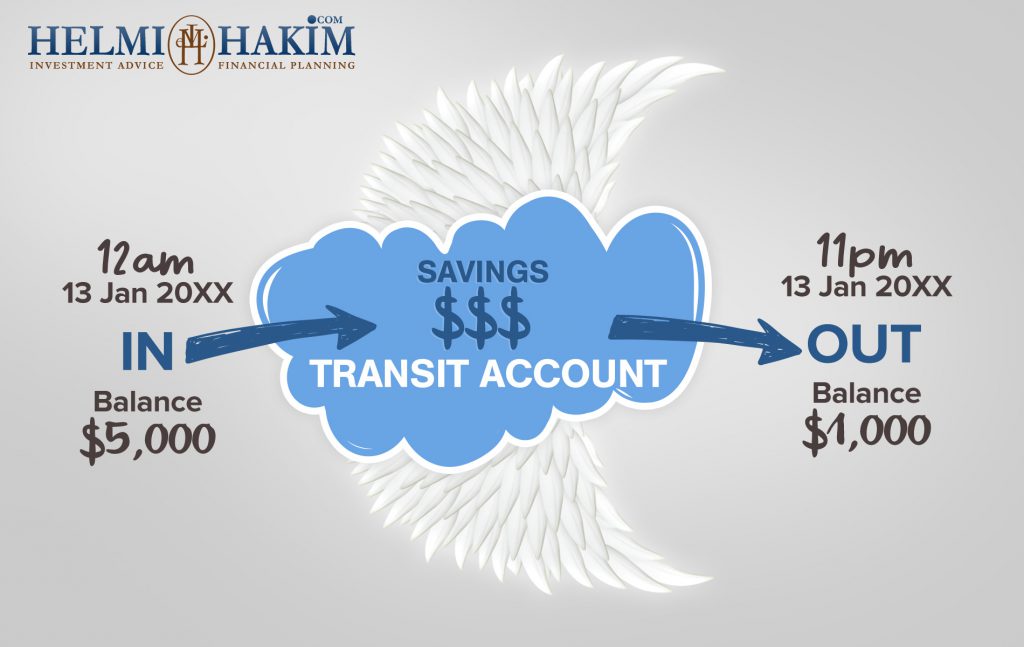

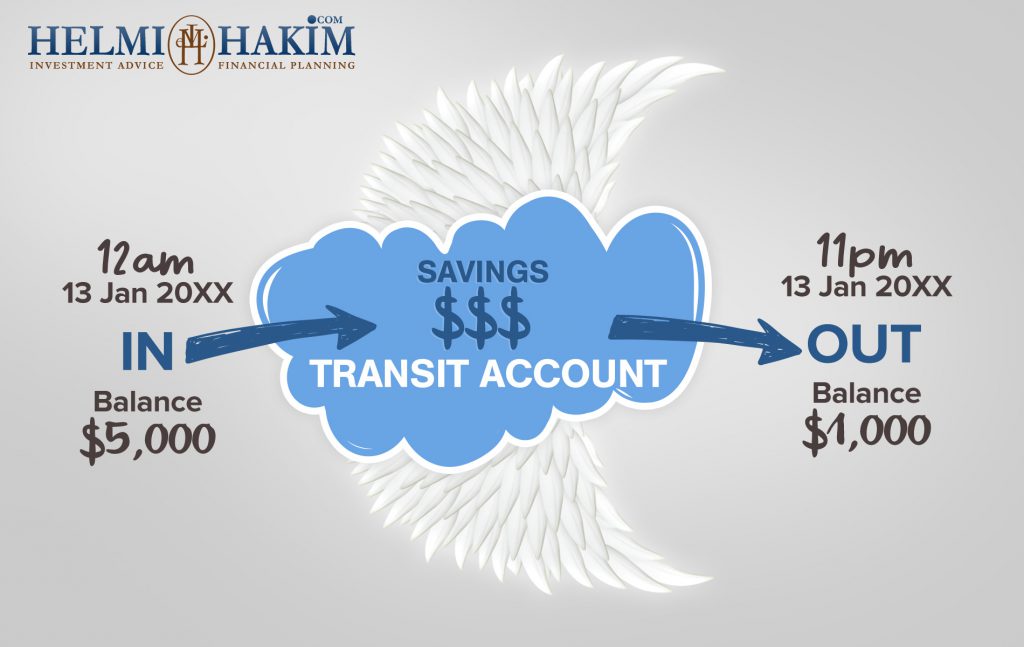

Yet. My SAVINGS account is more like a TRANSIT account.

The money rarely stayed at one place.

It moved around.

And it seldom remained in the account.

How many of you are like that?

Man… The feeling was bitter.

Every 13th of the month, at 12am, my salary would be credited.

By 11pm, the same day, 3/4 of my salary was gone to pay bills.

I told myself back then.

“I want to be a MONEY MAGNET!

Not a MONEY REPELLENT!”

So what did I do?

I read books.

I found mentors. (Paid lots of $$$ to learn from them)

I followed proven systems that many successful people had followed.

You know some of those concepts.

Concepts like,

‘Save First and then Spend’,

‘Forced Savings’

‘Identify and Differentiate Between Your Needs and Your Wants’,

‘Invest in Equities, Bonds, Commodities, REITS, Properties, ETFs’

‘Robert Kiyosaki ESBI’ model

”

Coupled with my 3 year knowledge Diploma In Accountancy from Ngee Ann Polytechnic, I began to develop the right mix.

The right recipe. The right formulas.

It’s a bit like cooking Sambal Udang.

(picture from resepinannie.blogspot.com)

.

.

You need to find the right balance.

The right amount of cili kering (dried chillies).

Tamarind.

Salt. Sugar. Prawns.

Everything in the right proportion.

And….

My small, little advice.

If you have found a recipe and a system that works well for you…

Don’t have ‘itchy fingers’.

Stick with it. Follow the system closely.

Repeat the process again. Again. And all over again.

Till you reach your retirement objective.

It is that simple.

Simple yet sometimes, difficult to follow.

………………………………………

………………………..

……………..

Yes. If you have been trying to save money, and failed numerous times.

Let me tell you 1 thing.

It is not your fault.

We are human beings. We have our own DNA.

We have our strengths. And we have our limitations.

So the key here is for you to personalise your plan.

This is HOW I PERSONALISED my retirement plan.

As a Muslim, I know that Allah S.W.T. determines my rezeki.

Everything that I do, can only happen with Allah’s will.

……………………

……………….

……

Say: “Nothing shall ever happen to us except what Allah has ordained for us. He is our Mawla (protector).” And in Allah let the believers put their trust.)

Quran (Surah Tawba, Verse 51)

………………….

………..

….

Thus I made a decision, that whatever financial strategy that I am going to do.

I am going to do it the shariah compliant way. The Halal way in Singapore.

Because at the end of the day, its not all about strategies. Its about baraqah.

Its about seeking redha from Allah S.W.T.

I made up my mind.

I made a commitment.

I set myself to pursue knowledge to COMBINE the best financial planning practices in the conventional world and the Islamic Finance world.

Below are some concepts that I have innovated. If you want to learn more, click here for a free consultation session. 🙂

……………………………………………………………..

………………………

…………….

Rule #3. Consistent

One of the most important rule when it comes to savings for your retirement the Halal way in Singapore is that you must be CONSISTENT.

In Arabic, we call it Istiqamah.

I remember the story of “Rabbit and Tortoise”, that my teacher shared with me when I was in primary school.

You know the OVERCONFIDENT rabbit that lost the race to the tortoise.

The overconfident rabbit slept halfway, thinking he was fast.

He was quick. He was agile.

The slow tortoise will lose to him.

But lo and behold, the slow tortoise won the race because the slow tortoise was CONSISTENT.

…………………………………

……………..

What I learnt from this story is that you can be the best financial wizard in the world.

You can have the best retirement strategies in place.

Yet, if you are not CONSISTENT in applying them.

Having enough money for your retirement will remain a far-fetched dream.

………………………..

………………………….

I realise that a lot of people, treat money-saving habits like “hangat hangat tahi ayam.”

At first they get excited with the idea of retirement planning. But when they realize that it requires work, they feel let down.

Every other day, I have strangers asking my opinions on the latest get rich quick schemes.

Some asked for my opinion. Some asked for my endorsement.

(Something like this)

………………….

……….

….

I disappointed them by telling them in the face that there is no elevator to success.

You have to climb up the stairs.

I am a firm believer of ” Man jadda wajada, wa man zara’a hasada, wa man yajtahid yanjah ”

Man jadda wajada, Siapa berusaha, dia dapat.

Man zara’a hasada means “sesiapa yang bercucuk tanam (Inshallah) akan menuai hasilnya.”

Man yajtahid yanjah means “sesiapa yang berusaha (Inshallah) akan beroleh kejayaan.”

and when it comes to savings for retirement. You have to CONSISTENTLY set aside a monthly amount for your retirement. Don’t touch that money. Don’t stop.

Because once you stop, you lose your momentum. And it will be difficult for you to start again.

……………………………………………..

………………………………

………..

Rule #4. Be Flexible. Adjust

Along the way, we may face challenges.

Things don’t go as planned.

I always share with my clients. You draw a straight line on a piece of paper.

It may look straight in your eyes.

But how confident are you that, the straight line that you draw is really straight?

…………………………………..

……………………….

In life, you need to be flexible.

I love this quote by Confucius.

Adjust the action steps.

Work with practitioners.

People who hustle and make things happen on the ground.

They devote their entire life perfecting their craft.

Be humble. Seek help from these people.

These people know the tricks of the trade.

And most importantly, they do it the legal way.

In short, we call them street smart.

If someone is doing better than you, its because they know something you don’t.

Be flexible. Model a proven winner. Copy someone who is making a mint right now.

If things don’t work for you, don’t shift your goals. Adjust.

…………………………………….

……………………

……………

Rule #5. Don’t Give Up

We are lucky to be Muslims.

Because as Muslims, we believe in Allah S.W.T.

Whenever we face problems and challenges.

Don’t place everything on our shoulders.

Remember what Allah S.W.T says

Innamalyusriyurah…

Setiap kesusahan, pasti ada kesenangan.

(Behind every difficulty is a blessing.)

………………..

As Muslims, our 6th pillars of Iman is Qada and Qadar.

My mentor always reminds me of Qada and Qadar.

Qada is ketentuan from Allah S.W.T.

Sunatullah that Allah S.W.T. has set.

Example, for rainy days, one of the signs is that the sky turns dark. Cloudy.

And rain falls from the sky. Not from the surface of the earth.

If rain falls, we cannot stop that.

However, we can AVOID ourselves from GETTING WET.

HOW?

.

By opening an umbrella. Open and walk under that umbrella!

That Umbrella is Qadar. Which is our effort.

We cannot stop the rain (Qada) yet we can avoid getting wet by using an umbrella (Qadar).

Don’ be disheartened when you stumble and fall down while working towards your financial objectives.

Dust yourself up, stand and continue working towards your goals.

……………………………………………..

……………………..

Now… I hope you have benefited from my sharing on 5 Most Important Rules To Halal Savings For Your Retirement in Singapore.

If you are seeking a mentor, coach, consultant to share with you practical aspects on how you can protect your wealth using Halal Insurance in Singapore

OR

save, accumulate and grow your money the shariah compliant way in Singapore, I am always ready to help you.

You can always whatsapp/sms me at 96520134 to schedule a FREE consultation.

Or perhaps click here to schedule an appointment.

You will want to schedule it asap because I can only accommodate 5 slots for this month.

Click here to schedule your FREE consultation today!

Take Care!